Within the past 48 hours, social media giant Facebook just launched their long-anticipated Libra cryptocurrency white paper for the controversial global stablecoin. With the promise of near-zero fees for making payments or moving money, some may be intrigued, but others are concerned, and for varying valid reasons.

source

Libra is born amid a storm of controversy

Facebook has just launched the testnet of Libra and the Calibra wallet to be built into WhatsApp, and the finance industry may never be the same again as this competitor to their monopoly essentially becomes a global bank, payment platform and social media site all in one.

But is it safe, is it private, is it decentralized and is it even legal?

These are some of the questions that still remain unanswered.

This new beta testing phase will continue until mid 2020, by which time it will go live. With over 2 billion users of Facebook and their subsidiaries WhatsApp and Instagram, which will host the Libra payment system it’s no wonder that the US regulators and the finance industry in general are more than a little interested and downright concerned.

Millions of dollars invested but the pundits are skeptical

Despite their concerns, major companies have invested into the Libra Association, including Visa, Uber, Mastercard, PayPal, Stripe, eBay, Coinbase and Investment fund Andreesen Horowitz, putting in $10 million each so far.

Facebook’s new subsidiary company Calibra will handle the actual cryptocurrency dealings while supposedly protecting customer privacy, effectively protecting Facebook itself from still further controversy or potential future legal backlash regarding data breaches.

But will this be enough?

Crypto legend Andreas Antonopoulos doesn’t think so.

Remember that the initial investors are in it for the profit.

They will be receiving their share of the interest accrued on all our money paid in to buy the Libra stablecoin. Antonopoulos addressed a full house at the recent London Coinscrum meetup and voiced his concerns regarding Facebook’s attempt at launching a cryptocurrency.

But is Libra even legal?

The most obvious concern is that although the Libra stablecoin is supposed to be backed by a basket of fiat currencies, like the Dollar, Pound, Euro and Swiss Frank, it might not actually be legal to perform international cross-border payments without the scrutiny of the governments involved.

“There are laws about what you can and can’t do with money”

“laws that Bitcoin doesn’t have to deal with.”

Libra is nowhere near open source or decentralized like Bitcoin so there are going to be problems ahead. Facebook may be promising a decentralized or private facility for cross-border payments but

“they can’t be borderless because they have to abide by the regulations that prohibit transfers of money across borders without know your customer (KYC) and anti-money laundering (AML) checks”

Antonpoulos reminded his audience.

Move over fiat, here comes Silicon Valley

Besides that, if you think Facebook are going to be able to keep their monopoly over the market like this, then think again because soon you will have Applecoin, Twittercoin, Ubercoin, AirBnBcoin and any other progressive tech startup jumping on board the blockchain train.

If Facebook can do it then they will all want to get into the space. Banks are going to have some serious competition and they could end up losing at least 8% of their future customers, which equates as a massive dent to their bottom line.

And they won’t be taking that lightly.

How private is Libra?

Privacy will vanish as “surveillance capitalism” emerges where all our payment information through Facebook’s stablecoin will potentially be available and sold to the highest bidder, ultimately eroding privacy and even democracy in even the most developed countries via this token which is anything but “crypto” (secret).

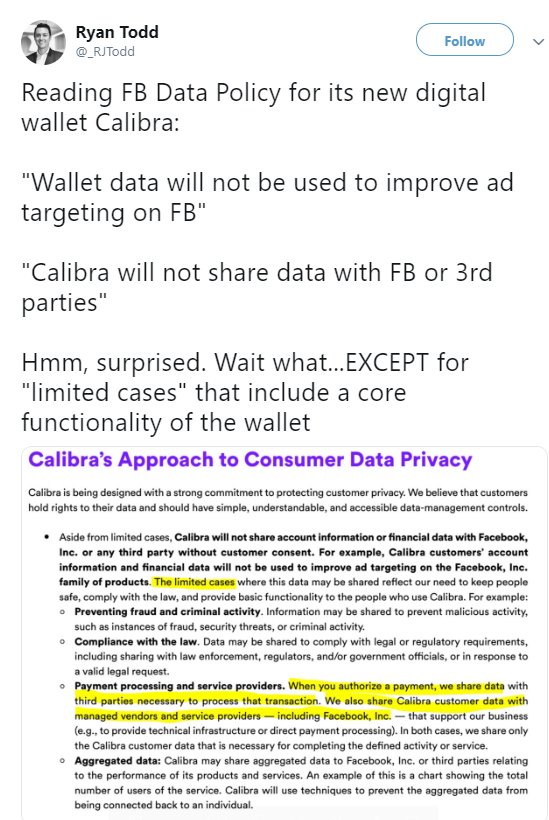

As reported by a Twitter user @_RJTodd in his tweet, FB will actually share our data upon authorizing payments.

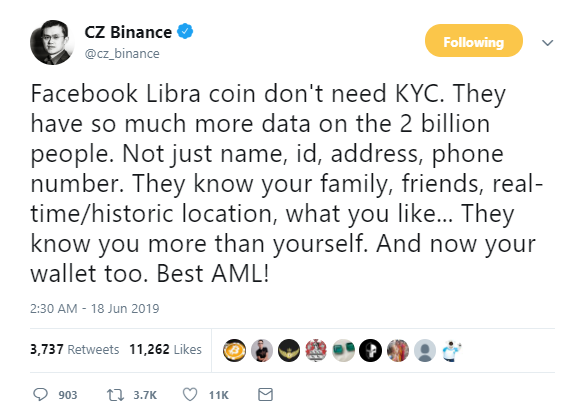

CEO of one of the largest cryptocurrency exchanges in the world, CZ, was even more vocal about the topic in hist tweet.

While @LukasBydzovsky on Twitter, shared a more optimistic viewpoint in his tweet.

Is Facebook's Libra cryptocurrency decentralized?

Facebook's 29-page Libra White Paper may describe the Libra blockchain as:

“a decentralized, programmable database designed to support a low-volatility cryptocurrency that will have the ability to serve as an efficient medium of exchange for billions of people around the world”

but Antonopoulos has certainly questioned this fundamental premise.

Facebook promises PoS

The promise that they will move to PoS (Proof of Stake) one day in the future is elusive and by no means a guarantee. Ethereum has promised the same thing in January next year, along with the release of Casper, but they are years ahead in development, despite still requiring scalability to handle the thousands of TPS (transactions per second) required to match Visa or PayPal, for example, much like Bitcoin without the Lightning Network.

Burn as you earn – learning from BNB and EOS

The concept of burning any returned tokens, like the BNB token does, to keep the price of the stablecoin stable, may look the same but Libra will be constantly creating new coins as each customer requests to buy them and then burning them when the customer sells them back.

This is something not seen before in large cap coins. And the concept of being “ledger disposable” where you don’t keep the entire ledger of all past transactions will probably run up against the requirements of lawmakers and tax officials in various countries.

In other words, like EOS, there is still a lot to be worked out, like the somewhat centralized governance approach, which is so controversial. But hey, EOS raised a ton of startup capital (the most ever for an ICO) and they are still climbing smoothly to new heights.

The code behind the Libra coin

Facebook's Libra blockchain, built using the Rust programming language which is designed to prevent security vulnerabilities, and their unique Move code language isn’t quite ready yet. It’s open source, based on an Apache 2.0 license so will impress developers who want to build Apps on top of it.

There are even plans to launch a bug bounty via HackerOne later this year if you want to see if you can find any flaws in their protocol.

Move is exclusive as a code language to Libra, designed specifically to move coins between accounts without duplication, or the double spending problem. Move will eventually also enable smart contracts. One concern though is that Move is open to use and build, which might open it up to scammers who build dodgy Apps in order to defraud novices.

Facebook is already hugely suspect in the eyes of many for its security breaches or data mining, and if more problems occur involving actual money belonging to customers, it could seriously compromise their future business reputation. Despite this they are unwilling to vet or validate developers who want to build on their blockchain, which could end up being their Achilles heel.

Libra token economy comes alive

The Libra Association is actually encouraging more developers as well as merchants to adopt Libracoin by offering coins and commissions as incentives for any validator node operators who sign up other users who will need to pass the KYC (know your customer) and AML (anti money laundering) procedure and use FB’s exclusive Calibra wallet for a year.

These incentives can then be used by the wallet holders to attract still more customers via discounts and thus spark healthy competition.

For example companies like Spotify or eBay could give out discounts for customers that use the Libra cryptocurrency.

In fact the reason why companies like Spotify have adopted the Libra and its wallet as a payment platform is because they have until now lacked an easily accessible payment system for the millions of unbanked globally, many of whom have a smartphone and probably use Facebook or WhatsApp already.

Engineered by geniuses to be simple to use

Facebook’s Libra stablecoin may have a formidable team, led by David Marcus from Coinbase, and numerous Ph.D students from Stanford, but the loopholes in the logic and law are still too big for it to feel legitimate as a working product.

For now it looks like you will apparently be able to just buy some Libracoin online or at a grocery outlet where you now buy your airtime, transact anonymously or "pseudonymously" via the Calibra wallet on WhatsApp, regardless of national borders but some still don’t buy it, pun intended.

The board and shareholders who have the say

Some big names do though, as the other investors lined up to become founding members include Mastercard, PayPal, Stripe, Visa, Lyft, Vodaphone, Coinbase and others. With Libra Association run from a Swiss bank out of crytpo friendly Geneva, the eventual 100 investors and founders will each receive a 1% vote, thus effectively exonerating mark Zuckerburg from full responsibility – on paper.

Read the fine print though and you will see that there will be one managing director voted in by the council, and s/he will appoint en executive team and board of between five and 19 top representatives, probably like EOS with it’s 21 top members.

As I previously mentioned FB is not the only social media giant to launch its own cryptocurrency. Others, like Twitter and Telegram are hot on their heels already. Andreas Antonopoulos may well be correct in his assessment of the future of this trend.

Nevertheless with so many skilled members in their team as well as considerable investment backing from top players in the industry. The jury is divided as to exactly what will transpire from this breakthrough move by Facebook and its global stablecoin.

It certainly is revolutionary and could historically change the face of finance forever, much to the joy of some but serious concern of others.

We will have to keep an eye on this one.

What do you think will come of Facebook's Project Libra?

- Will it become a competitor to Bitcoin?

Will it act as an easy onboard for billions more people into crypto as a whole? - Will it open us up to invasion of financial privacy and even more phishing or targeted marketing?

- Or will it run up against regulatory hurdles that see it crash and burn before it gets off the ground?

Leave your comments below and let us know!

To answer your bottom questions, from my perspective.

Will it compete with bitcoin? Given the trend of people evacuating facebook, and the lack of trust from a growing number of people, and the perceived risk by those who have been deplatformed or simply witnessed their favored channels disappearing. There's going to be some challenge in adoption, since many will view a facebook wallet as something that might be taken away from them if they somehow offend zuckerberg.

Will it onboard people into crypto?

To an extent, for millions of people this might be their introduction to crypto currencies.

Will it open up further privacy invasions?

Given Zuckerbergs opinions on privacy, it seems that the INTENT is to get more information on their users. What better way than to have a direct line into their wallets?

Regulatory hurdles?

Zuck already acts as though he and his company are above the law. Little doubt that he will ignore any laws until they are finally enforced against him.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree, people should/will be suspicious about using the token concerning all of the issues they might face in the future.

It sure does seem like it. Will be interesting to see Zuck battle with regulators though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Personally, I think it will run up against regulatory hurdles that see it crash and burn before it gets off the ground. Governments around the world are already not too keen on Facebook's influence and to couple that with even more ways to extract wealth out of people and nations seems like way too much power for one company to have.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They already have :D Though, facebook may already be too big to shut down by regulators. We've seen how light the consequences of the Analytica scandal were. Who's to say it's going to be different this time around just because they want to launch their own coin. I wouldn't put my money on regulators or governments being able to stop FB from doing what they want to do with Libra.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm all for capitalism but there comes a point where there needs to be balances and checks in place. I mean you already control so much information and 22% of the worlds referral traffic comes from Facebook. They have more than enough to monetize.

If they were to adopt a currency or currencies that are overlayed in its system and they host nodes or whatever cool but having your own currency on a system where there are data scandals, algorithms running wild and censorship with clear favouritism its just a recipe for disaster.

If they cant be stopped then sure go ahead and it will be up to the people to say no this isn't what we want, which I doubt, sheeple will be sheeple and fb shareholders will continue to get rich

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Considering other big tech companies will most likely create their own cryptocurrency initiatives, they could add more privacy features to their cryptocurrency as a way to compete with Libra.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's probably going to be the case moving forward into the tokenized future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 10.00% complementary upvote from @swiftcash 🤑

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Social credit system here we come. Leftists will love it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's an Orwellian dream!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @runicar!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 5.247 which ranks you at #847 across all Steem accounts.

Your rank has improved 5 places in the last three days (old rank 852).

In our last Algorithmic Curation Round, consisting of 189 contributions, your post is ranked at #12.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted!

Lb is an abbreviation of the Latin word libra. The primary meaning of libra was balance or scales. The libra is also why the symbol for the British pound is £—an L with a line through it. GOT THAT? READ AGAIN!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit