Venus

Venus is portrayed as decentralized commercial center for banks and borrowers. It is furthermore likewise perceived as a currency market and engineered stablecoin convention. As indicated by the Whitepaper, Venus is pointed toward empowering the decentralized stablecoin, VAI, which is based on the Binance Smart Chain and upheld by a container of stablecoins and crypto resources.

Venus is basically an algorithmic-based currency market framework which is intended to give clients a comprehensive decentralized money based loaning and credit framework using the Binance Smart Chain for quick, minimal expense exchanges and to access a profound organization of wrapped tokens and liquidity.

Clients of Venus can use their crypto resources by essentially providing security to the organization that might be acquired by promising over-collateralised advanced monetary forms. This should work with a safe loaning climate where a moneylender would get an accumulated financing cost yearly (APY) paid per block, while the borrower would pay revenue on the crypto resources that are acquired.

The financing costs are set by the convention in a bend yield, where the rates are robotized based on the interest in a specific market, for example Bitcoin. The prominent upper hand that Venus has over other currency market conventions is that Venus empowers the utilization of insurance provided to the market, for acquiring different resources just as for stamping manufactured stablecoins with over-collateralised places that ensure the convention. A bushel of cryptographic forms of money backs the engineered stablecoins and not fiat monetary standards.

Sushi

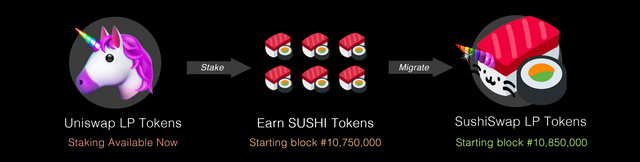

The Sushi biological system comprises of the famous SushiSwap mechanized market producer. The trade is intended to permit token holders to exchange up to 100 ERC-20 tokens. It utilizes a comparable model to other decentralized trades like Uniswap, where clients are not needed to give personality confirmation to utilize the trade. Every one of the a client is needed to have is a Web 3.0 wallet and Ether to pay expenses for the trade. Trade commissions per exchange on SushiSwap is about 0.3% when a client joins a liquidity pool. About 90% of the charge is dispensed as benefits to liquidity suppliers. Other little exchange expenses might be material when a client endorses another symbolic's pool.

The biological system additionally incorporates liquidity pools. SushiSwap normally offers rewards to financial backers who can give cash-flow to help the liquidity pool that they take part in and an ERC-20 token is given to them as remuneration for the liquidity they give. In the same way as other decentralized conventions, SushiSwap comprises of a scope of liquidity pools.

Another segment is the ranches and clients don't should be liquidity suppliers to procure rewards. SushiBar permits clients to boost yield by marking SUSHI tokens for xSUSHI. About 0.05% of the charges from trades made on the trade are circulated as SUSHI in relation to a lot of the SushiBar. At the point when a client has their SUSHI tokens marked into the SushiBar, they get xSUSHI consequently which they can use for casting a ballot rights and they likewise have a completely composable symbolic which can collaborate with different conventions. A client's xSUSHI will proceed to compound and when the client chooses to unstake they will get the SUSHI tokens that they initially kept and the tokens acquired from expenses.

Curve

Curve is another computerized market producer and basically a non-custodial trade zeroed in on empowering clients and other decentralized conventions to trade stablecoins like DAI to USDC through it with low charges and low slippage. What makes Curve exceptional is that not normal for different trades that match a purchaser and a merchant, it utilizes liquidity pools like Uniswap. For this to be conceivable, Curve requires liquidity and as such it rewards tokens to those liquidity suppliers.

On brought together trades, a back-and-forth among purchasers and dealers for the most part decides the cost of a resource. On a decentralized trade like Curve, the proportion between two resources in a given pool is the thing that decides the cost. Basically, a DEX like Curve Finance is comprised of a progression of pools, where each pool contains 2 kinds of crypto resources. How about we illustrate:

Suppose there's a pool containing 10 ETH and 1000 USDC. Each ETH is valued at $100 (1000 separated by 10). Presently suppose some substance chooses to buy 1 ETH from the pool for $100. This would suggest that the cost of ETH would then be $111 for the following individual who comes in to purchase. This design motivating forces merchants to go to an alternate trade and buy ETH at the real market cost recently settled as $100 and thusly sell it for a benefit on a DEX by adding 1 ETH to the pool. This is intended to reestablish the proportion between the resources and take the cost of ETH back to what it ought to be for example $100. The more crypto resources made accessible in a pool, the less the value instability when somebody chooses to buy or sell a crypto resource that is in the pool.

To keep up respectable measured pools and keep costs inside a good reach, Curve and other DEXs normally boost clients by making it feasible for them to store crypto resources into such pools. Bend offers loan cost awards to clients who store assets into the pools from exchanging expenses made on the stage. The more mainstream the pool, the higher the loan fees gave to those clients loaning their resources. Moneylenders are likewise ready to pull out their crypto resources alongside the premium procured with no punishments and they can do so uninhibitedly whenever.

Curve dominatingly manages stablecoins and 'loans' its pools to DeFi loaning stages like Compound Finance. This additionally implies that clients who store their stablecoins into a pool on Curve and if that pool is being 'loaned' to Compound they will procure interest from Compound, just as the exchanging charges on the Curve Finance stage. This can furnish members with appealingly high loan costs on stored reserves relying upon the economic situations.