Introduction

In this post I will try to guestimate potential price appreciation for FCoin based on Price-To-Sales Ratio. FCoin mentions below statement in their Regarding FCoin's Revenue Distribution Mechanism

"Please note that our revenue sources include but are not limited to transaction fees. As a transparent exchange open to public review, our principle for revenue distribution is: whatever is the composition of our revenue base, is what we distribute to our FT holders, using the same ratio stated before. For instance, if our transaction fee revenues included BTC, ETH, LTC, FT etc then the platform would distribute BTC, ETH, LTC, FT etc in kind."

And the earned revenue is distributed as below:

- FCoin will distribute 80% of the platform's revenues, called distributable revenue, to FT holders. The remaining 20% will be utilized towards development and operation of the platform. The

- 20% of the distributable revenue on the day before the daily allocation (still based on the locked FT amount), and the remaining 80% is included in the Annual Accumulated Revenue.Annual accumulative revenue of the previous year will be allocated on January 1 of the following year, according to the FT holding ratio at 0:00 (GMT+8) on January 1 (not limited to the locked FT), along with Ex-dividends on the day.

It was important to mention above statements in order to analyze the FCoin ecosystem from publically available data.

5 Day Activity Snapshot

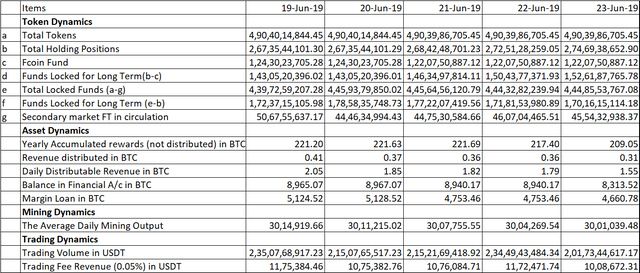

In order to understand and do relevant computations I collected 5 days data from their website that they daily update. Below pic shows it:

In general, the token distribution is changing among long term token holders, Short term token holders, Fcoin fund, and token available in secondary market. Following are few important conclusions that can be made:

- Total token are reducing as they buy back and burn

- FCoin fund size is reducing, which supports entire incentives economy of the ecosystem

- There is reduction in secondary market FT circulation

- The trading volume is apprx 2bn USD on daily basis

- And Daily mining output is in line with their announced plan of 3 Mn FT to be mined in first term which ends on July 16' 2019

How Much Revenue Does FCoin Ecosystem Generate

As mentioned above that revenue sources not only include transaction charges but system does earn from other activities also. But we do not know how much they earn from other sources. However, it is easy to estimate how much revenue does ecosystem generate from transactions/trading.

The dominant trading fee on FCoin platform is 0.05%. Then with appx 2bn USDT Trading volume - the ecosystem makes around 1mn USDT as trading fee revenue. That means apprx 350 mn USDT revenue per year.

All the trading activities that happen on platform are charged in according to the pai being traded. For example when BTC/USDT is traded then fee collected is in BTC or USDT depending on the side of the trade and when ETH/USDT is traded then fee collected is in ETH or USDT depending on the side of the trade.

And the mining rewards are issued in terms of FT tokens to token holders including traders . So traders give trading fees in the form of other cryptocurrencies or holders buy FT tokens from market and collect FT as rewards.

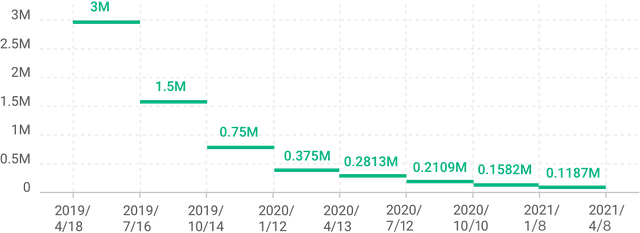

Currently 3mn FTs are distributed on daily basis which will be reduced to half after every 3 months. The last term is expected to complete in 57 year from now.

And participants (token holders, traders, investors) seeing the earning potential (350mn USDT/year) of the ecosystem keep increasing their stake in the ecosystem by adding more FT tokens thereby reducing the secondary market FTs. All this reduces FT token supply which helps in price appreciation of the token.

FT Token Valuation and Price Projections

On average 5000FT are being burnt on daily basis that means in one year total of 1825000 tokens will be burnt. Then remaining token at the end of next year will be 4902189844.

With 350mnUSDT as yearly revenue - that gives a 0.081 usdt revenue per FT Token.

That gives a ratio of 2.2 for price-to-sales with current price of 0.18 usdt for each FT token.

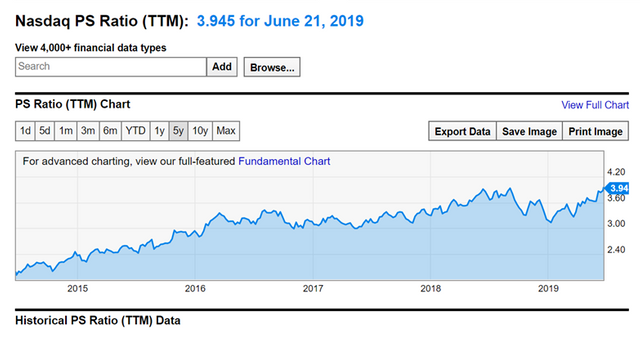

So where do we stand with respect to stock market price to sales ratio? Below pic shows price to sales ratio history for nasdaq from ycharts :

It shows current PS ratio for Nasdaq is 3.94.

That gives us a conservative estimate that FT token can appreciate up to 1.8 times from current levels at any time.

And this is only the conservative estimate because in case of Nasdaq most of the shares are available for buy and sell in the market.

But in case of FCoin only 45,54,32,938.37 FT tokens are available as of now for buy and sell and all others are locked. Assuming that there will not be any increase or decrease in secondary market tokens the sales per secondary market token will be 0.86 usdt which results in price-sales-ratio of 0.2.

That gives us an aggressive estimate that FT token can appreciate up to 19 times from current levels at any time.

And with all the coverage in media and my own assessment Buy Signal Continues : Prediction Working- we are in bull market for next 2-3 years. That if not anything then could help realize aggressive estimates presented above.

Pramesh Tyagi

Member of FCoin Overseas Team 节点

@actnearn supporters, this is our promotion post. Pls support and earn rewards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit