The ones who forecast the Fed and Government caving to the markets were correct.

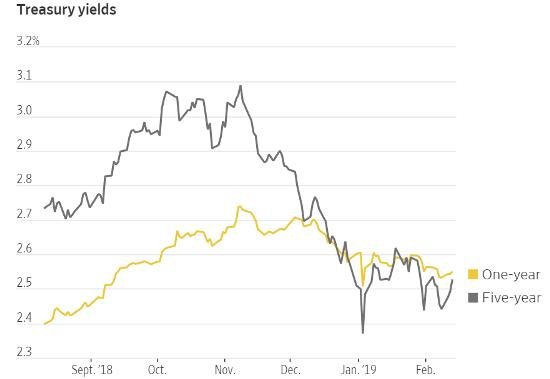

We now see a Fed, hawkish a few months ago, now take a dovish stance. This means the tightening is over and we can expect rate cuts in 2019.

This will cause bond markets to move higher along with real estate. Companies will load up on debt causing an increase in inflation. This will force the Fed to have to tighten again.

And we just keep repeating the cycle.

Click on image to read full story.

About 92.42$ has been spent to promote this content.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for using @edensgarden!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit