The Yield Curve is not a signal for recessions.

It is true that a recession often coincides with an inverted Yield Curve. The reason this is stems from the fact that the Fed often takes to long to reverse course.

The Curve, instead, is a better indicator of future policy. We saw the Fed reverse course based upon the change in the Yield Curve dating back to June.

This time might be different if the Fed acted quickly enough. With little inflation, the move means a dovish stance is warranted.

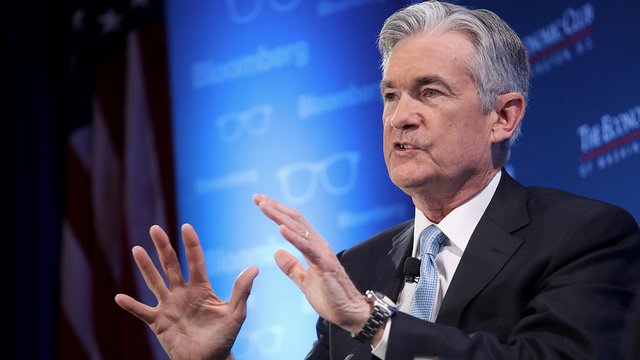

Click on image to read full story.

About 60.24$ has been spent to promote this content using

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for using @edensgarden!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 20.72% upvote from @brupvoter courtesy of @steemium!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit