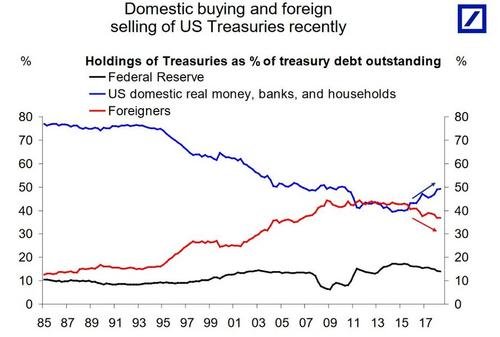

Three years ago the United States Federal Reserve stopped buying the government's debt. WIth the end of the quantative easing, there was concern would domestic buyers step up.

The answer is a resounding yes. Mom and pop have been switching into bonds, buying Uncle Sam's debt.

For the first time, U.S. Household holding has surpassed that of the Fed: $2.28 trillion compared to $2.24 trillion.

Click on image to read full article.

This is really a shocking outcome. It’s the first time I’m coming across a situation where households and non-government entities hold more US monetary risk than the Fed itself. Trying to think of an outcome that doesn’t end up affecting the economy in numerous ways.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good for the US government. What ist the situation in the EU? I don't think any reasonable person would buy Italian bonds at 3%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

About 18.09$ has been spent to promote this content.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 8.92% upvote from @brupvoter courtesy of @steemium!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit