Blog link: https://newsforecasters.com/?p=4539

From Bernie Sanders to Warren Buffett, many say that U.S. wealth inequality is a problem. In 2019, big ideas about how to solve it have been in the air. One of the most unlikely solutions is emerging from the Federal Reserve (Fed).

Neel Kashkari, the outspoken dove at the Minneapolis Fed, says monetary policy can play the kind of redistributing role once thought to be the preserve of elected officials. While that likely remains a minority view among U.S. central bankers, Mr. Kashkari has helped lay the groundwork for a shift in Fed communication this year.

It is true that elected officials have been the biggest abusers of currency debasement via deficit spending. But the Fed has also done its fair share of currency debasement. Under the Obama administration, the Fed has accumulated and is holding on its balance sheet nearly $4.5 trillion in assets purchased with fiat currency - currency debasement. In addition, many believe the nature of a fiat currency along with fractional reserve lending (leverage) is also a leading cause of wealth inequality. Odd to see a Fed as the primary administrators of the rise in wealth inequality, to now think that they can be the solution.

First, let's look at deficit spending. Many are seeing big headlines about how Trump is blowing the budget, and a deficit spending crisis is imminent. But let's take a closer look at the deficit numbers (in trillions):

| President | Start | End | Amount increased | Percent increased |

| Bush | $5.8 | $11.6 | $5.8 | 101% |

| Obama (this does not count the $4.5 the Fed put on its balance sheet) | $11.6 | $20.2 | $8.6 | 74% |

| Trump (8-year CBO projections and Fed balance sheet is $4.0) | $20.2 | $29.3 | $9.1 | 30% |

We could just balance the budget immediately. But to do this, we would have to make massive cuts in entitlements, which is nearly already absorbing 70% of all federal spending. These budget items grow automatically and do not even come up in Congress' annual appropriations process. Imagine stopping food stamp payments, cutting social security checks by 30%, and increasing Medicare and Medicaid co-pays to 50% - not going to happen. Cutting the military would do little, as it is only 15% of all federal expenditures.

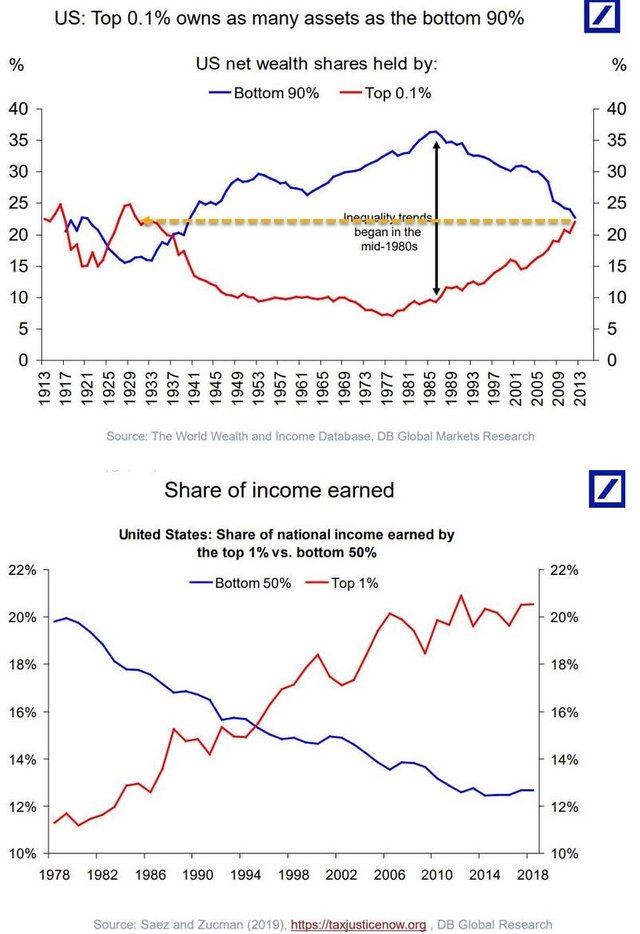

Is wealth inequality an issue? See the inset chart - a rather eye shocking view of wealth distribution in America. Wealth inequality does have a measure - Gini coefficients. Currently, the United States Gini score is around 0.81, one of the highest in the world, according to the 2016 Allianz Global Wealth Report.This is problematic for all political affiliations. Why? It often is the cause of political movements to change the status quo - revolutions. The left uses the wealth inequality issue to fight for socialism (more entitlement spending) and massive redistribution programs. Conservatives would rather promote more fair free-market solutions.

So what causes wealth inequality? Many have weighed in on this question and many have differing opinions. But it is the belief of News Forecasters and many others - it is all about fiat money that allows for currency debasement. To get extremely wealthy, there is really only one way - other than winning the lottery, having a special skill, special situation, or some special new innovation. But for the majority of others who want to get rich, you buy assets on credit at today's fiat currency value and pay it back later with debased fiat currency. Real estate is often the vehicle used to do this, but there are others. It's truly magic and the biggest not understood, openly available to be understood, but little spoken of secret.

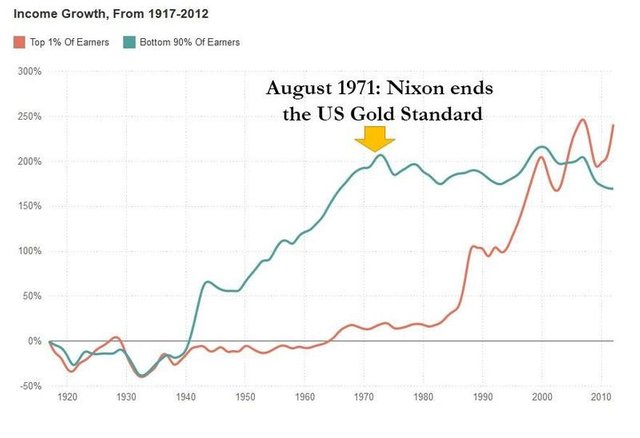

Take a look at this inset chart - it explains it all. Prior to the US going on a fiat currency system, money had a fixed value. Money was tied to gold but it doesn't necessarily have to be. This fixed value of money allowed both rich, middle class, and poor all to rise at nearly the same speed. But due to the costs of the Vietnam war and the Democratic socialist programs of the 1960s, the US faced a bank run - people wanted gold instead of valueless paper currency. Hence, Nixon in the early 1970s had no choice but to closed the gold window for any redemptions and print paper fiat money - the rest is history.Once we delinked from fixed money and started the fiat money printing - it sent the US on the meteoric rise in wealth inequality - the rest of the world followed. So why not just go back to fixed money and watch the wealth inequality go down? Ahh, if it was only so simple as this. If one has fixed money, how would we finance all the government debt? We would need to balance the budget. Instead, we just print money and debase the currency. To be clear, fiat money is the fuel for politicians to buy votes. Both political persuasions have been guilty of this. For those rich, it is a market distortion to get richer. For the poor, they tread water at zero - while the wealth gap widens.

What can the Fed do? Little, other than making a bad situation worse. The Fed is merely deflecting any blame on what they know will happen. Any political or Fed-induced redistribution programs will either exacerbate the wealth inequality or make us all poor. Is it a conspiracy that politicians know the things in this posting but do it anyway? Some do understand, most do not and don't care. They live for today. It is a conspiracy of sharks seemingly swimming in an aligned formation towards its prey - you. Short-term, the Fed will do little on this subject - if an economic crash occurs, they may very likely come back to these thoughts. The Fed is merely laying the groundwork today, in case it wants to use this economic tool in the future.

News Forecasters asks, which direction will the U.S. head in terms of getting to balanced budgets or more fiat currency money printing policies? As said before, both Democrats and Republicans are guilty. Human nature says that politicians simply can not control themselves. Hence, it is our belief that, as many other countries have done, go down the path of endless money printing until eventual collapse.

When is the collapse? This is the tricky question - it will depend on the short-term political directions. But this links to a previous post we did on hyperinflation. In this post we said 10 years away - we will stick with this forecast, though any sudden shift in political policy can change this.