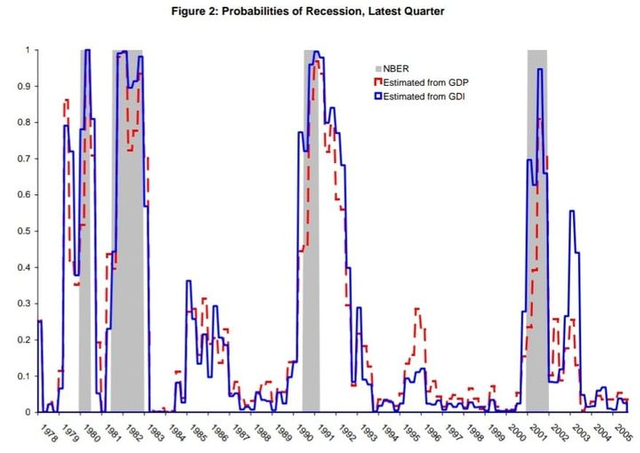

This is a fun paper from the Federal Reserve. It shows that a model relying on Gross Domestic Income is much better at predicting the start of a recession than Gross Domestic Product. GDI tends fall more than GDP in recessions and is more reliable than GDP at the start of recessions.

As you can see the blue line (GDI model) tends to rise faster than the red line (GDP model) before a recession (the grey shaded regions). The y-axis is the probability of a recession with 1 being 100%. As such the GDI model predicts a recession earlier than the GDP model.

This is part of why NBER's Business Cycle Dating Committee relies on both to determine a recession.

Historically when these two numbers disagree, GDP tends to be revised towards GDI with the GDI estimate better predicting the final revisions than the GDP estimate.

For Q1, GDP was -1.6%, but GDI was 1.8%. A very large difference compared to the typical gap between the two numbers.