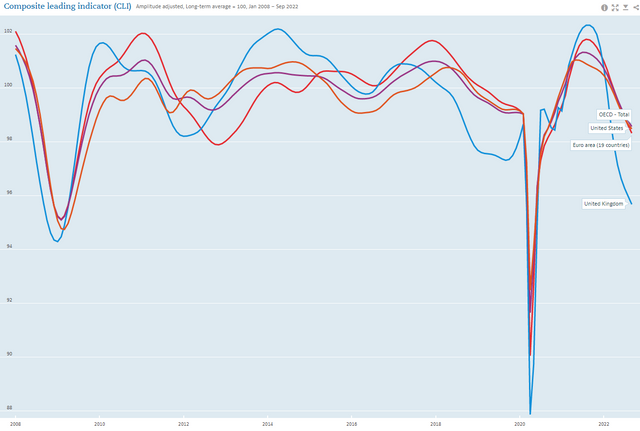

The OECD leading indicators are designed to lead - that is, to provide some advance warning of looming global recessions.

By September leading indicators in the U.S., Euro area and OECD had dropped back down to levels seen in early 2008, after recession had begun.

For the U.K., the leading indicator index was comparable to late 2008, when most countries were deep into recession.

Since then, the Fed and BOE have been busily raising interest rates to "slow the economy."

Central bankers may be looking too intently at lagging indicators (notably unemployment) rather than leading indicators such as yield curves, or stock and bond markets.