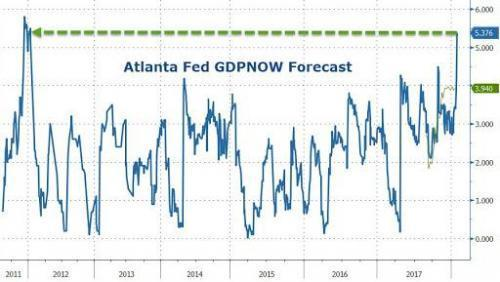

The Atlanta Fed forecast a Q1 2018 GDP for the U.S. economy of 5.4%. This was the highest prediction since 2012.

Today, the forecast was lowered to 2.6.%, a 52% decrease in less than a month.

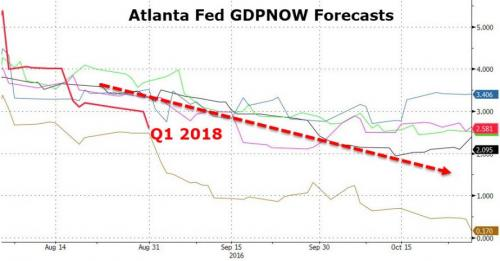

After this morning's Advance Economic Indicators and durable manufacturing reports from the U.S. Census Bureau, the nowcasts of the contributions of real nonresidential equipment investment and real inventory investment to first-quarter real GDP growth declined from 0.45 percentage points and 1.20 percentage points, respectively, to 0.37 percentage points and 0.95 percentage points, respectively. The nowcast of first-quarter real residential investment growth declined from 0.6 percent on February 16 to -4.5 percent on February 26 after housing market releases from the Census Bureau and the National Association of Realtors.

This is in line with the trajectory for the last couple years. We are now seeing a repeat of the 2017 level.

Non-adapted content found at zerohedge.com: Source

Hi @zer0hedge Was there secondary market damage causing a slow down.??????????????? It's really a big hit when the government suspended Wells Fargo, and this might have had a chill in this sector for housing loans as other banks limited exposure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

U.S. real GDP annual growth since the recession ended in 2009:

2010: 2.5%

2011: 1.6%

2012: 2.2%

2013: 1.7%

2014: 2.6%

2015: 2.9%

2016: 1.5%

2017: 2.3%

Average: 2.16%

Can someone show me the "Trump Boom" please? Looks like more of the same. The bond market indicated the Fed might be more aggressive, possibly raising rates as many as four times this year. Yields on the 10-year Treasury spiked to as high as 2.95% a four year high.The Fed isn’t raising rates because the economy is strong or they’re trying to get out ahead of inflation. GDP growth for all of 2017 was just 2.3%, only slightly better than the 2.13% cumulative growth since 2009. And worse than the 2.9% growth rate in 2015 and the 2.6% rate in 2014. The real reason the Fed is raising rates is because it’s desperate to get interest rates up to around 3–3.5%. That will allow it to prepare for the next recession. The last recession ended in June 2009. It’s almost nine years since the last recession. This has been one of the longest economic expansions in U.S. history. It’s also been a very weak expansion. Growth is running about 2.1% versus 3–3.5% historically. That means we’re going to have a recession sooner than later. I’m not saying we are, but we could be in one already. We usually don’t know we’re in a recession until about six months into it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, there is a problem in the various important sectors that make the U.S. Trump has come with some policies that he may be thought that will work, but it couldn't.

On my view, the U.S.A is no longer performing as it could and now focus on other issues related to foreign countries such as north Correa or Russia. The UnS government has forgotten to bring out strong strategies to raise the populations GDP.

The people are crying, unemployment is hitting high and they all there focusing on how Russia hacked the electoral system.

There are sectors that should be reviewed, especially in the industrial sector. We have seen China, Brazil, Japan, German coming and competing against U.S companies. Some of the U.S companies no longer stand and left behind, then taken over by Chinese.

The implication is that U.S industrial sector will have a reduced demand, affecting the whole country's exonomic sector leading to a reduction of employees cause a rise in unemployment. There is always a way of rising up, but the arrogance of the government will make the country to pretend as being steady yet loosing at a faster rate.

For a consistent rise in the GDP, there are major sector that should rise: industrial and foreign relationship with the world. In addition to that, there must be political stability, peace and security. An increase rate of murder will increase on the level of fobia causing people to be relactant in performing some tasks that would be done. For example, a school teacher may resign due to the rest killing in the school.

I believe that we can raise the GDP if only the government should try to solve the above explained cause and effects to the community of interest.

@jona12

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is not good news for the US economy. USA might be having the worst financial crisis if the economy continues to grow at this rate for the rest of the year. From the news I got from the media today, statistics were showing a fall in the contribution of inventory investment to Q1,

a fall in real personal consumption expenditures, a fall in real nonresidential equipment investment, a fall in the contribution of inventory investment to Q1 growth.

This is a long list to have it coming from one of the most economically powerful countries.

Many countires are advising their citizens not to visit USA as a result of Trump's policies which are pressing non citizens in USA. This has led to a drop in tourism, overseas studying, foreign business travels, visa inquiries. There are a lot of investigations and prosecutions from the IRS with the tax authorities granting themselves the ability to try and seize foreign assets to pay fines for those not having filed US tax statements. This I believe is the reason the economy is going down.

Let's pray for the reforms to be reviewed. This I believe will stabilise the economy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The US is a ticking time bomb. You thought it was bad with Tony Blair and George Bush going haywire in Iraq? Yeah, it's countries like Greece, France and Italy (and Iran for that matter) that have to deal with that shit.

And now with people on the throne? I mean, he is probably too dumb and weak to actually do any direct harm, but just indirectly a lot of stuff can happen from having him around. His entire point (which happens to be true) is that America is on the decline, and that China is taking over, and we'd better do something about it.Well great, start by spending less money on weapons.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Once you look beneath the surface of this GDP prediction, it’s very easy to see how they rigged it before this report of 2.6%, to use Donald Trump’s expression. Not that it’s some kind of a conspiracy, but look at these numbers, there was a spike in exports. This the biggest gain in exports in recent years. It’s not in manufactured products that we’re exporting, where you’ve got some high-paying jobs. The other factor that really boosted the GDP, was a big boost in inventories. I’m not sure where that came from. Is it that retailers are just stocking up early for the Summer season? I think retailers are overestimating the ability of Americans to go shopping this Summer season. As much as they want to buy stuff they can’t afford, they can’t afford it so much that they can’t even do it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a "nowcast" of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The more I hear about what's been going on especially with the Fed propping up not only the traders/bankers, but the markets as well I start to regret .

At the moment, these sleazeballs can't lose. But they are the problem.

It would be nice if we had an AG (or Senate or House or President) with enough principal and balls of titanium to take on the uber-affluent and their crimes against the state (and not just in the US).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No joy in mudville?

Forecasting is tough and GDP is really a dated stat. It is what is so used so for comparison purposes, maybe it is worth something.

That said, while the MSM wants to tout how things are on fire, I simply do not see it. Companies at the upper end (mega corps) are doing well but small businesses...struggling.

Plus, we know the average person isnt taking home more money...in fact, they are probably falling further behind since medical costs, at leas tin the US, exploded.

This is something that few want to discuss. There is a separation of the ones enjoying this "real growth" and those who are not.

The entire boom period is nothing but easy and cheap money fueled.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No judgment used to adjust the forecasts.

Once the GDP Now model begins forecasting GDP growth for a particular quarter,

the code will not be adjusted until after the "advance" estimate.

If we improve the model over time,

we will roll out changes right after the "advance" estimate

so that forecasts for the subsequent quarter use a fixed methodology for their entire evolution.

Here,

These charts show how the forecasted GDP subcomponent contributions to growth aggregate up to GDPNow's real GDP growth forecast for each update day in a particular forecast quarter and how changes in the subcomponent contribution forecasts aggregate up to changes in the GDP growth forecasts. Whenever a user hovers the cursor over a bar in one of the charts, the pop-up box displays the data releases for the date of the bar as well the numerical values for the GDP growth forecast and either the levels or changes in the subcomponent contribution forecasts. For previously reported quarters, the final date in the top chart shows the official first estimates of real GDP growth and the subcomponent contributions to growth from the Bureau of Economic Analysis (BEA). The final date in the bottom chart shows the forecast errors of the final GDPNow projections of the BEA's first estimates of real GDP growth and the subcomponent contributions to growth.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Atlanta Fed GDPNow model also mimics the methods used by the BEA to estimate real GDP growth. The GDPNow forecast is constructed by aggregating statistical model forecasts of 13 subcomponents that comprise GDP. Other private forecasters use similar approaches to “nowcast” GDP growth. However, these forecasts are not updated more than once a month or quarter, are not publicly available, or do not have forecasts of the subcomponents of GDP that add “color” to the top-line number. The Atlanta Fed GDPNow model fills these three voids

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The GDP growth rate is the most important indicator of economic health. It changes during the four phases of the business cycle: expansion, peak, contraction and trough.

When the economy is expanding, the GDP growth rate is positive. If it's growing, so will businesses, jobs and personal income. But if it expands beyond 3-4 percent, then it could hit the peak. At that point, the bubble bursts and economic growth stalls.

If it's contracting, then businesses will hold off investing in new purchases. They’ll delay hiring new employees until they are confident the economy will improve.

Those delays further depress the economy. Without jobs, consumers have less money to spend.

If the GDP growth rate turns negative, then the country's economy is in a recession. With negative growth, GDP is less than the quarter or year before. It will continue to be negative until it hits a trough. That’s the month things start to turn around.

@zer0hedge thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"Cut in half", shrinkage, must be cold in Atlanta. I wonder if all the bubbleheads will be reporting on this market affecting news?

NOT!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A 52% discrepancy ought to result in analysts losing their job...pitiful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very infortant metter share you.well post...

thanks for shareing....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

they predict a lot of things, let's see how it actually turns out

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

GDP growth rate (seasonally adjusted annual interest rate) in the first quarter of 2018 The GDPNow model was 2.6 percent in February, 3.2 percent in February. This morning, following the durable production reports from Advance Economic Indicators and the US Bureau of the Population, real-housing non-residential equipment investment and real stock investment contributed to the real GDP growth in the first quarter by 0.45 percentage points and 1.20 percentage points, respectively, and a decrease of 0.95 percentage points. After the Bulletin of the Census Bureau and the National Realtors Association released on the housing market, the growth of real housing investments in the first quarter fell from 0.6 percent on February 16 to 4.5 percent on February 26.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They change everything at any other moment of information that the Federal Reserve, the US central bank, is changing course to raise interest rates this year, minutes from the last board meeting showed.

The meeting papers showed Wednesday that some members of the council were worried about the global economic slowdown and the damage it could inflict on the United States.

US economic policy officials have agreed on "growing uncertainty" since the decision to raise interest rates in December.

Some members realized that more severe economic conditions would be "almost equal" to further increases in interest rates.

US Central Bank members unanimously voted to raise the key interest rate of the Federal Reserve by 25 basis points, from 0.25 to 0.5 percent in December.

Since this decision, oil prices have continued to fall and stock markets have been subject to significant fluctuations.

"The minutes actually indicate a thin language (non-aggressive action) on the part of the Fed, and the likelihood of a rate hike in March is likely to fall," said Omar Aznar, director of market analysis at the Commonwealth Foreign Exchange.

Effect of economic

According to the minutes of the meeting: "Members noted that if the global financial situation continues to be severe, it may be a factor that increases the downside risks" to the US economy.

Members agreed that it was too early to determine whether the data represented a justification for changing the course, but they planned to continue monitoring the situation.

In addition to her testimony to Congress last week, Federal Reserve Chairman Janet Yellen warned that the growth of the US economy could be hurt by the global economy.

The economic slowdown in China and other emerging countries is a factor that "could affect the US economy."

The minutes also showed that members were concerned about the impact of the Chinese slowdown on Mexico and Canada, being the two largest trading partners of the United States.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit