In 2018, the initial coin offering (ICO) as we knew it in 2017 was pronounced dead several times. While the ICO gold rush definitely helped increase the cryptocurrency market capitalization; the project valuations, hype, pump and dumps, scam projects and ICO project’s/company’s un-accountability attributed to the industry’s damaged reputation.

Having invested in a great deal of ICOs, I would like to see a shift in funding method as the traditional utility token-based ICO is not beneficial to individual investors anymore. Especially in this continuing bear market, the risk of investing in an ICO is almost never worth it for individual investors, who are usually served last when it comes to buying tokens.

Binance launchpad

Last week, something slightly unexpecting happened. People got excited about an ICO again. The marketing efforts of Justin Sun, founder and CEO of the TRON Foundation and Changpeng Zhou, the co-founder and CEO of digital asset exchange Binance, enabled a surge in users trying to purchase BitTorrent tokens (BTT) on Binance re-introduced token sale launchpad. BitTorrent was the token sale that launched on Binance after TRON, Bread and Gifto all successfully conducted their public sale on the digital asset exchange dedicated token sale launchpad. According to Binance, the launchpad is an exclusive token launch platform, and they are right. It is exclusive as we could see with their most recent BitTorrent (BTT) token sale. Only 962 were able to get in because the platform faced continuous errors and defaults during the 15-minute-long flash token sale. The token sale could have sold out in seconds, had it functioned properly. BTT launched on Binance just two days after the token sale, establishing a 4x ROI for investors selling on the first day after the launch on the exchange.

While the re-launch of the Binance launchpad was successful for the digital asset exchange, in my opinion, this is not a good way to continue for the majority of Binance users. The launchpad will pretty much only make Binance and the ICO project richer while individual investors, that hold on to the token for too long or buy the top are most likely being dumped on sooner, rather than later.

One of the things I would like to see them change is making a shift to a more fair distribution scheme. For instance, set a maximum cap per participant. By the amount of KYC applicants, they might be able to give a rough estimate of token sale investors. There were a lot of disappointed people after the BTT token sale. The first-click, first-serve format leaves too much to just luck of clicking at the right time, so they might want to change that to give more people a chance of actually buying tokens on the launchpad.

On February 1st, Binance announced the Public Sale of Fetch.AI tokens will be launched on its launchpad on February 25. Interested investors that want to participate in the sale need to apply KYC first. As usual, some countries are excluded from the sale.

Fetch.AI

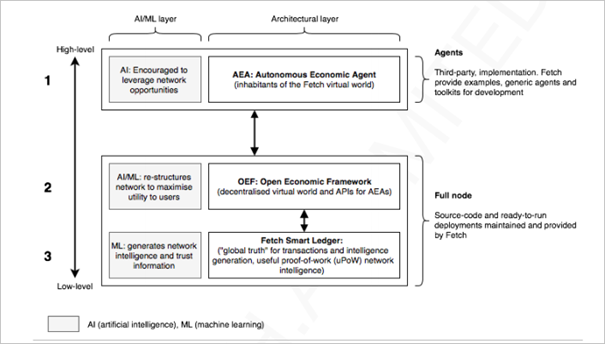

Fetch (FET) proposes an open-source distributed ledger technology framework that is comprised of three architectural layers. Layer one is reserved for the digital entities called Autonomous Economic Agents (AEA). These agents are third-party implementations. Agents live in the second layer’s Open Economic Framework (OEF). To support the digital world, Fetch introduces a scalable smart ledger, in layer three, that provides collective superpowers to support agents’ individual power. Layer two and three form a network node. All three layers support Machine Learning (ML) and Artificial Intelligence (AI) functionality.

Fetch’s distributed ledger project is initially open-source and permissionless, but it can be permissioned if needed. For instance, delicate healthcare or IoT data is best suited to be processed on a permissioned blockchain.

Two of Fetch’s proprietary features are its useful proof of stake (uPoS) consensus system and a high-performance machine learning oriented virtual machine.

Fetch is working on solutions for the transport sector, the supply chain industry and the energy market.

Fetch.ai is a project of venture capital firm Outlier Ventures, that is managed by CEO Jamie Burke, that is also one of the project's advisors. In March of 2018, Outlier Ventures announced its newest venture, Fetch AI. At the time it had been in stealth mode for 14 months. The core team has been working on the project for two years now.

Partnerships

Fetch is a founding partner of the Blockchain for Europe association. Other members are Ripple, NEM and the Cardano Foundation. The goal of the partnership is to foster the understanding of upcoming regulations in the DLT and blockchain industry in Europe.

UK-based, online sharing platform for scientists, Clustermarket, engaged in a transformational scientific equipment venture with Fetch. Clustermarket will be one of the first platforms to deploy autonomous economic agents and thus demonstrate a primary use of the network, maximizing the value of the asset. According to CrunchBase, Clustermarket has raised 250,000 GBP in two previous funding rounds. The company is comprised of four employees.

Other partners include: Mobility Open Blockchain Initiative, MOBI, Warwick Business School (WBS), TokenMarket and ULedger.

Tokenomics

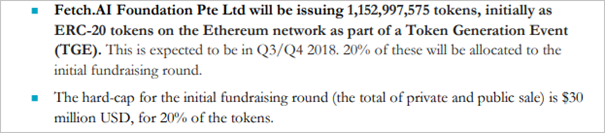

According to the token overview paper on the website, a total of 1,152,997,575, ERC-20 based FET tokens will be minted. The pubic sale was initially planned for Q3/Q4 2018. Only 20% of the tokens will be available for the private and public token sale. At this moment, it is unsure if all the Public sale tokens will be offered at Binance’s launchpad.

The amount of money that is being raised in the initial fundraising round is $30 million, for the previously mentioned 20% of total tokens, which means a fully diluted market cap of $150 million, which in this market seems a bit outrageous to me, for a utility token offering.

Another thing worth mentioning is that the team consists of 33 people, according to the fetch.ai website (38 according to LinkedIn), of which they state three co-founders. A total of 20% of the tokens is allocated to the founders. They have a vesting scheme that will last for 3 years with an evenly unlocked token amount each year, starting after the first year. Five advisors are listed on the website. Advisors are allocated 10% of the total token supply, following the same vesting period of three years.

I suspect with a team of 33 people the monthly burn rate will be very high. The Binance labs report showed Fetch liquidated some ETH SAFT funds into GBP, at a rate that was much lower than the amount raised converted into GBP at the time of conducting the private sale.

If they manage to raise their intended hardcap they could go on for a few years, but I am curious to know how they intend to survive in the long run. What is their business strategy? How will they ensure continuity?

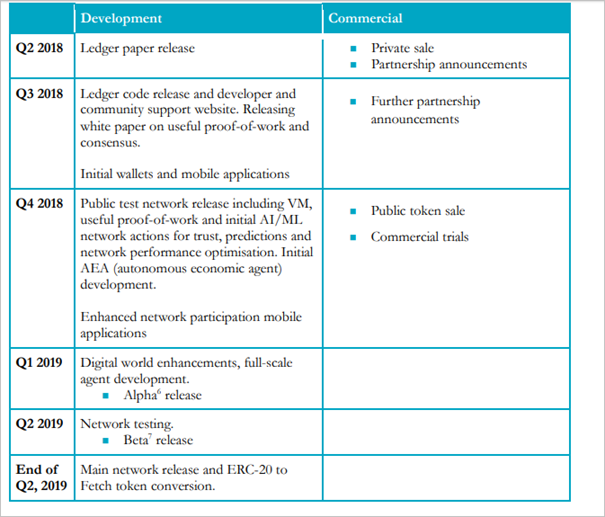

Roadmap

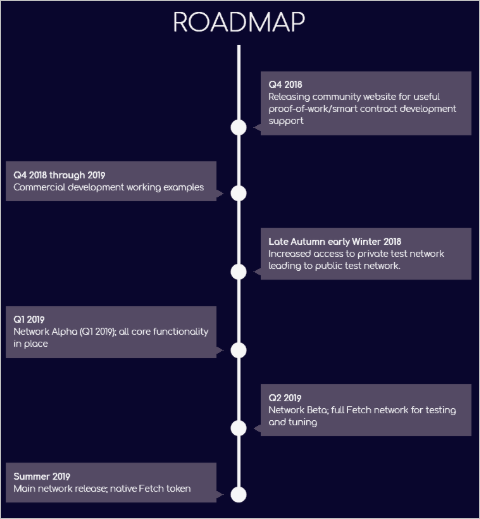

The initial roadmap estimated the mainnet launch in the summer of 2019. In the updated version the mainnet launch has been set back to the end of 2019.

Old roadmap Fetch AI

Updated most accurate roadmap

Fetch.ai legal disclaimer

The legal disclaimer posted on the website states very clearly that by purchasing Fetch Tokens you will get absolutely no rights of any sorts. That’s important to know because a case of bad management or poor business decisions will not give you any recall or complain options.

They basically tell you to do your own research, before investing, they are not implying you should buy their tokens, investors should take into account that the token might depreciate in price, and they will not be liable before, during and after you buy FET tokens.

Smart contract

In the past, there were some allegations against the fact that Fetch did not have a smart contract while conducting their ICO private sale. Cryptocurrency advocate Filip Poutintsev wrote about it in two Medium articles. Fetch has since come up with a smart contract that has been audited and deemed safe by smart contract auditor Hosho.

Smart contract audit by Hosho:

https://token.fetch.ai/publications/hosho_smart_contract_audit_report.pdf

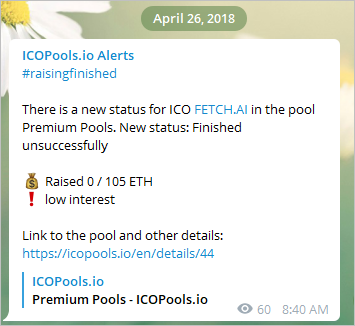

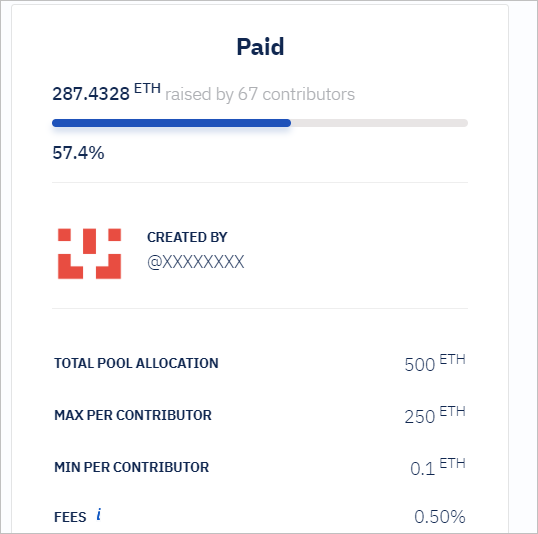

ICO pools for Fetch AI

Fetch started their private sale in April of 2018. During a time that the investor's interest in ICOs was quickly decreasing. A lot of ICO pools offered Fetch on their platform. Many pools did not succeed in raising the allocated amount in ETH, due to bearish market conditions and a lack of interest in investing in an ICO.

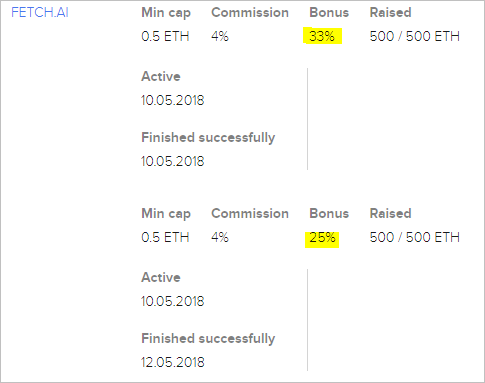

Participation capital managed to raise 1,000 ETH in exchange for FET, at a 33% and 25% bonus.

All pooled funds have a lockup period, which means that private sale pool participants will not be able to sell their tokens on the exchange if FET tokens are launched on Binance or another exchange soon after the launchpad token sale (keep the initial supply low, right).

Concluding remarks

When BitTorrent initiated their ICO on the Binance launchpad, for a second (or 15 minutes) following the process took me back to those exciting times in 2017 when ICO investing was a highly competitive industry, that was often based on good preparation and a large dash of luck. However, I don’t think that ICO investing will ever become a big thing again, and I hope it won’t because it will not bring value to the industry, if anything it has a pretty destructive nature, because of the lack of accountability.

Pros:

They have a large team of industry professionals and are backed by a well-connected VC-firm

Launch on Binance launchpad, which attracts the majority of individual token sale investors

They allow the smaller investors to be able to invest in their project, not only available for institutional investors

Higher probability of listing on Binance, which will benefit the token liquidity, if Binance continuous to be a top volume exchange

Cons:

Fetch proposes a very high valuation ($ 150 million) on a fully diluted basis

They are not liable in any way shape or form after purchasing Fetch Tokens, according to the legal disclaimer

Very low initial supply, great for price manipulation, thus high risk

Personally I will not be investing in this ICO. The traditional ICO conducted in this way has no long-term viability in my opinion. For small time individual investors, the risks are too high, under these bearish market conditions. I do however think this ICO can perform well after it is listed on Binance during the first few days. My guess is that after a few days the hype will fade away and the token price will be decreasing at a rapid pace. The mainnet is set to launch in Q4 of 2019, so there is not much, besides new exchange listings and the announcement of interesting partnerships to hold up the price.

I think this project is in line with some other projects that are competing for a slice of the cryptocurrency market pie, but I have yet to discover something that sets it apart from the other projects. The project is still in its test-phase and in this phase, the uPoS consensus method has not been tested yet on a large scale. I am curious to know why Binance decided to launch Fetch on their launch pad. Maybe the low initial supply, as Binance’s CEO stated he liked in a recent Tweet.

Final remarks

The overall conclusion as to why I will not be investing in this ICO:

— This ICO has been in execution phase for almost a year, first private sale, soon to be public sale. Private sale investors have a lockup and a bonus of 33% or 25%.

— The private sale didn’t attract many investors, the team is about six months behind on their initial roadmap, mainnet is planned for EOY. In the meantime other than exchange listings and partnerships probably not much news.

— The project might run out of funds soon if the token becomes illiquid or doesn’t raise additional funds, as 85% of private sale SAFT funds have already been converted into fiat currency (approximately $3.5 million). A large staff that needs to be paid, estimated burn rate between $200k and $500k a month.

— Only 20% of the total tokens will be offered in the token sale, 11.62% in the private sale (locked), which leaves 8.38% for the public sale. Fully diluted, the market cap is too high for an ICO that has no liability to its investors.

What are your thoughts on Fetch.ai? Do you think it will perform well? Please let me know any remarks or questions in the comment box below.

Website:

https://fetch.ai/#/

Smart contract audit by Hosho:

https://token.fetch.ai/publications/hosho_smart_contract_audit_report.pdf

Fetch Technical paper:

https://fetch.ai/uploads/technical-introduction.pdf

Fetch bluepaper:

https://fetch.ai/public/pdf/Fetch-Token-Overview.pdf

Disclaimer: I would like to state that I am not being rewarded or incentivized to write this project overview of Fetch.ai. This article is not intended as investment advice. You should always do your own research. All the information provided in this article is based on my own personal opinion. During these challenging market conditions I strongly urge everyone to thoroughly research projects to potentially invest in. If you do decide you want to invest, only invest money you can afford to lose.

If you like my content about blockchain and cryptocurrencies, you can give me a follow. I also have an account on Steemit and Twitter. You are welcome to follow me there as well. On my LinkedIn page you will find a bit more personal information. You can ask me questions on Telegram: @LindaCrypto.

I hope you have enjoyed this article, and please comment in the allocated section below if you have any further questions.

Thank you!

LindaCrypto

Originally posted on: https://hackernoon.com/fetch-ai-a-project-overview-of-the-next-ico-on-binances-launchpad-662ce3878de6

Congratulations @lindacrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit