The Fibonacci retracement or "Fib lines" at its core is just a tool for measuring a market by dividing the overall vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100% when used correctly and in conjunction with other indicators this becomes a very powerful tool and can definitely give you an edge when trading. I have had lots of people ask me how to use fib retracement so i have decided to write an article to try and help people learn fibs and hopefully tilt the odds in your favour.

Fibonacci retracement is created by taking two extreme points, usually by clicking on the Swing Low and dragging the cursor to the Swing High as shown in the pic. Once these two levels are identified you will then be able to use the horizontal fib lines to identify possible support and resistance levels, as you can see on the chart below the 50% fib line became the support after being the resistance, this is quite a common instance, resistance when broken will often become support and vise versa. Also is a good idea to run the fib from a few different points also changing between timeframes will give you a bigger picture on what is happening. Hopefully after reading this post, using and practicing with fibs you can start to see just how accurate and powerful this tool can be when used correctly and in conjunction with other confirming indicators and TA.

In the chart below we have zoomed right in on the action from the 3Day down to 5min chart, i have ran my fib from the lowest point to the highest peak and you can see how BTC has bounced right off the 50% fib line again, it is defiantly worth keeping a note of any patterns you find, you may find this more useful that you think.

Below you can see a picture of me trading NEO on Bitfinex, I have re-entered my buys just to demonstrate how i used the 50 & the golden 60% fib line to enter a trade. You can see how a spike down to the 60% fib got me into play and how it has bounced me straight into profit! Now to lock in profits and to stop me loosing money on the trade i will pull my stop up above my buy-in price, then i can sit back in the knowledge that i am not going to loose money on this trade, if NEO does retrace more and i get stopped out then i will simply re-chart, set up my fibs and wait for another opportunity to buy in.

Fibonacci retracements are often used to identify the end of a correction or a counter-trend bounce. Corrections and counter-trend bounces often retrace a portion of the prior move. While 23.6% retracements do occur, 38.2% to 61.8% retracements are much more probable outcomes (with 50% in the middle). You have probably heard traders mention the 60% fib most often, The key Fibonacci ratio of 61.8% - also referred to as "the golden ratio" or "golden mean"

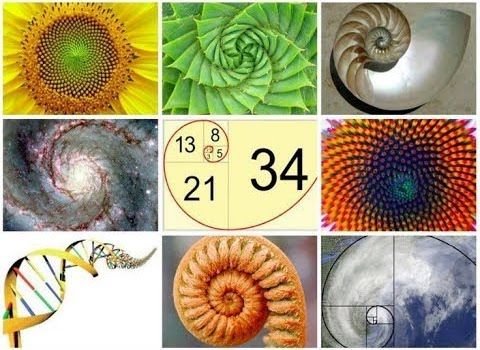

The golden ratio (symbol is the Greek letter "phi")

Phi is a special number approximately equal to 1.618 It appears many times in geometry, art, architecture and many other areas in life! In fact if you look deep enough, it can actually be found basically everywhere in nature and has even calmed the name of Gods Fingerprint. From a shell on a beach to the spiral of galaxies, even your own DNA, it all has the exact same mathematical blueprint that is underpinning the entire universe.

Scientific observations have proven time and time again that Fibonacci numbers are interconnected between nature, the human brain and our collective behaviour, The natural tendency of collective human decision-making follows a unique pattern that reiterates by the ratio of 61.8%. The sequence begins with the numbers 0 and 1 and then each number is the sum of the preceding two: 0+1+1+2+3+5+8+13+21+34+55+89+144+233, and so on.

There is a mystical mathematical property that makes this sequence remarkable, Dividing each successive number by the preceding one gives a quotient progressing toward a constant roughly equal to 1.618 or ‘phi.’ These factual correlations between Fibonacci, Human and Nature are not a coincidence. Fibonacci numbers are ‘Log Periodic Series’ that repeat in any system of Chaos at every scale from impulsive to corrective manner, eventually restoring order. Today there are very few daytraders who do not use Fibonacci methods in order to gain an edge in their trades and the more traders that do use fibs the better they will work.

Congratulations @crypto-decrypt! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto-decrypt! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto-decrypt! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto-decrypt! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit