Introduction

The theory of six degrees of separation (SDOS) is an idea that makes the world seem so small. In simple terms, this idea states that any two random people in the world are connected together in six social connections or less. This means that a person can meet another person from the other side of the world by introducing themselves to six or less “friends of friends”. This theory was thought of by Frigyes Karinthy in 1929 but then was worked on by many others. A very important person in SDOS world is Kevin Bacon as we will see further on.

This is a very interesting theory that changes the way we see the world however this can be further developed by applying it to the finance or economic world and help us predict the future of these two disciplines. This is where the Six Degrees of Financial Separation was introduced. Investors think that markets are separate and don’t affect each other but this is quite the contrary as we will see further on from past examples. When something is affected and is part of a network it would affect others in the same network. It is believed that through such theories we can predict when markets will fall and which other markets will be affected by it. The problem here seems to be that since this theory is quite in its early stages not much information can be found on it. This makes it much harder to apply this concept to the financial world.

Understanding the Theory

The world is full of connections and relationships which when seen as a whole make up networks. These can be found anywhere and are extremely important. Nature itself is filled with networks as one can see our own bodies are filled with cells connected together in a network making up all of our organs. The question is, how can different component affect each other and how? Networks are divided into two categories which are the random networks and scale-free networks. If one looks at the theory in itself it looks quite possible. Let us assume that a person knows 44 people and each of those persons knows 44 different people. When you calculate it, you see that in just six steps you can be connected to 446 which comes out to be 7.26 billion people. This is more than the people that are alive on Earth today.

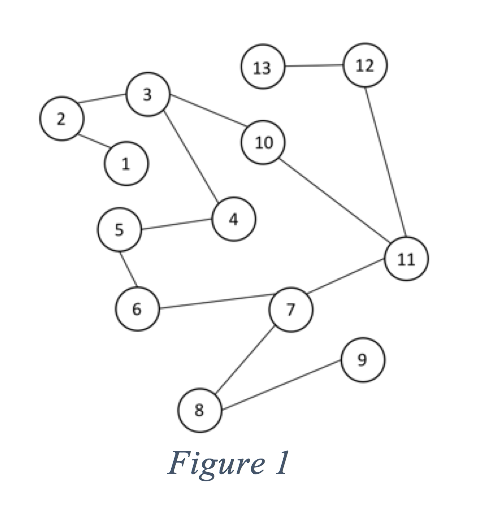

To explain SDOS we first must look at random networks. A random network is a construct of random links between nodes (see Figure 1). These have no order whatsoever. The nodes in this network can be considered to be people and the links between them is the relationship people have with each other. A person can know more than one person. Now let’s say person 4 wants to give information to person 7, he cannot give it directly as he does not know the person. Hence, he would have to go through persons 5 and 6. The more people get to know each other the more connections are made which means that the distance can shorten quite drastically.

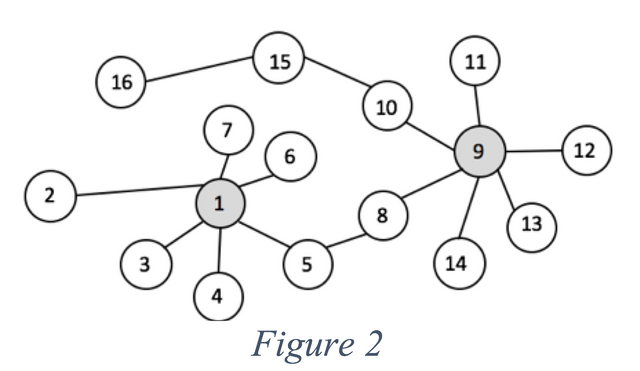

In random networks, each node has approximately the same number of connection. When a network model has many connections, it is known as a “scale-free” network. The scale-free model makes use of hubs, which are nodes having the largest concentration of connections in the network (see Figure 2). Persons 1 and 9 are considered as hubs as they have the most connections. When having these hubs in a network it shortens many paths quite significantly as if you pass the information to a hub chances are it would have a higher probability of knowing the target receiver. This, however, is a risk as if the hub is attacked there would be many nodes feeling the consequences as well.

Applying the Theory

In 1967 Milgram tested this theory out by sending 296 volunteers a document which contained: a description of the study asking the receiver to become a participant, the name of the target person, a roaster and a stack of 15 business reply cards. The rules where simple; the receiver has to add his name on the roaster, detach a postcard, fill it and return it to Harvard University, then if you know the target person on a personal basis send the folder to him else mail it to a personal acquaintance who is more likely to know the target person. Sixty-four of the folders actually reached the target person. This means that 29% of those sent out by starting persons eventually reached the target. “This study demonstrated the feasibility of the “small world technique, and took a step forward demonstrating, defining and measuring inter-connectedness in a large society”.

As mentioned in the begging, this theory will prove to be very useful in many different market sectors. In order to this one has to calculate the relationships and the strength of the relationships between the nodes of the desired network.

A perfect example proving this would be the Lehman Brothers Case. Lehman Brothers filed bankruptcy on September 15, 2008. It was the fourth-largest investment bank in the US with twenty-five thousand employees. The company filed bankruptcy with $639 billion in assets and $619 billion in debt. We will now see how this incident affected the financial markets around it.

If we start from the beginning we see that when the American Express spun off from the Lehman Brothers it led to a quarterly loss of $2.8 billion from Lehman’s side. This outcome resulted into a decline of 3% in bank stock returns, loans, savings and brokerage firms that very same day. When looking at the size of each respective financial institution into consideration, results are presented that show that larger financial institutions were affected more so by these events than smaller financial institutions. Results are thus presented that show that the many types of financial institutions were impacted by Lehman Brothers’ difficulties in its final months.

When looking closer at the results of the financial institutions we see that the larger the institution was the more affected it was by this scandal. Obviously the effect these large financial institutions had effected smaller institutions connected to them. This shows how these institutions are like one large scale-free model. The larger institutions which are represented as hubs effect the smaller institutions represented by the smaller nodes.

When looking for an economic example we find Brexit. This is one of the most recent events that shook Europe in particular. In 2016, the United Kingdom planned to withdraw from the European Union. This is of course a long process which started in March 2017. Brexit will affect itself and those around it economically without any doubt. The biggest risk this could imply, apart from financially is politically. For example, Brexit has raised questions about the Eurozone, Schengen and the relations with Russia. When a country exits the Eurozone, it would be destabilizing because even the possibility of leaving could provoke bank runs. An example showing how Brexit affected us locally is that when this actually happens many products we import from the UK will increase in price by a lot since the agreements the UK would have had with Malta because of the EU would be gone.

Future Possible Works

There are endless possibilities that can be done with the help of six degrees. If one considers to map out all financial institutions around the world and their connections with each other, we could be possible on the brink of a breakthrough. When this is done and a software monitors the activity in the financial markets we can see that if for example, a company has some kind of problems it can affect other financial institutions such as Stock Exchanges around the world.

If we look at the connections England has economically with other countries we see that with their ‘Brexit’ decision they have not only effected other countries directly but also indirectly. This is because as we have been saying whenever we are dealing with networks we almost always have that ripple effect where, if one node has a negative impact, those surrounding it will probably suffer as well. We see that using the same principles mentioned above but in an economic way we can predict which countries will be effected by certain decisions and by how much they will suffer.

Conclusion

We have seen the great importance this theory has and also its possibilities but it does not end here. Nowadays with the help of the internet and social media, we are getting to know more and more people. This, in terms of modules, is creating more connections between the nodes hence shortening path lengths.

In 2016, Facebook conducted their own research about this theory and from their 1.59 billion active people on Facebook they found that each person is connected to every other person by an average of 3.57 other people. This as stated by them is just a calculation with a statistical algorithm but it measures the distances with great accuracy.

This proves how by time, with the help of technology, the world is getting smaller and smaller and people are getting to know more and more people. With this the technologies based on six degrees would get more and more accurate by time. However beneficial having more and more connections in a network might seem, it carries many threats which can disrupt the synchronicity and consistency in of the network.

Congratulations @andre.kinder! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @andre.kinder! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit