The fight is fast approaching. Mayweather has decided to come out of retirement to battle it out with the Mixed Martial Arts wonder kid, McGregor. In this fight, Mayweather is clearly the favorite while McGregor is the underdog. This highly publicized bout has made me think of another looming showdown in the financial sector. The fight between financial institutions (Banking sector and the remittance industry) vs Blockchain. Just like the Mayweather vs McGregor fight, the banking sector in the fight of the banking sector vs blockchain, we have an underdog. In this case, Blockchain is the underdog but still the favorite. Interesting, right?

The fight is not sanctioned; this might be the problem. But fights like this are not uncommon. The battle over transactions is just getting started. Disruptive technologies are usually a pain in the ass for established industry players. We saw what happened when Uber and Airbn come up. The uber vs Taxi fight was taken to the streets, cars were getting burned. But as expected, uber won. Disruptive technologies always win. They offer better products and services at a lower cost. Cable companies where fighting against satellite companies, now they are both fighting againast streaming TV services. The list is endless, but the outcome is still the same, disruptive technology always wins!

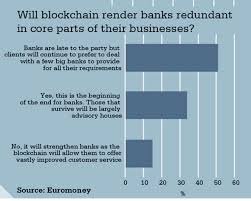

Back to the blockchain technology versus the banks. Banks have finally reconognize cryptocureencis as a competitor. They are paying attention. Cryptocureencies are no longer just a fly the wall. The fly is getting bigger. Its becoming a nuisance. Banks have realized that the have to embrace blockchain for survival. They have realized that by using blockchain and cryptocurrencis, they can greatly cut operating costs and increase efficiency. They can move large amounts of money in seconds. Ripple, a blockchain company has decided to bridge the gap between the banking sector and cryptocurrency by trying to get banks to embrace this as they claim they can save the average bank around $600,000 each year on expenses directly related to moving money around. Everything on the chain is completely decentralized and therefore doesn’t require a bank president approving each transaction from the bank sending money. The same holds true for the approvals on the receiving banks’ end. This is because each bank has their own ledger and combining ledgers among the banks would be nearly impossible.

In my opinion, its up to the banks to decide the fate of this fight. The advantages offered my cryptocurrencies is no longer negligible. For example, using bitcoin for transaction purposes is more advantages than sending money using banks. The fees are negligible without legal obstacles. You can send over $1000,000,000 using $50.Apart from the low transaction fees, convenience is another factor. Blockchain technology allows gives you a bank in your pocket. You can send money anytime, anywhere. Its not restricted by office hours. You don’t have to fill lengthy compliance forms to transact. No, everything is nice and easy!

Banks know all of this. With this in mind, banks have taken this disruption as a threat to their very existence. If they continue on this path that may come to fruition as their profits are always being strained from the increased cost of doing business. Banks have realized that every penny that migrates to digital currency is a penny lost and to them, this is a serious threat!

Banks are responded by completely blacklisting any organization or individual using cryptocurrency. Any company or individual using cryptocurrencies cannot do get a loan with a bank. But the question is, is this really effective? When a country or organization places stringent rules around the movement of currency it always results in making things worse. Venezuela is a great example of that as tight monetary controls and restrictions against the people have contributed to the dollar being 7,500 times stronger than the Bolivar. That has resulted in Venezuela having the highest inflation and unemployment in the world.

Every time banks go against cryptocurrency, people lose more trust in banks and invest more in cryptocurrency. Some banks are doing a good job of embracing the change, but many banks need to wake up and embrace it soon or they will be replaced by disrupters who are more than happy to fill the void.

Follow @bitbizke

www.kryptotrade.net

.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/banks/@investorcrypto/the-blockchain-vs-the-banks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit