Image from Pixbay

Disclaimer: I am not a financial adviser. Please do not consider this as a financial advise.

First of all, its my birthday today. So shower some love, upvote and resteem. :P

I am born and brought up in India in a middle class family. I have lived a middle class life till date and plan to do so for the rest of my life.

Financial planning is a thing which is often not given enough importance at the right stage of life and then regretted later on. Here is something which I think.

1. At the age of 21-25:

- Spend everything. Live your dreams. YOLO

Image from Pixbay

An individual should start earning at an age of 21-25. Sooner the better but pursuing post graduate degree in India can take time. Some courses like medical also take longer to complete. But 25 should be a good age to start earning and becoming financially self sufficient.

One can spend all money which comes in till the age of 25 years. A newly earning individual will have some personal aspirations and fair to be accomplished. Personal aspirations can vary from buying a good phone, good bike to buying cars or smart watches. This purely depends on individuals interests. Some personal interests may already be accomplished by parents blessings but there can still always remains some no matter what.

- Exception

As soon as an individual becomes financially self sufficient he should inculcate a small discipline in himself. That I will call as investing in PPF which is Public Provident Fund. These are funds invested in government banks generally considered as retirement safety. It have a locking period of 15 years. It pays a compound interest to all money invested and is tax free. Check for EEE investment instrument for details.

Clicked from my phone. A dream which came true after 9 years of wait.

2. At the age of 25-30

Once personal level smaller dreams are fulfilled, an individual should start taking financial planning seriously. This is often forgotten and people get carried away. People continue with their spending habit and end up taking their standard of living to an all together different level.

I personally believe that transition from a non earning to earning individual should improve your standard of living to a certain extent. But it shouldn't continue to grow linearly with age. The issue I see here is that most of the times standard of living once raised is very difficult to compromise in future. May it be forced or willingly, there are very less individuals who can accept a lower standard of living after living a superior life.

One should plan on following milestones not necessarily in the same order

Buying a home

Buying a car

Saving for your marriage and honeymoon

Contributing in family expenses

Contributing in family luxury like buying a bigger television etc.

Clicked from my phone. My contribution to my family luxury

Above milestones may not be completely achieved by the age of 30 but one should at least start a loan and start paying installments on the loan availed. Generally loans for these milestones continue for long period of time.

3. At the age of 30-35

Once you are recovered from the heavy expenses of above milestones you should focus on saving some money again.

This is again another important milestone of your life which shouldn't be ignored. At this age one should start planning the future financial life even more maturely.

Securing future of your loved ones

Often people get married around the age of 30. That in itself adds up some responsibilities. However the bright side is, you have a partner to share your emotions and even the financial burden. Once you are settled with your marriage and marital expenses, one should immediately plan on buying a term plan and a mediclaim policy. These 2 are very important and often regretted if became victim of. A term plan is kind of a life cover promised in case of death of an individual in the decided tenure of say 20 years. Mediclaim is a policy promising to cover your medical expenses capped to some amount. You have to pay a monthly premium to the insurance company for both of them. The premium varies on various factors like smoking habits, drinking habits, existing illnesses, family medical history, sum insured etc.

One should be very careful while selecting them because a hidden or ignored clause may void your policy.

Distributing your investment

Distributing your wealth across various investment instruments is a wise decision.

- Real Estate:

If not bought a house already, one should buy a house and invest in real estate. Real estate in India is something which will never fail you. It surely rises, its just that you can't be assured of the growth or rate of growth.

- Stocks:

Another good investment is stocks or equity market. There are good stocks which are on an upward trend in the long run. One can buy some shares and stack them up for long term. A timely check on the price value of the stocks is an implicit necessity though. Stock market is volatile and thus one should not fall for the easy money. If your risk appetite is low you should not get carried away by trades in equity funds. Obviously if you are an expert trader then you know the risk probabilities well.

- Commodity:

Gold and silver are also good investment components. They too can be bought in small volumes but at regular intervals. Their long term trend is also upwards.

- Cryptos:

Being a crypto lover I would add this component too as a good investment. Definitely do your research before buying cryptos. But invest in a good project backed by a good team and HODL for a long term. Just imagine buying Bitcoin as an investment 5 years ago. History may repeat itself, just with a different coin, or very well with the same coin also. Who knows.

A well distributed investment portfolio just keeps your risk low and chances of losing your savings low. With that it obviously reduces the chances of high profits too. I personally have a low risk appetite so I would prefer slow but assured returns rather than high but risky returns.

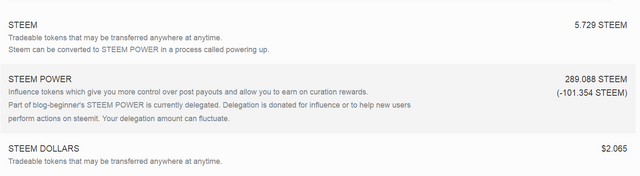

My investment in Steem

4. At the age of 35+

Lifestyle these days has changed a lot. Eating habits have changed too. Competition and stress level keeps on adding up. With all this, human life is getting shorter and shorter. We are falling pray to new diseases and disorders. Having said that working till you die may not be a very wise option. With inflation and your ever increasing needs this sounds bizarre right ?

How are we supposed to survive without working ?

Here is how. Keep your needs low. I am not asking you to live a low profile life but control your unnecessary expenses. And secondly setup some passive incomes. 35 to 45 is the age where you should start thinking of financial independence. In other words you can call it as 'work as per your will'. You shouldn't be forced to work in order to earn your bread and butter. There should be ways in which you can earn your day to day expenses without working.

There are various ways to achieve this. Chose/invent your ways.

- Rent out homes:

Renting out homes is a great source of passive income in India at least. It gives you a fixed monthly income without having to work for it. This definitely needs good investment in real estate. But if done, it can easily support your day to day needs.

- Interest from PPF:

If you have invested right amount of money starting from the right age(21-25) you will get hefty returns in terms of rate of interest. The magic of this investment is that the investment made every year is tax free plus as a bonus even interest earned is tax free.

- SP delegation:

Like money from rent even steem earned from delegation can be treated as a nice passive income. This largely depends on the government though. The much discussed ban on crypto currency by Indian government may rule out this option for the Indians.

Retire when you are young so that you can live longer.

Image from Pixbay

Final Words

It is very well said that 'Money saved is money earned'. I am a true believer of this phrase. I take pride in saving money and the techniques I use to save it. Indian economy deals a lot in cash. So we have to use cash for day to day transactions. I have a habit of storing cash coins from any any left transaction into a piggy bank. Small value coins are generally spent without even noticing them. However if they are collected in this fashion for a tenure of even an year they turn out to be good sizable savings. I have always been doing that since childhood. Anything bought out of such savings gives me a feeling of getting something for free.

Little drops of water indeed make a mighty ocean.

My current piggy bank which can buy me at least 500 Steem

Clicked from my phone

If you are a plankton, join us here discord We grow together and It rains cryptos here!!

Project by @cadawg and @mermaidvampire

PS: Plankton Token is tradeable in the Steem-Engine Dex now at 0.35 Steem/PLKN.

This footer GIF was made by @gerber

Posted using Partiko Android

God damn it, I'm early to the party. I'll come back in 12 years then (My 18th was a few days ago). =(

Anyway, Happy birthday. See you in 12 years 😭

~ @cadawg

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, hand over all your steem to me and go on hibernate for 12 years. I'll keep your portfolio safe. Haha

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ever heard

Not your keys, not your coins- I believe that strongly so how about nah!I'll let you keep 1 steem of mine safe forever though :)!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for being an awesome Partiko user! You have received a 95.00% upvote from us for your 22353 Partiko Points! Together, let's change the world!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@blog-beginner Your subscription is now expired. See here to extend your subscription or delegate 30 SP for a daily resteem and daily $~0.02 upvote.

Reply OFF to turn off notifications (or if you've already re-subscribed - new credit gets applied after reaching 0)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Of course a diversified investment portfolio is important. However, I think it's equally important to be able to lower your standard of living, should that be necessary. That way you always know how to distinguish necessity from luxury, and won't feel bad about selling your car and switching to a bicycle, in case your gov't fund or the stock market... or even the allegedly rock-solid real estate market don't deliver as promised. Also, by being aware of what luxury means, you'll be able to enjoy it more, as it does not turn into a false sense of necessity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very well said @stortebeker. I totally agree. Luxury if enjoyed for long is often confused as necessity.

Many people get depression when crashed financially. That's why controlling it at the right time is very important.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @blog-beginner! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit