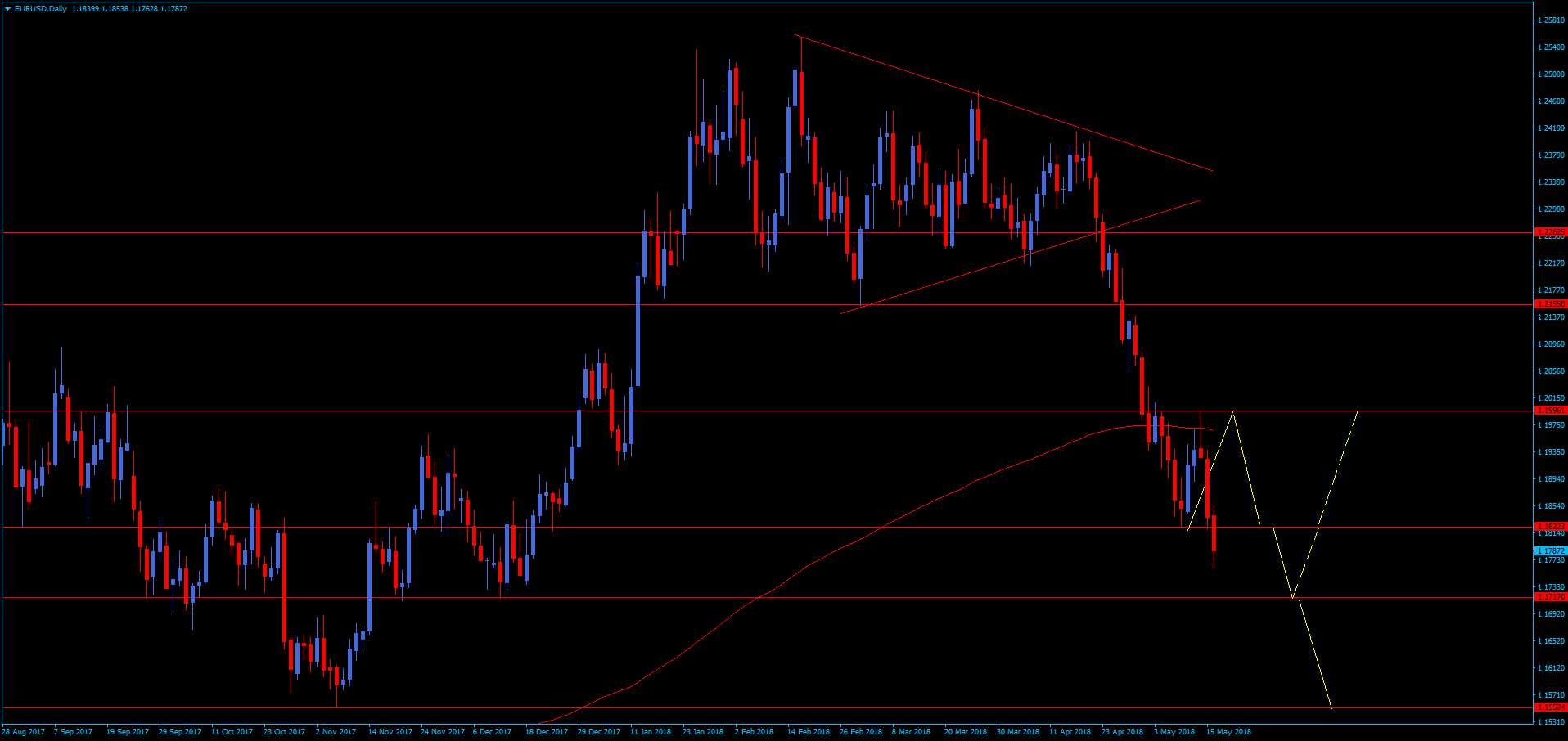

EUR/USD Daily

The pair Yesterday followed the previous signal from the candle at 14.0.5 as it has foreshadowed the strength of the correction for a possible reversal. The price opened at 1.19233, made an effort to climb a little bit just to reach 1.19379 and then the Euro started dropping real fast. The movement has pushed the price lower to 1.18198, after that the Euro closed at 1.18368. The lowest point was the last dip from 09.05 and test it with a little reversal. A small hope was given to the Bulls that the price may reverse there.

For now the price has executed half of the predicted path of the Euro (green lines). Currently the move is ongoing to executed the forecast towards 1.17170 (The 12.12.2017 low). After that we have two possible outcomes: 1. Price continues its downside momentum towards 1.15524 regarding strong Buck and fundamentals. 2. The price manages to pull back to 1.18223 and beyond that towards 1.19000 levels.

Fundamentals were not in favor for the Greenbuck Yesterday as Core Retail sales came at 0.3%, forecast was to increase to 0.5%. Retails Sales as well came in at 0.3%, forecast was to drop to only 0.4% from 0.8%. Empire State Manufacturing Index was the only indicator to come at positive territory. The index settled at 20.1% from the forecasted value of 15.1%. Business Inventories was flat, coming in at 0.0% from 0.2%. Housing Market Index remained flat at 70 from 70 forecast.

For now the negative momentum is remaining strong for the Euro, so longs stay safe and try to sell at the tops. Short-term movement towards lesser value for the Euro against the Dollar remains bias. Any additional factors that may subdue the price will be revealed in future events and data.