Hello!

Below is a quick recap of the Kevin O’Leary event Kayla and I went on May 3rd. Photos included from the key takeaways from his presentation, and a link below to basically the same exact speech he gave at the event for your viewing.

The event was pretty similar to that of a timeshare presentation. The opening guy, who is some Hedge Fund manager I never heard of that is apparently on CNN a lot, and then a guy that teaches stock and options trading, but feels more like a sales guy. I feel a little bit like my time was wasted, but the idea of looking at stock options is now in my head for what I should start researching. Clearly, the objective of the seminar was at the core, to push their classes. They started with an introductory rate of $997, but I did some research while they were talking, and the customer reviews say that the $997 class is just a tease as they try to push you to take their $60,000+ courses.

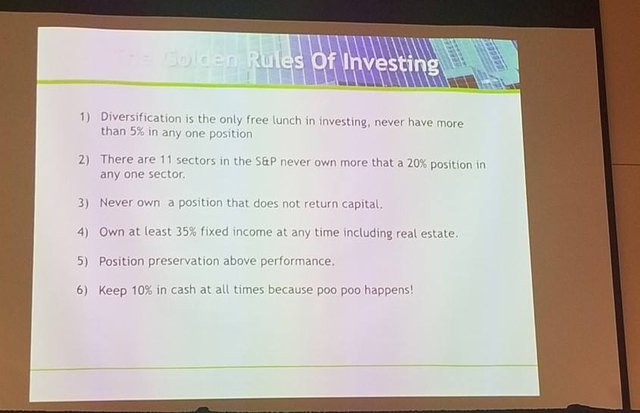

I admit, I was excited and initially signed up for the $997, but I quickly started to do my due-diligence and canceled it immediately. Controlling emotions can be tough for me as I do like to be impulsive, and these sales tactics totally play into the people like me. However, I reflected on the investing principles learned from other investors I listen to and read about, including Kevin O’Leary from his interviews. Which is funny, because it was completely counter information from what those guys were pitching.

Don’t believe people that say they can consistently beat the market or have a way to consistently beat the market. Average returns are 7-9% in the S&P 500 and bonds is 3-5%. Here are a few things that concerned me…

This guy said he consistently beat the market by 20%+. Sometimes over 250%. Huge red flag!

The worst you can lose in buying options (call or put) is your gain. You can’t lose the principle. Which I found out was not true. If you hold onto an option for a long period of time and it expires. You lose the money you pay to keep the option open if you don’t sell. You may not lose as much as a stock going to $0, but you still can lose money.

Note: I am still learning this whole process, but that is what I have gotten from Moneyweek and other videos on options.

They said they were going teach us tactics and the know-how. They did none of that. Just blasted the audience with charts and played to people’s greed and fears.

Absolutely no questions direct from the audience. They blame time management, I think it’s more the speakers don’t know much else from their script.

Kevin’s presentation had nothing to do with what they were saying and was a word for word presentation of what I have seen him present online. It felt like I was watching a puppet perform rather than an engaging session on investing.

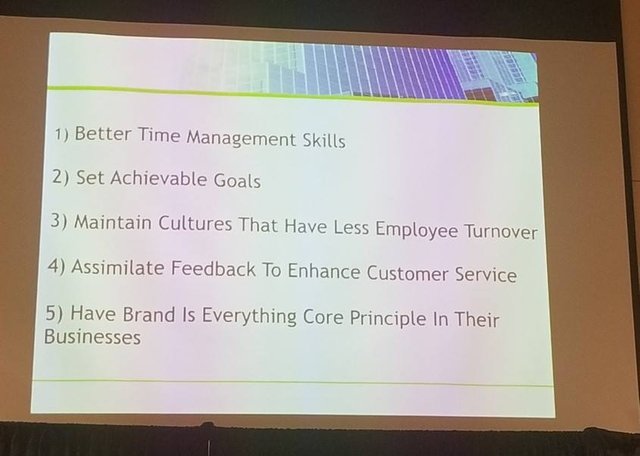

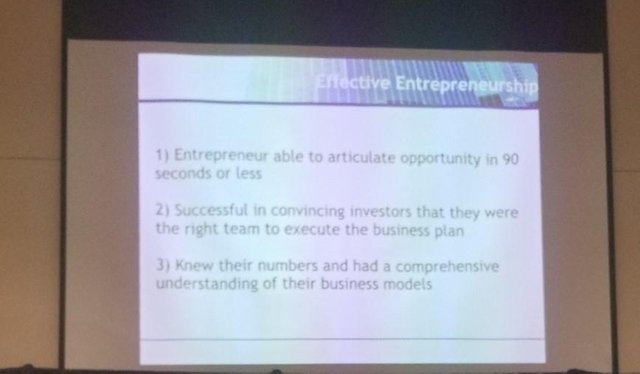

So that is what I got out of it, and Kevin’s slides had some good key themes for good pitches and entrepreneurship, which is why I am even sharing them on this post.

The thing that honestly hurt out of this presentation, was reflecting back and seeing the audience. Specifically, the elderly that were there. Many there were people that clearly didn’t build a retirement, low income and were in less than ideal situations. For that, this felt heartbreaking and a bit wrong. These people will likely be set up for failure and lose at least their $997. I wish these people well and I hope the blogs and reviews I read on that company are wrong. I just couldn’t be sold to commit. If anyone, has gone to the Interactive Investor classes and they are great, let me know what the experience was like and what you learned.

I hope this painted a picture of the event and added some value. Have a great weekend!

Kevin O'Leary on Investing:

.jpg)