We've all heard the saying, The poor and the middle class work for money. The rich have money work for them. What does it all mean? What do the rich do different? How do they keep getting richer?

It's the mindset that differentiates them. It's about the way they think, manage and invest their money. There is a growing need to become financially educated, and make money work for us than the other way around.

People work hard to become better at their jobs to make more money, but fail to learn how to make money work hard for them.

So then, what is savings? What is growing money? What is investing?

Saving money and growing money are two very different things.

One comes with no risk and very little gain, the other with varying risks and comparatively more gains, if done right. To put it in perspective, that surplus cash which you have at the end of every month and is usually idle cash are your savings. Whereas growing money involves circulation of money into various investment instruments and eventually creating assets.

Investment instruments are just ways to grow you money. Now there are various investment instruments out there with certain risk and return associated with each of them.

They can be broadly categorised into:

1. Fixed Income Instruments

2. Equity

3. Real Estate

4. Commodities

Varisty by Zerodha has beautifully curated content to learn about financial markets and you can read more about each of the investment instruments.

You could invest into any of these instruments depending on your risk appetite.

Important thing is that you begin investing and remember not to put all our eggs into one basket. That is, Diversify between your investments.

When you talk about what kind of an assets we should aspire to build with our investments, I think Robert Kiyosaki puts it the best in his book Rich Dad Poor Dad.

"Our assets are large enough to grow by themselves. It is like planting a tree. You water it for years and then one day it doesn't need you anymore. Its roots are implanted deep enough. Then the tree provides shade for your enjoyment."

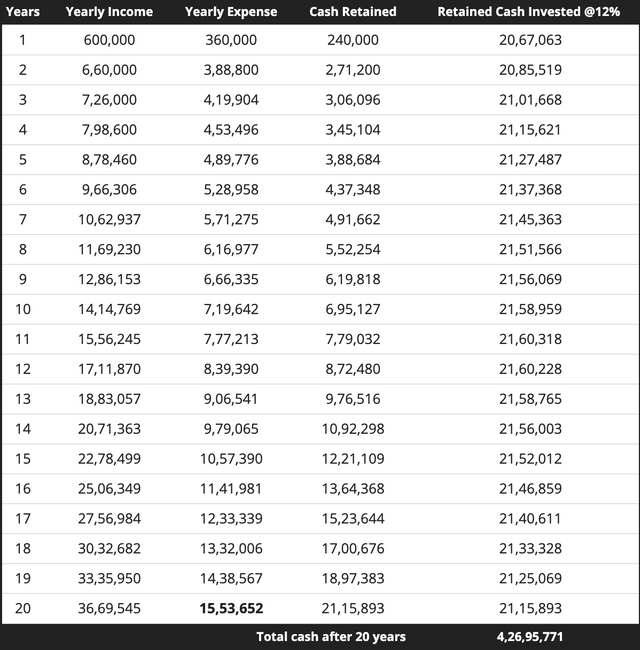

I came across a great example that really caught my attention and made me think. It compares two scenarios - one without any investment (Keeping cash retained idle) over the period of 20 years and the other with money invested over the years. Off course it's an oversimplified example to give you an understanding, and in reality there are going to be many other variables to be factored into before consideration. It simply shows the power of investing and growing your money over time.

Here's the gist - You would have grown your money by a whopping 2.4x times the regular amount if invested at an average of 12% returns (From Rs.1.7Crs to Rs.4.26Crs starting at Rs.6,00,000) with salary hike at 10% and cost of living (inflation) increasing at 8% every year.

I would like to give a short Indian mythological take on why we should invest. It's well known that in India we worship Lakshmi, the goddess of wealth.

In the book "How to become rich" by Devdutt Pattanaik there are a few very interesting and insightful take on Lakshmi. He says,

"Lakshmi is considered a restless goddess (chanchal), which means wealth brings value only when it is circulated, not locked up. Those who grab and lock her up get profits (labh) without happiness, not prosperity with happiness (shubh-labh)"

He also says,

"Lakshmi (wealth) and Saraswati (knowledge) argue until we discover Vidya-Lakshmi (knowledge of circulating wealth)." - Which basically talks about financial literacy. Educating ourselves about money.

These inferences are from the Vedas (over 3000 years old) and the Puranas (over 2000 years old), so even ancient knowledge reflects on the need to invest and put your money to work. I really hope that this article has helped give you some perspective on why we should invest and ignite a spark to begin. It's a beautiful and fulfilling journey once you begin. On a side note, always try to have a long term perspective and don't let short term gains get the better of your investments. Let the magic of compounding play its course.

I would like to leave you all with another saying from his book,

"Wealth is to be seen as a fruit (phala), to be enjoyed now, and a seed (bija) to be invested for the future."