International Business Machines Corporation(IBM)

Company Description

International Business Machines Corporation operates as an integrated technology and services company worldwide. Its Cognitive Solutions segment offers Watson, a cognitive computing platform that interacts in natural language, processes big data, and learns from interactions with people and computers. This segment also offers data and analytics solutions, including analytics and data management platforms, cloud data services, enterprise social software, talent management solutions, and solutions tailored by industry; and transaction processing software that runs mission-critical systems in banking, airlines, and retail industries. The company's Global Business Services segment offers business consulting services; delivers system integration, application management, maintenance, and support services for packaged software applications; and finance, procurement, talent and engagement, and industry-specific business process outsourcing services. Its Technology Services & Cloud Platforms segment provides cloud, project-based, outsourcing, and other managed services for enterprise IT infrastructure environments. This segment also offers technical support, and software and solution support; and integration software solutions. The company's Systems segment offers servers for businesses, cloud service providers, and scientific computing organizations; data storage products and solutions; and z/OS, an enterprise operating system. Its Global Financing segment provides lease, installment payment plans, and loan financing services; short-term working capital financing to suppliers, distributors, and resellers; and remanufacturing and remarketing services. The company was formerly known as Computing-Tabulating-Recording Co. and changed its name to International Business Machines Corporation in 1924. International Business Machines Corporation was founded in 1911 and is headquartered in Armonk, New York.

| Valuation Metrics | International Business Machines Corporation |

|---|---|

| Price | $124.79 |

| Daily Range | 4.57% |

| Opening Price | $119.34 |

| Daily Price Range | $118.30 - 123.94 |

| Bid | 119.27 x 1000 |

| Ask | 119.30 x 1000 |

| Fifty-Two Week Range | $118.30 - 171.13 |

| Trading Volume | 18,955,588 |

| Average Trading Volume | 4,979,431 |

| Market Capitalization | 108.409B |

| Beta | 1.03 |

| P/E Ratio (TTM) | 19.13 |

| EPS (TTM) | 6.21 |

| Earnings Date | Jan 22, 2019 |

| Forward Dividend & Yield | 6.28 (5.03%) |

| Ex-Dividend Date | 2018-08-09 |

| Target Price | $157.89 |

| Sharpe Ratio | -0.91 |

Summary Statement:

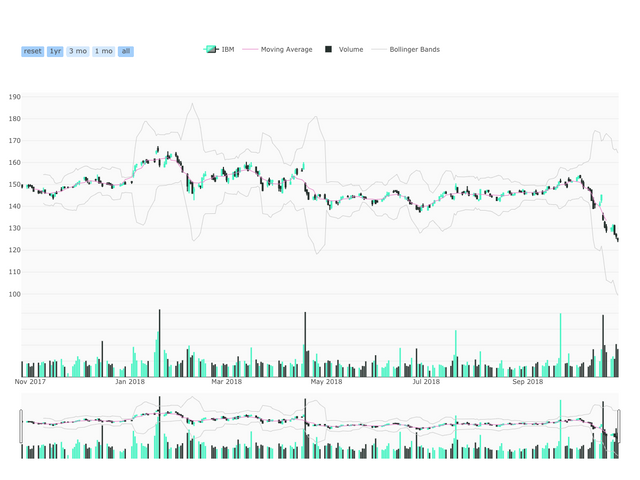

International Business Machines Corporation currently trades at a spot price of $124.79 with a one-year expected target price of $157.89 meaning an expected forward return over the next year of 26.52%. Some important measures to look at are the company's beta of 1.03 the company's Sharpe ratio of -0.91.

Disclaimer: This article is not investment advice. As with any investment, investing in stocks is risky and can result in a loss including principal. For advice consult your licensed financial advisor or broker.

Data provided in this article was brought to you in part from Yahoo Finance, Robinhood (using Pandas data reader web API), and Quandl.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=112350

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit