The Jews are known as "the world's number one merchant". So, in the eyes of the Jews, what kind of merchant is the most powerful? The survey shows that Jews admire businessmen who dare to make amazing investment strategies the most. They believe that if you want to make a lot of money in investment, you must do one thing first, and this is a lot of money! That is to say, in investment, we must be bold and careful, move quickly, and dare to make amazing investment strategies.

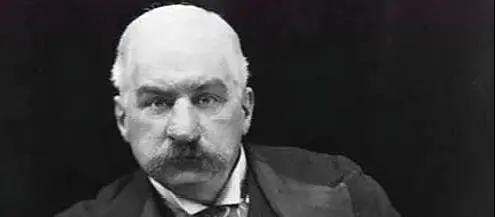

The American financial magnate J.P. Morgan, who is as famous as Rockefeller, is a typical big businessman who is bold, cautious, and daring to make amazing investment strategies. The money machine is running fast, because the concept of investment in his mind has fully matured."

At the end of the 19th century, rail transportation was the pillar supporting the transportation system of the American industry, but the various sections of railroads, like a disc of sand, could not fulfill this important task. If we want to integrate scattered railways and form a railway network, we need to spend a lot of money on railways and invest a lot of money. In this case, the extent to which the railway relies on bank investment is quite prominent. With the development of productivity, the degree of corporate socialization has become higher and higher, and the dissolution and merger of American companies have become more frequent, and the amount of borrowing funds has also become larger. This requires that if you want to invest in a railway bank, it not only has a strong backing of assets, but also a high reputation. In a situation where other banks in the United States may not have enough strength or reputation, the bank syndicate founded by Morgan has become a model for the U.S. banking investment industry in the new era. Faced with the economic crisis in the United States, many bankrupt companies put their hopes on Morgan, hoping that he can acquire their company, become their savior, and give their company a new lease of life.

In these times of crisis, Morgan quickly took action to turn the tide and help the building Yu Jiangqi. He took a scalpel and performed a major operation on the railway industry. This time he adopted a "buy at a high price" strategy. Whether it is the western railroad or those railroads that have long failed to meet the requirements of today's development, he has to spend a lot of money and buy them all so that they can quickly rectify the American railroads.

Morgan's investment strategy of buying railways at high prices, which some people call the "trust plan", fully reflects the amazingness of Morgan's investment strategy. Morgan's massive investment this time is not speculation, but to promote the development of railways. The reason why he set a price to beat all his competitors was also because he did not want to rely on this investment to make a profit in a short period of time. In addition, in Morgan's view, if the railway, as the pillar of the industrial economy, is occupied by others, then the hegemony he has just won in the financial world will become empty talk. Just for this, Morgan thinks it is worth a fight, which fully shows that he is also very careful in mind besides being bold.

Morgan's big investment and rectification in railways marked the transition from the initial stage of development of the American economy to a modern stage that emphasizes operation and management. It fundamentally changed the traditional American business strategy and thinking. The success of Morgan's amazing investment has a major impact on the direction of the US economy. This is even more true on Wall Street. Morgan’s business and investment ideas have become the target of imitation on Wall Street, and they are still influential.

From "pirate-style" management to the formation of syndicates, and then to trusts, Wall Street has transformed from a paradise for early speculators to the economic center of the United States. Wall Street later became a symbol of the development of the American economy and aspired to the world's financial hegemony. Morgan's contribution can be said to be second to none.

Through Morgan’s investment strategy, we can find that the Jews are full of risks and opportunities in investment. They are willing to try to make money from risks. This kind of investment strategy of “courageous, careful and quick” should also be a good businessman should Have the basic qualities.