You should know how your retirement savings is working for you - and how you can maximize the savings effort.

Did you know that realized gains earned in a Roth IRA are not subject to ordinary income tax. Does that mean you should take more risk with your retirement account than any other?

So try to wrap your head around this Catch22.

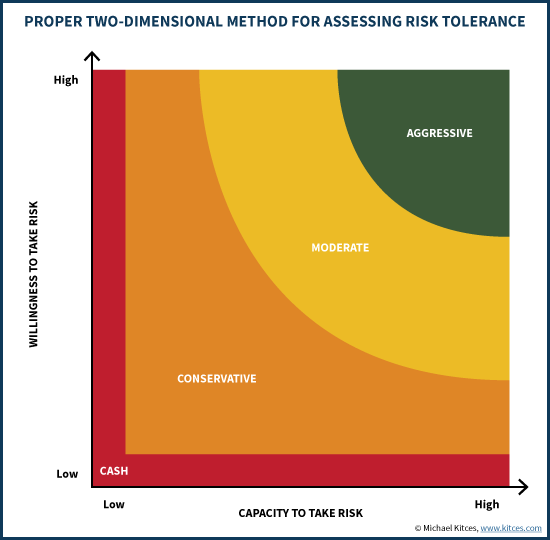

Factor 1 - Risk Tolerance vs Capacity

If you are a risk taker, but have nothing to risk, you will have a high tolerance but low capacity... This means, that even if you are interested to invest in high growth (High Risk) stocks, you should avoid them if you do not have the capacity to deal with the potential losses.

Factor 2 - Investing Timeline

Young investors have "the rest of their lives" to recover from a stock market loss and therefore should be heavily weighted toward stocks. But young investors usually have very little saved, or a low capacity for risk.

Factor 3 - Tax Treatment

If you have realized gains in a "non-retirement" account (aka Brokerage account), you will be required to pay tax on those realized gains when filing your taxes. But if those same gains are associated with your Roth IRA, you will generally be able to realize your gain without paying tax, allowing your account balance to grow unhindered by Uncle Sam until retirement.

The Catch22 arises when young people try to apply this to their situation.

What is your Risk Capacity? If it is low, you shouldn't be investing in high risk stocks.

How old are you? If you are young, you should be investing for the long term, and not paying attention to the small moves in the market. Highly volatile stocks are just fine for long term investors not concerned about the day to day movements.

Are you young and have a low Capacity? What do you do then? SAVE and invest slowly.

Review your options for investing through your employer sponsored plan (401(k) or similar plan). Establish an investing plan that allows you to contribute on a regular basis - every paycheck - and see if you can get invested in a mutual fund that charges no fees for systematic investments. Most trades these days are $4-10 depending on who you are dealing with, but many mutual fund companies will allow you to establish a purchase plan at no cost. (Think purchasing $40 of the fund each week). As long as you stick to the plan, the purchasing fee is waived. This is a great way to kill two birds with one stone. Build your retirement savings and pay as little in fees while developing your portfolio.

Actionable tid-bits (not factoids) from the Trad.Fin.Guy

Congratulations @trad.fin.guy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @trad.fin.guy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @trad.fin.guy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit