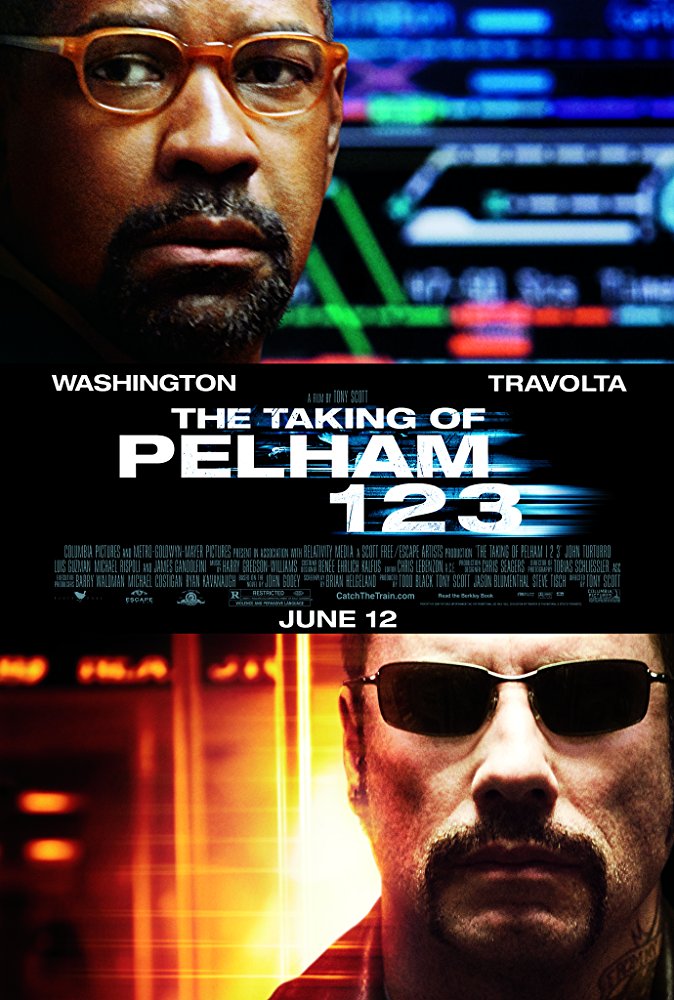

Have you ever seen the movie "The taking of Pelham 123?"

It is a movie about a terror attack plotted to crash the stock market, so that the attackers can profit from the short term drop caused by the attack. The Fed and the SEC are aware that these type of attacks are thought to be successful by many terrorists. Especially after the 9/11 attacks caused some short term tremors in the financial markets.

If you look at a long term chart of the S&P or DOW and match up the recent terror attacks in the Obama/Yellen era or the active shooter situations in the Trump/Yellen/Powell era, you will notice that the market always moves upward rapidly immediately following the terror attacks. This rapid upward movement is enacted by the SEC's Operation to deter terror's, thought of, impact on the markets.

Example #1. On July 7, 2016, Micah Xavier Johnson ambushed and fired upon a group of police officers in Dallas, Texas, killing five officers and injuring nine others. Two civilians were also wounded.

On July 7th, 2016, the S&P was at 2136, by August 8th, 2016 the S&P was at 2184.

This is only one example, but every terror attack/active shooter situation has ended with the same results.

Take, for example, the most recent shooting happening yesterday at YouTube HQ

When the shooting occurred Tuesday, around noon, the S&P was at ~2590, at the time of writing this article, only approximately 24 hours after the attack, the S&P sits at 2644 upon close. These up moves may seem minuscule to the average Joe, but traders recognize the magnitude of these immediate moves.

Now is the time when the naysayers start screaming "Correlation does not imply causation!" The disbelievers may be correct with their doubts, however, this immediate up move has occurred in over 90% of terror attacks and active shooter situations over the past ten years.

The most interesting attack's effect was felt by the Parkland Stoneman Douglas School shooting.

.jpg)

On February 14, 2018, a mass shooting occurred at Marjory Stoneman Douglas High School in Parkland, Florida. Seventeen people were killed and seventeen more were wounded, making it one of the world's deadliest school massacres.

The crazy thing is that the stock market was plummeting and in free fall until the Parkland shooting occurred and the shooting, practically, caused a bottom in the free fall. As outrageous as this sounds, you can witness it's almost immediate effect on the charts.

Correlation does not imply causation is a legitimate argument, but when this keeps happening over and over again, the argument is definitely being defeated. The SEC and the Fed, both, know that terrorists like to think they can impact the market, but the only direction they can cause it to move is upward. Thus, deterring the terrorists from making a negative impact on the country!