Reliance Share Price Analysis: Navigating the Ever-Evolving Indian Conglomerate

[https://finance6737.blogspot.com/2023/07/relative-share-price.html]

Reliance Industries Limited, commonly known as Reliance, is one of India's largest and most diversified conglomerates. Founded by Dhirubhai Ambani in 1966, Reliance has transformed from a textile manufacturer into a global powerhouse with interests spanning oil and gas exploration, petrochemicals, refining, telecommunications, retail, and more. The company's growth trajectory has caught the attention of investors worldwide, making Reliance share price a topic of keen interest. In this blog post, we will analyze the factors influencing Reliance share price and provide insights into its past performance and future prospects.

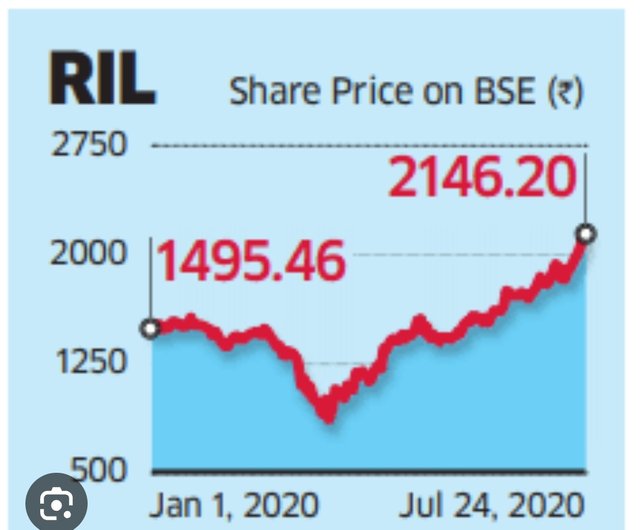

Historical Performance and Recent Trends

Reliance Industries has experienced remarkable growth over the years, leading to significant value creation for its shareholders. In recent times, Reliance's share price has been subject to both fluctuations and upward momentum, driven by various factors.

- Digital Transformation: Reliance's foray into the digital space with Jio, its telecom subsidiary, has been a game-changer. Jio disrupted the Indian telecom market by offering affordable data plans, which led to a massive subscriber base growth. This digital transformation has unlocked new revenue streams for Reliance and has positively impacted its share price.

- Expansion into Retail: Reliance's retail arm, Reliance Retail Ventures Limited, has witnessed rapid expansion and consolidation. Through strategic acquisitions and partnerships, Reliance has built a dominant presence in India's retail sector. The growth potential in the retail market has boosted investor confidence, contributing to the rise in Reliance share price.

- Oil and Petrochemicals: Reliance operates the world's largest refining complex and has a significant presence in the petrochemicals industry. Oil prices and global demand for petrochemical products play a crucial role in determining Reliance's financial performance and, consequently, its share price.

- Regulatory Environment: As with any company, Reliance's share price is influenced by the regulatory environment it operates in. Changes in policies related to sectors like telecommunications, retail, and energy can impact investor sentiment and, subsequently, the share price.

Factors Influencing Reliance Share Price

- Revenue and Profit Growth: Investors closely monitor Reliance's financial performance, including its revenue and profit growth. Consistent growth in these key indicators indicates a healthy business trajectory, which tends to positively impact the share price.

- Sector-specific Developments: The performance of Reliance's individual business verticals, such as telecom, retail, and oil, can significantly influence the overall share price. Positive developments like new contract wins, expansion plans, or regulatory advantages can drive the share price upwards.

- Competitor Landscape: The competitive dynamics within each of Reliance's sectors can affect the share price. Investor sentiment may shift based on factors like market share gains, pricing strategies, or disruptive innovations from competitors.

- Global and Macro-economic Factors: Global trends and macro-economic indicators like GDP growth, inflation rates, and currency fluctuations can impact Reliance's share price. Investors consider these factors to gauge the overall economic climate and make informed investment decisions.

Future Outlook

The future outlook for Reliance Industries appears promising, given its strategic initiatives and the dynamic Indian market. Reliance is expected to continue leveraging its digital capabilities and expanding its presence in the e-commerce sector. The company's focus on clean energy, through its initiatives like the Dhirubhai Ambani Green Energy Giga Complex, also positions it for future growth and sustainability.

Additionally, Reliance's ongoing investments in sectors such as advanced materials, healthcare, and biotechnology highlight its commitment to exploring new avenues for growth and diversification.

Conclusion

Reliance Industries' share price reflects the company's journey from a textile manufacturer to a diversified conglomerate with global influence. The factors influencing Reliance share price are multifaceted, ranging from its performance across various business verticals to broader economic and regulatory trends. While past performance can provide insights, it is important to remember that the stock market is inherently dynamic and subject to volatility. Therefore, investors interested in Reliance should conduct thorough research and seek advice from financial professionals before making any investment decisions.