The Quickest way to make money is by being the boss of the money you have! I am sure you can instantly create a few thousand dollars of income each year by following these simple steps!

Once you have saved some cash by following these steps, buy some steem power with it and post like crazy!

#1 Stop buying, and start selling

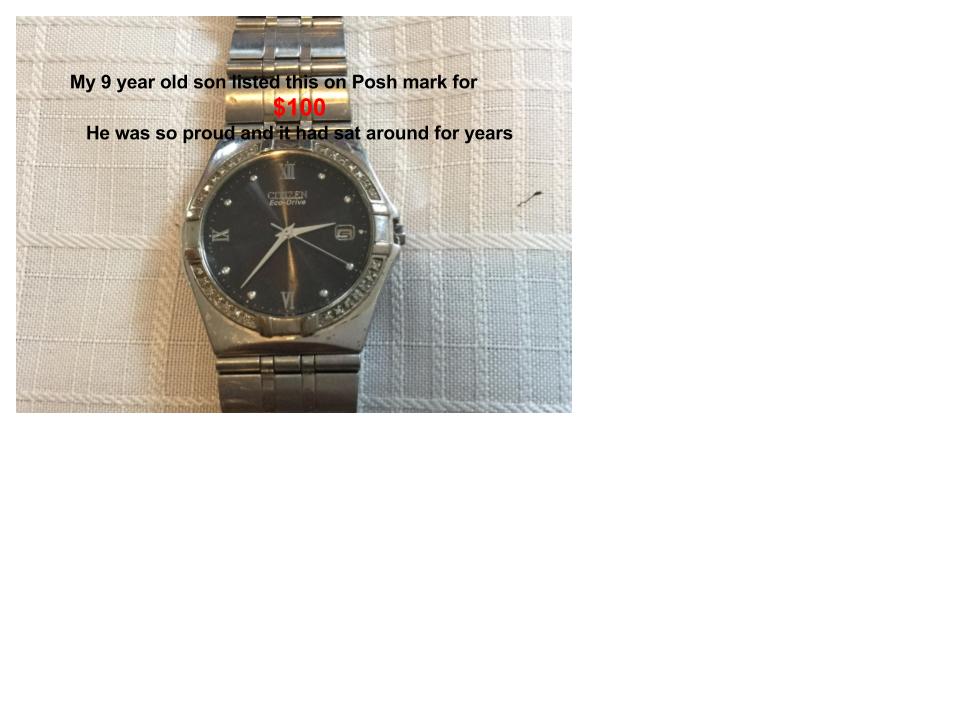

This is self explanatory. Many people buy for reasons that they are unaware of my personal story was pretty much just not being aware. When we made the decision to become financially free one of the first things my wife did was de-clutter and YARD SALE. This was a little invasive and we had to bargain a lot. A better way we found was selling on poshmark.com mercari.com ebay.com and other thrift sites.

This has turned into a fun habit for the whole family and now we have a family list it night once or twice a month. We even go as far to buy items locally at yard sales and 2nd hand stores and resell for a profit. Quite a fun endeavor and good family time to boot!

#2 Cut credit card and use the cash envelope method

If you have credit card debt your are losing hard earned money and strapping your self financially. Even if paid off in full each month it creates a dangerous mental state that opens you up to overspend. We stashed our cards and delegate cash for each item in our budget each month. Groceries, clothes, entertainment ect. The large bills and utility I pay with my debit card checking account. By doing this we have been in the Black every month and now invest or plan with the left over for things like family vacations and college funds for the kids.

#3 Drink more water

I haven't gone as as far as to give up coffee, but do make it at home instead of giving starbucks a small fortune. Also by dropping all other juices, pop and on the road bottled water we save an estimated $80 per month. That's $960 per year just by being healthier. Your personal situation is probably different but make the plunge for a month- you won't regret it and the extra $ money really adds up!

#4 Turn off the lights.

With a family of 5 we run an electric bill of 120-150 per month and we have gas heat in the winter. By consciously turning off the lights and unplugging extra appliance sucking devices we have managed to be under $100 some months. This has added 3-400 per year in extra cash that we were literally just sending out the door. If you have not made the switch to led light bulbs yet they also are supposed to reduce the amount of electricity used. I personally am not convinced and have had them burn out as often as the old incandescent bulbs. The added costs of leds are still a little frustrating for me personally. We bought most of them at costco however and returned them with no receipt. The headache was not worth it but the money was!

#5 Cancel memberships.

If you are getting your money's worth things like gym memberships and magazine subscriptions keep them. However left unchecked you will be surprised at the amount of phantom recurring billing that just plain sucks you dry. We now do a thorough analysis of any subscription to make sure we are either using it to its fullest… or its gone.

#6 Buy thrift store and peer to peer

I was a little skeptical of this at first, but some of the nicest dress clothes I wear on a constant basis my wife has found used online or at a consignment store. I still have plenty of name brand department store goods, but its funny that I wear the $5 used eddiebauer sweaters and similar items more then anything else. It can be quite fun to see how far the dollar can stretch when we take $100 bucks out and go find some deals. My girls are getting a little older and don't appreciate it as much any more. My wife and I have saved thousands of dollars over the last few years shoppoing this way and enjoy the time hunting down the treasures.

#7 Parks, library, Hiking, biking, free time

Be mindful of your free time! It can be one of the most rewarding and soul filling ways you invest. Going for a walk instead of scanning the internet or playing video games this will save money on electricity and is great exercise. When spending time online you are blasted with advertisements and other peoples stuff that only make you want to be a part of buying more stuff. Checking books out from the library, however old fashioned is almost novel for me and flipping the pages manually at night instead of being on my ipad actually helps me sleep better and wake more rested ready to take on the day.

.jpg)

This is just a few of the many ways we have slashed our spending and started to save and invest. We have made the process fun and rewarding for the whole family along the way. The bottom line is every person has to find what works for them. I hope by sharing what worked for me and my family inspires somebody else to get out of debt and closer to true financial fitness!

Good post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love this post brodenjohn, hope you keep posting stuff like this up. Educate people to live within their means and analyse their daily spend and try and make some side cash :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @brodenjohn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit