Amigos!

Let me reveal the one lifehack that will finally answer these 2 questions :

- Can I afford to buy my latte everyday on my way to work? (or how can I balance today and tomorrow's little pleasures?)

- How do I start building wealth?

The funny story is that I have used this financial "strategy" for more than 10 years now without knowing it had a name. The why and how I applied it are actually very simple. When I started to work and got my first paychecks, I was wondering how I was going to spend that HUUUGE amount of money that just magically appeared in my bank account every month (I started as a trainee so it wasn't´t that much at all :). I had to pay the rent, some other costs, groceries,... and the leftover would simply be "fun money"! In the first months after graduation it was great and I managed to live well within my means, but I was not saving anything for the future.

As a Belgian, just spending money and not putting some aside started to "feel wrong". No, really believe me Belgians are champions when it comes to saving, it is highly ingrained in all of us. (on a side note : we may save a lot but my fellow countrymen need to step out of their financial comfort zone). So although I did not have a specific savings purpose I gradually re-organized my finances differently and started to save small amounts as soon as I received my monthly tiny trainee paychecks.

At first I really just wanted to know how much I could use on frivolities, trips, restaurants, new clothes,...while still putting money away for later.

Sure, the savings were small at first and I was not diligent every single month neither - let me be honest with you - but after a few months the small monthly streams started to turn into a small river,...

..., 10 years have passed and I discovered the personal finance sphere where I learned that what I was doing had a name : Paying yourself first.

What does it mean to pay yourself first?

By paying yourself first you are automatically directing a portion of your paycheck towards a certain savings "bucket" before you start paying your bills and other consumption purchases. The savings could typically go to any type of financial goal : a savings account to build your 3-6 months emergency fund, your online brokerage account to invest in stocks, bonds and low-cost index funds, fund a retirement account, the downpayment for your first home,...

While personal finance bloggers and gurus differ on various aspects of personal finance (buying vs renting, etc), this is the one technique they all agree on as a way to achieve your financial goals.

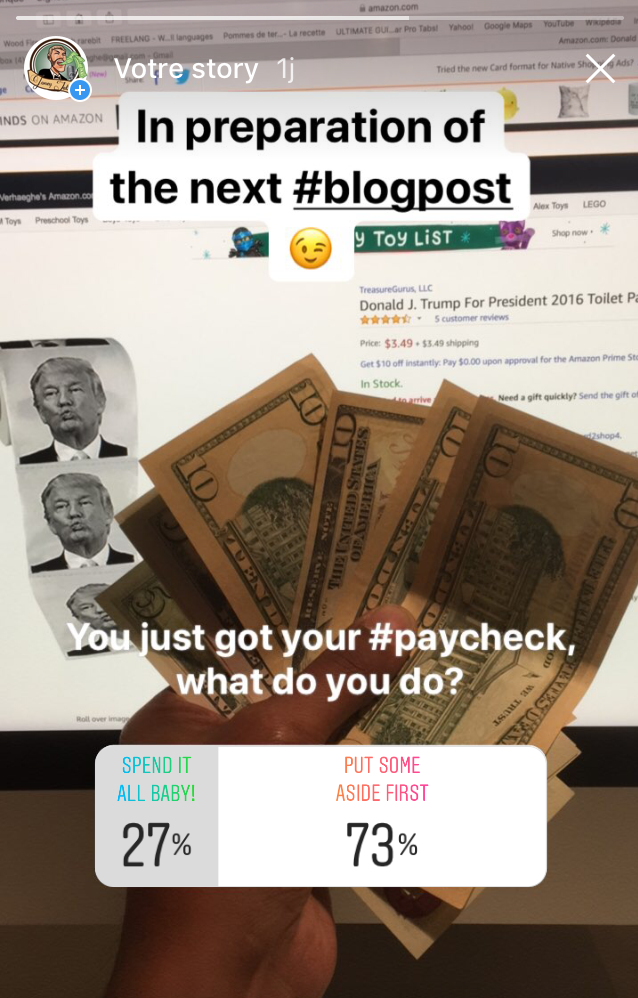

As you can see I ran a little survey on instagram and I was positively surprised by the results! Excellent job! As with any survey results, the statistics are to be taken with a container of salt of course but maybe some instagram amigos just got tempted to purchase the Donald Trump toiletpaper instead of paying themselves first, who knows!

What are the advantages and what do I like about it?

- It is dead simple : You set the process once in your bank account and the money is re-routed automatically, nothing to think about.

- You do not have to overthink every single purchase in the future : Can I afford this coffee? Shall I take a cab home? Is it reasonable to order wine? Should I not save instead? You are already saving so if there is money on your account go ahead, have a glass of sparkling and drink to me! I will be honored you follow my tip and you will drink it guilt-free! (try Ferrari it is a great alternative to champagne)

- Getting rid of the Latte factor phobia: This is similar to the point above. In short the Latte factor is a rule created by David Bach, author of The Automatic Millionaire, telling us that by cutting back on small everyday luxuries and investing we could accumulate massive wealth in the long-run. While it makes sense mathematically, I am not going to cut back on wine and Spotify because I could accumulate 300 000 EUR in 30 years. (and in case you wondered I am not "Jonathan from Spotify")

- It is to me the best effortless way to balance today's guilty pleasures with my future self´s financial security.

- You will not miss the money : you will not miss what you have not seen. If you are trying to lose weight and have no donuts in your home it is "easier" to forget about it and be tempted, right? The same goes for your hard-earned dinero, if you have not seen the money in the first place you will be less tempted to spend it.

- Just imagine your after tax salary is 2 300 EUR and you put 10% monthly in a low-cost S&P500 index fund. The S&P500 is known to have returned approx 7% over the last 100 years, so your monthly 230 EUR you have never seen could grow to 16.467,63 EUR in 5 years or even to 117.393,39 EUR in 20 years.

- Your wealth will grow significantly without you lifting a single finger thanks to the power of compounding as shown above, and of course the longer you save/invest the more dramatic the effects of compounding. (Disclaimer : Past performance in the stock exchange market is not indicative of future results)

It will work as a charm when you get a raise : you could decide to add some or all of your raise into that automatic savings account. I have personally done a 50/50 split in such cases : A little more money put to work for me but as well a little more wine! - Good and easy start for building wealth isn't it?

So how do I start paying myself first?

- Define your financial goal : A car? A house? An emergency fund? Growing wealth through the stock markets? If not sure yet start with the savings account, the most important part is to get started.

- Start with putting 10% of your after-tax income aside into a the correct account so it never appears in your available balance. Ideally this should be automated, so that you actually never see that money.

- Pay your bills (gas, electricity, car loans, school fees, Netflix subscription,...), automate this as well here so you never miss a payment.

- Plan for groceries and other necessities.

- Enjoy your "fun money"! Your savings are working for you in the background already!

Final thoughts

Just like Obama is wearing only gray or blue suits to avoid decision fatigue, following the "Paying yourself first" rule will make your financial decision-making so much easier. I personally really enjoy these kind of tricks (and good wine) : Making a decision for once and never look back, it frees so much mental bandwidth and removes unnecessary stress. You can leave your decision-making energy for choosing between a bottle of Château Pipeau and a bottle of Fat Bastard (yes this wine actually exists) this weekend.

While it may not be easy at first if you have never applied this financial habit, I strongly advise you to start experimenting with your next paycheck and hope you can see the long-term benefits : A safer and stress-free future for you and loved ones!

So amigos what do you do when you receive your paycheck? Put some aside or do you "spend it all baby!"? Any other financial lifehacks you have in store to share? Let me know in the comments below!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://joneytalks.com/2017/12/15/the-one-financial-lifehack-you-need-to-apply-today/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes that is the original written by me as well :) Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @joneytalks! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit