The following are a couple of speedy FAQs interestingly common supports financial backer.

What amount would it be a good idea for me to contribute?

Distinguish your objectives first; this will assist you with concluding the sum you really want to contribute to accomplish every objective.

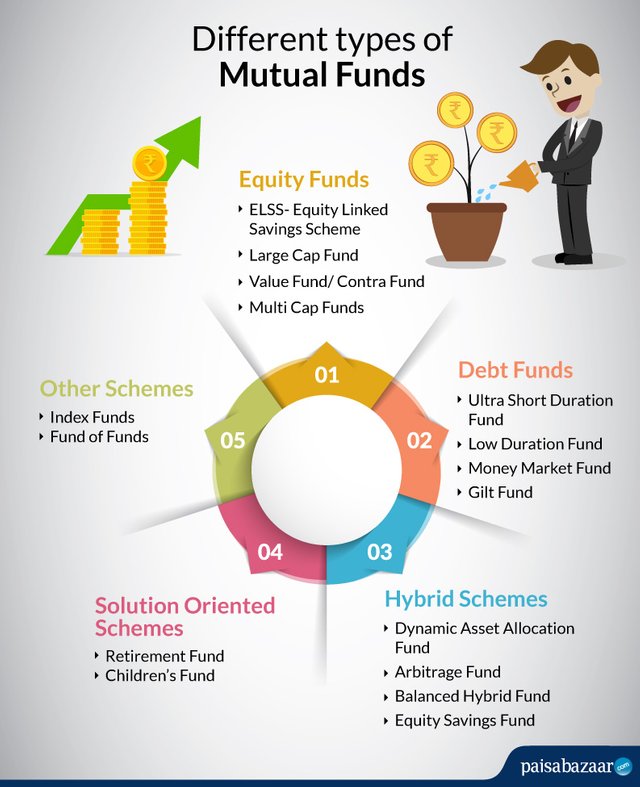

Would it be a good idea for me to put resources into value or obligation plans?

It basically relies upon your speculation objective, venture skyline and chance profile. Assuming you are contributing to accomplish a momentary objective that should be accomplished in two or three years, obligation plans are great for you as these plans are generally risk evidence.

Notwithstanding, assuming you have a drawn out monetary objective that should be met following five years or somewhere in the vicinity, you can put resources into value common asset plans as these can possibly offer unrivaled returns than other resource classes.

What is the base sum expected to begin putting resources into shared reserves?

It's essential to begin contributing and the excellence of mutual funds is that you can begin with as low as Rs 100 every month. The mantra is to "begin and remain contributed for long haul".

Assuming I start with Rs 100 every month, would I be able to continue to add as my pay increments?

Indeed, you can. In a shared asset plot, you can make extra buys in a similar asset.

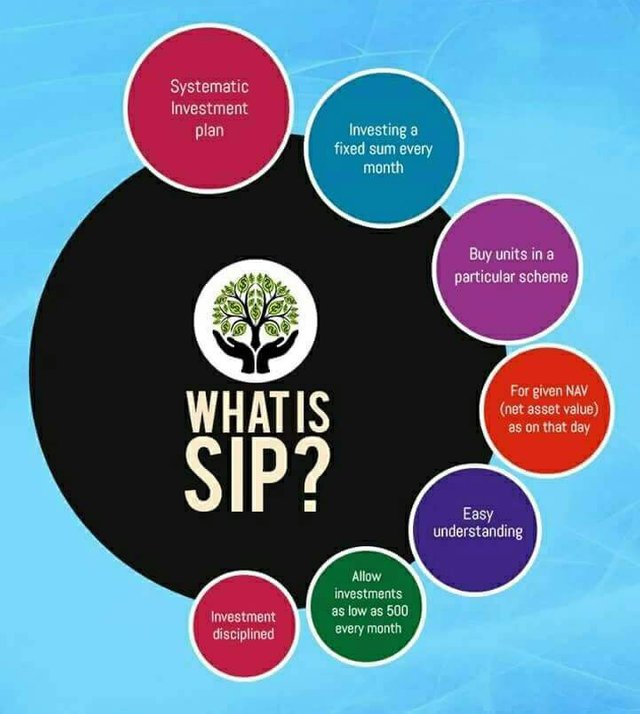

Is Systematic Investment Plan the main way or I can put resources into lumpsum as well?

It relies upon how much cash you need to contribute. A lumpsum venture gives more opportunity to speculation and results in better yields as the force of accumulating (fundamentally procuring interest on interest) increments with time.

Then again, a SIP (the pre-decided sum contributed at an ordinary span) provides you with the advantage of Rupee Cost Averaging (RCA), which essentially adjust the unpredictability of the market in the long haul. Since a proper sum is contributed at customary spans, you get to buy more units when the costs are lower as well as the other way around.

Significant recommendation!/

Since you are new to putting resources into shared reserves, you should contribute with the assistance of a common asset guide for smooth onboarding, well-qualified assessment and cautious plan determination.

About us!

Nivesh.com is a paperless encounter for the financial backers. The stage works on the interaction by ordering assets according to wide speculation targets, and further arranging plans to give a waitlist. The point is to remove the intricacy while guaranteeing objective speculation process. After starting record creation, financial backers can execute in shared assets in not many basic advances. Post exchange, the stage assists in following the portfolio execution with ideal cautions and notices