Bad News is good news for market indexes?! What? Why? This is a phrase you might hear on economic blogs and social media networks every so often. But is it true? And, if so, how? It may take a person years of research to figure out the answers to these questions. This is why we focus all of our blog posts on the aspects of these contrarian views. This will be the 3rd of many articles that prove why bad news always equals positive returns for market indexes.

Some of you remember our recent blog post about how school shootings are always bullish bottom buying opportunities. Others remember our viral blog post about how Trump's approval ratings were inversely related to stock index gains. And, I know that everybody remembers our posts about how terrorist attacks are massively bullish for U.S. equities. Now, we are finally getting a dose of more real proof with this recent trifecta of bad news and how it affected the U.S. markets.

First, let's start out with the Zuckerberg testimony since it was the first bad news bull catalyst to occur in time sequence.

It is April 10th, and the world is angry with Facebook, and so is congress, supposedly. FB is at ~$165.04

Zuckerberg spills the beans to Congress for two days straight, getting interrupted every time he tries to make an explanation. Things look rough in the eyes of a shareholder. However, as of writing this on Tuesday April 17th, Facebook shares are up +2% at ~$168.66

That was the first leg of our Trifecta on why bad news equals good news.

Next comes the Cohen Raid!

The citizens are in disarray as they think the U.S. government is in shambles.

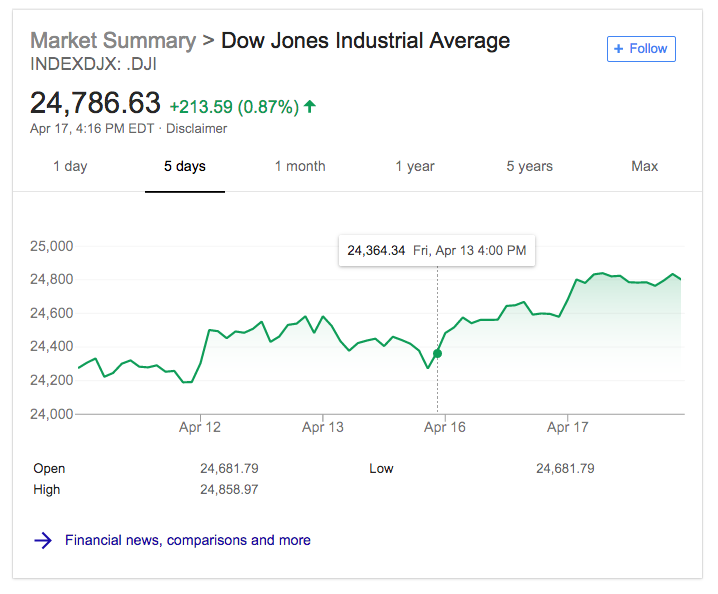

All the while, the U.S. markets are moving upward rapidly as all of this plays out on TV. And after all three of the bad news eventually come to fruition, on April 17th, the market indexes are up 3.5% in one week! That may not sound like much but, over the course of a week, that is a big move upward. The highest percentage gain actually occurred after the 3rd leg of the trifecta brought us the big money.

The Syria bombing!

Wait......What? No!? A war can't possibly be bullish for stock indexes? OH YES IT CAN!

While all 3 of these terrible events were happening, simultaneously, the Dow, the S&P, the Nasdaq, and the Russell were all moving upwards rapidly. This is the also the 3rd article released by Unscammable proving that Bad News is Good News for market indexes, no matter what the market environment.

So always remember, when you see something negative on the national news, BUY the market indexes A.S.A.P. And never, ever forget what Rothschild taught us, "Buy when there is blood in the street!" You will thank us later