Financial apps provide users with convenient access to a wide range of financial services right at their fingertips. Users can perform various transactions, such as checking account balances, transferring funds, paying bills, applying for loans, or managing investments, without the need to visit physical branches or rely on traditional methods.

Financial apps offer tools and features that empower users to manage their finances effectively. They provide real-time access to transaction history, spending analysis, budgeting tools, and personalized financial insights. With these features, users can track their expenses, set financial goals, and make informed decisions about their money.

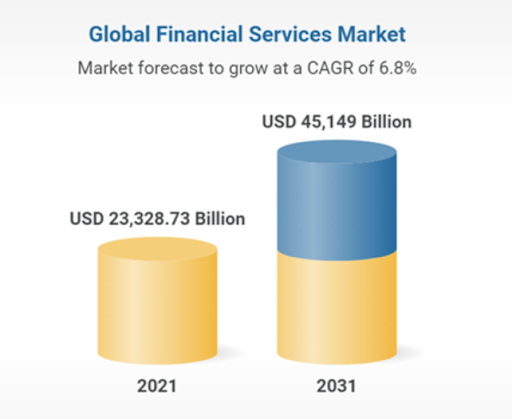

Financial apps play a crucial role in today's digital age, offering numerous benefits and importance to individuals, businesses, and the overall financial ecosystem. According to Research and Markets , In 2021, the financial services market achieved a value of approximately $23,328.73 billion, displaying a compound annual growth rate (CAGR) of 3.5% between 2016 and 2021. It is projected that the market will expand to $33,313.50 billion by 2026, reflecting a growth rate of 7.4%. Furthermore, it is anticipated that the market will continue to grow at a CAGR of 6.3% from 2026 onwards, ultimately reaching a value of $45,149.00 billion by 2031.

In this article, there will be a discussion about the importance of open banking in fintech mobile app development. This article will also incorporate a discussion about the cost factors involved in hiring financial app developers.

Importance of Open Banking in Fintech

Open banking has gained significant importance in the fintech industry for several reasons:

Enhanced Customer Experience: Open banking allows customers to have a more holistic and integrated view of their financial information. This improves the customer experience by providing convenient access to financial information and empowering customers to make informed decisions.

Increased Competition and Innovation: Open banking fosters competition among financial service providers.

Personalized Financial Solutions: Open banking enables the development of personalized financial solutions.

Streamlined Account Aggregation and Payments: Open banking simplifies the process of aggregating and managing multiple bank accounts.

Financial Inclusion: Open banking has the potential to promote financial inclusion by providing access to financial services for underserved populations.

Improved Security and Data Control: Open banking promotes the use of secure APIs and data encryption to protect customer information. It also gives customers more control over their data by allowing them to choose which third-party providers can access their financial information and for what purpose. This enhanced security and data control build trust among customers, fostering the adoption of open banking services.

Regulatory Compliance: Open banking is often driven by regulatory initiatives aimed at increasing competition and consumer protection. Regulatory frameworks, such as the Revised Payment Services Directive (PSD2) in Europe, mandate the implementation of open banking standards.

How Much Money is Required to Hire Fintech App Developers?

Here are some key considerations that can influence the cost. However, you can connect with an affordable fintech app development company for budgeted solutions.

Developer Rates: The rates charged by fintech app developers can vary depending on their experience, skillset, and location. Developers in regions with higher living costs and wages, such as North America or Western Europe, tend to have higher rates compared to developers in regions like Eastern Europe, Asia, or Latin America. On average, fintech app developers may charge anywhere from $50 to $150 per hour.

Project Complexity: The complexity of your fintech app is a significant factor in determining the cost. Factors such as the number of features, integrations with third-party services or APIs, data encryption and security requirements, real-time data updates, and compliance with financial regulations can impact the overall development effort and cost. More complex projects typically require more development time and expertise, which can increase the cost.

Design and User Experience: Building a visually appealing and user-friendly fintech app requires expertise in user interface (UI) and user experience (UX) design. If you require custom designs and a seamless user experience, the cost may be higher as it involves additional design resources and iterative design processes.

Backend Development: Fintech apps often require a robust backend infrastructure to handle secure data storage, user authentication, real-time data processing, and integration with external systems such as payment gateways or banking APIs. The complexity and scalability requirements of the backend development can influence the cost.

Security and Compliance: Fintech apps deal with sensitive user data and must comply with industry-specific regulations, such as data encryption, user privacy, and financial security standards. Implementing stringent security measures and ensuring compliance can increase the development cost.

Read more: Developing a FinTech App: Essential Features and Strategy

Conclusion

Financial apps offer tools and features that empower users to manage their finances effectively. They provide real-time access to transaction history, spending analysis, budgeting tools, and personalized financial insights. With these features, users can track their expenses, set financial goals, and make informed decisions about their money.

Financial apps prioritize security measures to protect user data and transactions. They employ encryption, two-factor authentication, and other advanced security features to safeguard sensitive information. Additionally, financial apps often provide real-time alerts and notifications to help users monitor and detect any unauthorized activities, enhancing fraud protection.