What is Asset Management?

Asset management by a financial services firm, generally an investment bank or individual, is the direction of the whole or part of a client's portfolio. Institutions offer investment services, and a wide range of traditional and innovative products that ordinary investors may not have.

Fintropy Asset Managers develop their signature portfolio of aggressive cross-market strategies that make it easy for investors to choose from one platform from among these portfolios. Fintropy also offers a gateway to access various DeFi services such as loans and insurance.

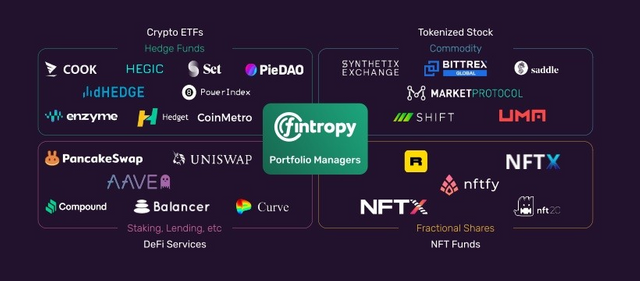

Fintropy provides an all-in-one platform for managing an all-in-one tokenized Exchange Traded Funds (ETFs) for dealing with cryptocurrencies, NFTs, stocks, commodities, and a wide variety of these assets. We allow asset managers to create their own unique portfolios of aggressive cross-market strategies, and let investors easily pick and choose from these diverse portfolios, all from one platform. Fintropy also provides a portal to access a number of DeFi services as well. The Fintropy platform will enable the aggregation of virtually any existing and approved asset, ETF or hedge fund from across the cryptocurrency ecosystem, while also providing the security and oversight necessary to make this vision a success. Fintropy will be able to balance investor safety while still giving asset managers the freedom to pursue their preferred strategy, and earn rewards in the process. With a simple LP synthetic token backed by the underlying asset,

What is Fintropy?

Fintropy provides an all-in-one platform for managing Tokenized Exchange Traded Funds (ETFs) allowing one to deal with cryptocurrencies, NFTs, stocks, commodities and many variations of these assets. By combining assets from across DeFi, Fintropy can provide the best trading experience possible, and help users unlock the science behind investing.

Fintropy allows asset managers to create their own unique portfolios of aggressive cross-market strategies, and lets investors easily pick and choose from these diverse portfolios, all from a single platform. Fintropy also provides a portal to access a number of DeFi services as well.

What is an exchange-traded fund (ETF)?

Exchange traded funds have become one of the most important and useful products introduced in recent years for investors. ETFs provide many advantages and are an excellent tool, if used correctly, to meet investors' investment goals.

An ETF is a basket of assets that a brokerage business can acquire or sell. Almost every type of asset, from traditional investments to so-called alternative assets, including goods or currencies, provides ETFs. Additionally, the new ETF design allows investors to take advantage of and avoid short-term capital gains taxes.

ETF Advantages

Ease of Trading - Unlike other mutual funds, which trade at the end of the day, you can buy and sell at any time with this investment.

Transparency - Many exchange-traded funds (ETFs) are indexed; Indexed ETFs are required to declare their holdings on a daily basis.

More fiscal efficiency - Lower distribution of capital gains from ETFs when compared to actively managed mutual funds

In-trade deals - Because trading is like inventory, investors can make some orders that cannot be executed with mutual funds (for example, limit orders or stop-loss orders)

Why use Fintropy?

Actively managed funds - Fintropy's investor portfolio is consistently rebalanced by experienced asset managers.

Asset diversification and strategies - The portfolio is diversified between underlying assets such as cryptocurrencies, NFTs, stocks and commodities.

Security & transparency - Community members and asset managers will be able to propose changes to vital aspects of the Fintropy ecosystem.

Performance Based Rewards - Get more out of successful strategies with our progressive incentive system.

Variety of Investment Tools - Rebalance portfolio using a unique strategy with any asset possible.

Strategy protection - No need to disclose portfolio structure or investment strategy

What is FINT?

FINT is the native token of the Fintropy ecosystem, serving as the backbone of the platform serving multiple benefits to investors.

Token Utility

Platform Payments - Used for all including performance based for asset managers.

Collateral Deposit - Stakes will be required for asset managers for investment profiles and synthetic assets.

Premium Services - FINT holders can use features such as fee reduction, leveraged trading, and loss insurance.

DAO Governance - FINT holders will have platform capabilities and fees, reward distribution, and asset manager oversight.

Tokonomics

- Token Name: Fintropy

- Ticker Token: FINT

- Blockchain: Ethereum ERC-20

- Total Supply: 30,000,000 FINT

Roadmap

Team

Conclusion

An exchange-traded fund (ETF) is a basket of assets that you can buy or sell mostly on a stock exchange. Fintropy provides an all-in-one management platform (ETF) for dealing with cryptocurrencies, stocks, commodities, and more. Alternative investments such as gold, goods or emerging stock markets may also be included. Financial success depends on diversification and streamlining of trading, making Fintropy one of the most attractive platforms for both traditional and experienced investors as well as new investors who may be introduced to investing in stocks or crypto for the first time.

For More Detailed Information:

Website: https://www.fintropy.io/

Twitter: https://twitter.com/fintropy

Telegram: https://t.me/fintropy

Media: https://fintropy.medium.com/

Author :Amild

Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=2583828

My ETH Wallet : 0xbf00577895715883E63C6694D33dA51b1cDEBDa8