SUMMARY

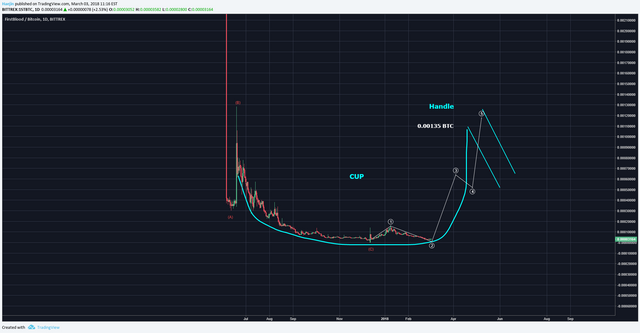

If you recall how long the Cup & Handle pattern for Steem took back last year, many sold and left out of frustration. When STEEM was sub $1, it seemed as if the pattern would never finish. Well, it's not so different for 1st Blood. And yes, these Cup & Handles take a very long time and often outlasts most investors' patience. But this is where discipline and the "Forest" view takes over so as not be lost in the "Trees". The pattern is still likely in progress as shown by the markings in below chart. The target still remains at 0.00135 BTC for the top of the handle formation. It's important to note that once the pattern is complete and confirmed; a lengthy bull run can be sustained.

The Elliott Waves could tentatively be placed as shown below. IF this is correct, then wave 5 should complete the cup formation. This would mean that the handle will probably coincide with the requisite retrace or wave 2's abc decline. IF the handle is wave 2, often the retrace is 50%. However, let's first see if price can climb the wall of the right side of the Cup formation.

A closeup shows a downward wedge formation that could be complete soon. The EW shows abcd as likely done and wave e remains. It would be interesting to see if this wedge decides to breakout at wave d rather than finishing e.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

This is a very optimistic forecast, other then the TA, there are not many variables to support it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @haejin! a friend of mine sent me yesterday one of your recent posts. Today i am slowly reading your blog and i must admit that i am intimidated and, a little bit , frustrated:) I do not understand a lot from your posts (and there are plenty of them). Even though i would call myself an intelligent person.;) but i guess this is one of the reasons why investing and understanding market fluctuations is difficult. Anyway, i really hope that with time I will learn to understand your analysis more easily:) I am powering up everything i earn from my travel stories, but my aim is to become an independent "investor". Thank you for your work! cheers!:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Start with the 7 tutorials linked at the bottom of each of his posts. Watch these repeatedly until you understand, then consider his daily posts. This point is critical: any bullish calls on altcoins remain dependent on BTC going up.

Also remember there will always be another opportunity down the road so don’t worry about missing one. I suggest you use you own research to determine which coins you think have value. Then follow Haejin and/or your own TA to determine entry and exit points.

I started following Haejin last summer with no knowledge of TA. I now successfully apply my knowledge not only to cryptos, but equities as well. You can also get the books he recommends as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you so much for this extensive comment and explications! 🥂 :) i will definitely do what you suggest! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's not easy to learn! I've put quite a bit of work into learning. I've read several books about TA and Elliott Waves. If it was easy, everyone would do it. Plus, there's so much interpretation involved- it can be discouraging. There's only one way to learn, however, and that's by doing it! Start small, keep track of your successes and mistakes, and keep learning. I've found Haejin's posts to be very helpful when I get discouraged by my own inability to see the patterns. He has a "wealth" of knowledge, and he wants to help those who want to learn and who are willing to take responsibility for their decisions. Oh, and just "mute" the bots, haters, and spammers who are always trolling the Comments of his posts- it can be very frustrating. Best of luck to you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

HEY YOU! #Haejin does offer help with his MASTER COURSE WORK SESSIONS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

1st is one of my biggest disappointments. I thought it had so much potential but it is not getting much press and progress seems really slow.

Are there any competitors in this industry?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

1ST got delisted from Bittrex...does that scare me...no...it's listed on HitBTC and it will go vertical soon...Patience~~~~

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am following your articles almost everyday in order to get a great analysis that could help me come with a strategy to 100X my investment, because actually I am tired of trding lool.

I get 6% to 15% from your signals before but It is hard to change something when trading with a small budget like me.

Keep It up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What about Bittrex Delisting it ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well delisting won't help. Delisted with Bittrex and poloniex deposit not working. Not good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Man! thanks for warning! I'm moving now all my 1st to hitbtc..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @haejin your information is very useful for evry one .thanks for sharing this information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for another interesting breakdown. I should really learn more about Elliot Waves so your tutorial links are very helpful!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm gonna check em out too,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted for being such a great supporter of the Steemit community!

Thank you for posting. Big supporter. Much Upvote. Please follow me and vote for me much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much. I had a large holdover position on 1st from the last run up.I think I will add to it for this next one!

If it gets anywhere near 1000 sat and goes to 135000 sat that would be phenomenal profits!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

is your analysis for BTX still valid?

https://steemit.com/bitcore/@haejin/bitcore-btx-is-a-breakout-next

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Update BitShares?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Last drop in price of 1st was due to bittrex announced about delisting them on March 9th. So indeed price now seems really low.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good informational article. very deft personality.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice on bro, you're doing great friend, could you please upvote my posts, thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post received one of the top 10 most powerful upvotes in the last 12 hours. You received an upvote from @ranchorelaxo valued at 216.54 SBD, based on the pending payout at the time the data was extracted.

If you do not wish to receive these messages in future, reply with the word "stop".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

mantap informasinya👍👍👍👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Привет! Я тоже хочу с Вами познакомиться! Как мне нравиться монета Биткоина. А Вы могли бы подарить, как талисман???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a very wonderful analysis, thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @haejin, this post is the forth most rewarded post (based on pending payouts) in the last 12 hours written by a Superhero or Legend account holder (accounts hold greater than 100 Mega Vests). The total number of posts by Superhero and Legend account holders during this period was 50 and the total pending payments to posts in these categories was $3865.98. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Or it could continue to dwindle as Steemit has not done a whole lot to fix some of the issues the platform is having such as the whale/minnow crisis, and the intentional railroading of posts by the bot crews. There are a host of reasons why the price is where it is, and MOST of it has nothing to do with the chart. There is an amazing amount of potential with Steemit, but the issues that are plaguing the users will dictate the price, not the charts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LRC update plz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Don't forget to consider market psychology when investing. Understanding what people think about the product is just as important as understanding the trends. If people start to doubt 1st's ability to provide value to the token by developing actual applications for it then it will quickly fizzle away.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your information is always accurate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good intentions, menbantu people for those who do not know, you are looking for a lot of advice you sometimes receive sometimes not for others, I think you have love advice, nice I thank, thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/airdrop/@resistcheat/cing-airdrop

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit