1.3 Profit principle of futures CTA strategy

The futures CTA strategy is profitable mainly because of the following points:

- There is reflexivity in the price trend, which always continues in the way of trend. When investors observe that the price rises, they will follow the trend and buy, resulting in a further rise in the price. The same is true of price decreasing. Because investors are more irrational, sometimes we can see that the price rises abnormally and falls abnormally.

- Each investor has an asymmetrical tolerance for the ratio of profit to loss and a different tolerance for risk. For most retail investors, they are more inclined to choose a more conservative homeopathic trading method, and the market is also more prone to the trend.

- The formation of the price is determined by the transaction. It is true that the transaction is driven by people, but human nature is difficult to change. This is the reason why the fixed pattern will recur. The strategy is effective in the historical data backtesting, which indicates that it may also be effective in the future.

In addition, the trading feature of trend tracking is to lose a small amount of money when there is no market, and make great fortune when the market comes. However, people who have done trading know that the market is volatile most of the time, and only in a small amount of time is the trend market. Therefore, the trend tracking strategy has a low winning rate in trading, but the overall profit and loss of each transaction is relatively large.

Because the trend tracking strategy is unstable in terms of income, many investment institutions will use multiple varieties and strategies to build a portfolio, which will also be configured with a certain amount of reversal strategies. The reverse strategy is an autocorrelation with a negative coefficient in the time series of prices, i.e., high selling and low taking.

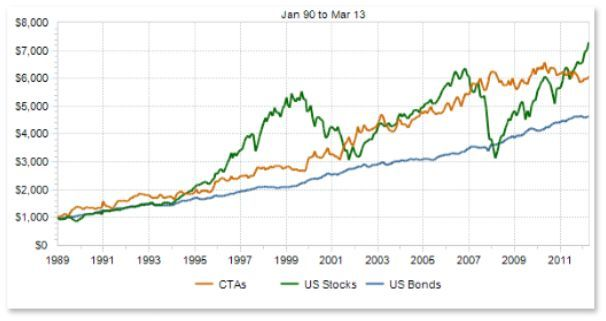

Correlation between CTA and traditional assets

Let's look at the above chart. Theoretically, various strategies with different styles or relatively low correlation will sometimes the same and sometimes different trading signals at the same time when facing various changes in market prices. As multiple return curves overlap each other, the overall return is complementary, and the return curve will become more flat, thus reducing the volatility of returns.

From the above point of view, it can be concluded that it is better to develop multiple moderate sub-strategies than to develop a master strategy. How to control these strategies? Here we can learn from the random forest algorithm in machine learning. The random forest is not an independent algorithm, it is a decision framework containing multiple decision trees. It is equivalent to the parent strategy above the sub-strategy of the decision tree. The substrategy cluster is organized and controlled through the parent strategy.

Next, we need to design a parent strategy. We can evaluate the liquidity, profitability and stability of each variety in the entire commodity futures market to screen out the commodity futures variety portfolio with low volatility of earnings, and then conduct industry neutral screening, further reduce the overall volatility through the industry dispersion of the portfolio, and finally build the actual commodity futures multi-variety portfolio through market value matching for trading.

Each variety can also be configured with multi-parameter strategies, and it can select the parameter combination with good performance in the backtest. When the market trend is obvious, the multi-parameter strategies will generally perform consistently, which is equivalent to adding positions; When the market is in a volatile situation, the performance of multiple sets of parameter strategies will usually be inconsistent, so that they can hedge risks by going long or short, respectively, which is equivalent to reducing positions. This can further reduce the maximum backtest rate of the portfolio, while maintaining the overall rate of return unchanged.

To be continued...