Good Morning,

Platinum Subscribers

Hope you have had a great week and a beautiful trading month so far. This is going to be a Major week for 2018 for most fx traders to give us clear direction on the Us Dollar and how to trade the major’s over the next 6 months

Have you made profit from our trading strategies if not attend our live trading event and let us show you how you can profit from just one trading event in the financial world, but along with this particular blog we believe that our readers and clients are equally important and would like to give you an fx strategy to help you to learn how to trade news forex events and how to plan for this next interest rate hike.

MAJOR FINANCIAL TRADING NEWS THAT COULD IMPACT THE FINANCIAL WORLD THIS WEEK

Before we dive straight into it lets have a quick brief into some of the forex event that we should be weary of this week.

Both the ECB (European Central Bank) and the Federal Reserve will dominate the markets this week when it come to Financial Markets. In this week as a Forex trader you should be looking at only the major pairs and that too Euro and the Yen and get mastery over your currency pairs. The big question is will the Fed increase the interest rates and will this be the last one for the year? All comes down to the statement at 19:00 GMT on Wednesday the 13th of June 2017.

PLATINUM ANALYSTS ARE EXPECTING A 95% CHANCE OF A HIKE IN THE INTEREST RATES OF 0.25%

The Markets have already priced in this rate hike in all fairness, but we must look at the statement and figure out whether there shall be a mention of any further rate hikes and if so when and look at the path for the rest of the year.

The ECB is expected to leave rates unchanged after its meeting on this week on Thursday but markets we may get a policy update regarding Quantitative Easing.

PLATINUM CONSUMER ALERT

If you are new to reading our blog content from time to time we tend so send out consumer alerts and, in this case, even if you are not trading what should you be aware of and what are the top financial tips for the month of June 2018.

Switch to a fixed rate mortgage from a variable or adjustable rate mortgage.

If you still have not considered this, it should be a top priority of yours so that you will not get impacted by further interest rate hikes. Lets take an example of if you lock in a 30 year fixed deal your interest rate will not jump from 4.50 to 4.75 or 5 Percent.

Pay off credit card debt

Anyone with debt will see an increase on their monthly bill within the next cycle or two. The best way to combat this, as well as the effect of future rate hikes, is to pay off as much outstanding debt as possible now.

Would you like us to show you how one of our client cleared of almost 40k of debt within 15 months of joining platinum. Attend one of our Generation X sessions.

Are your asset rich cash poor time to be liquid?

Time to re-assess your portfolio and take some cash out. Take your money out of longer term investment plans that have not been yielding. Why not talk to one of our consultants for a free portfolio review or even show you a way to earn a tax free income of between £1500 to £5000 a month with the art of trading just 3 Currency pairs.

How to Trade the USDX through the FOMC

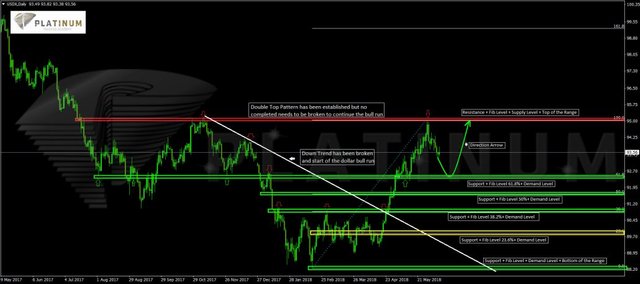

As you can see from the chart we have a reversal strategy as a potential play on the USDX, this is often a chart we will use to evalute dollar strength. On this occasion we are going to look at predicting the movements to profits from the trend. It has recently been very bullidh with a pullback occurring. We will look to enter on the pullback, which is the 61.8% Fib confluence demand area.

How to Trade the USDX

Long USDX @92.50 with a 40 pip stop loss and a target of 95.00

TRADE THE FOMC LIVE WITH A PLATINUM TRADER

WILL THE 12TH OF JUNE BE THE DAY OF JUDGEMENT FOR THE DOLLAR?

The Fed is back and will meet again this week with the Round table conference with the fed chairman Jerome Powell. Are there any major surprises not really it is an anticipated rate hike and Platinum Traders believe there could be another short-term rate hike.

The May meeting of the FOMC left interest rates unchanged, after having increased them previously in March.

Statement from the previous statement:

“In view of realized and expected labour market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent,” the Fed said in a statement after the meeting. “The stance of monetary policy remains accommodative, thereby supporting strong labour market conditions and a sustained return to 2 percent inflation.”

The Central Bank had stated that it was targeting an inflation rate of 2 percent at the beginning of the year, and after the meeting, it said: “On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent.”

The FOMC forecast report covers GDP, the PCE price index, the unemployment rate, and forecasts of the next change in the Fed funds rate and the expected rate at the end of the next two years. The FOMC forecasts are compiled based on individual outlooks from each Fed governor and District president.

See How Platinum Traders Profited Last Month

How to become a profitable Trader.

If you are a new trader and would like to learn how to trade, then sign up today to our 2-day free Foundation to Forex Trading Course. We have just introduced this as in the last month we have had a lot of inquiries on learning how to trade the financial markets. We can get you on the successful path of becoming a Financial Trader.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.platinumtradingacademy.com/trade-the-fomc-minutes-live-with-our-news-trading-strategy/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit