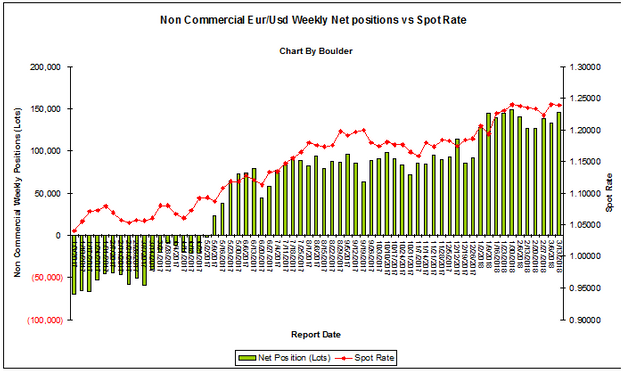

Until Tuesday, institutions were seen adding their net long positions in Euro , which was shown in the latest COT as of Tuesday, Mar 13, 2018.

The institutions net long Euro positions increased last week by 13,408 contracts to 146,380 contracts. Six week high. 98% relative to the record long.

12,099 long positions were added, and 1,309 short positions were closed. Now Longs total 239,453 contracts vs shorts total 93,073 contracts .

72% long exposure vs 28% short exposure, which 1% increased in longs and 1% decreased in shorts from previous week

This week Euro started at 1.2403 on 3/7, moved up to 1.2445 high, moved down to 1.2273 low on 3/9, where institutions closed their shorts , added long and pushed Euro up to 1.2407 high on 3/13, closed at 1.2389

Longs being added and shorts being closed, it indicates institutions tried to challenge higher price level, but they stopped their attempts below 1.2430 level, which made Eur/Usd lower highs in daily chart.

Euro is currently below 20 day (1.2320) and 50 day (1.23) , last Friday low was 1.2260, it looks bearish unless it can break above 1.2320 the short term resistance,

If it breaks below 1.2260 support, next support lies daily demand zone 1.2230-1.2150

Long Term Bullish but Short Term bearish… ##

Please note institutions take weeks and months to build a position in the currency market. For Euro, they have built their net long positions since 5/9/2017.

Therefore, the bullish sentiment is more for long term outlook, not intended for short term trading.

Thanks boulder2018 for the great informative posts. They are a big help in my Forex trading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit