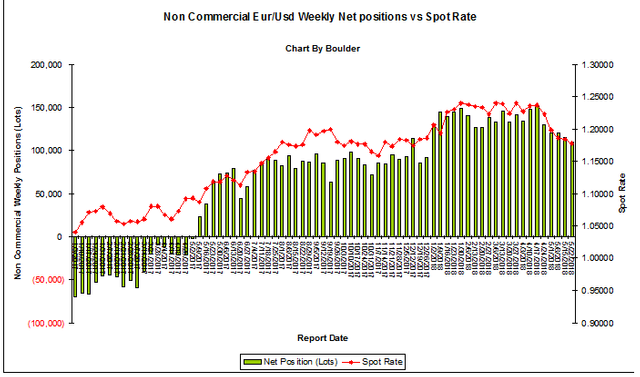

Until Tuesday, institutions continued to cut their Euro bullish bets for 5 weeks in a row , which was shown in the latest COT as of Tuesday, May 22, 2018.

The institutions net long Euro positions decreased last week by 5,370 contracts to 109,744 contracts

6,643 long positions were added, and 12,013 short positions were added as well . Now Longs total 225,960 contracts vs shorts total 116,216 contracts .

66% long exposure vs 34% short exposure, which 2% decreased in longs and 2% increased in shorts from previous week

This week Euro started at 1.1837 on 5/16, continued lower to 1.1716 on 5/21 closed at 1.1778 on 5/22/2018

Longs being added indicates they might think the temporary bottom soon; Some Shorts being added as well, as they may prepare for some pullback or hedge some their longs .

We did see it went down further to 1.1650 after the COT report.

Long Term Less Bullish, Short Term Trying To Stabilize Of The Fall, So Far No Evidence

Please note institutions take weeks and months to build a position in the currency market. For Euro, they have built their net long positions since 5/9/2017.

Therefore, the bullish sentiment is more for long term outlook, not intended for short term trading.

M

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit