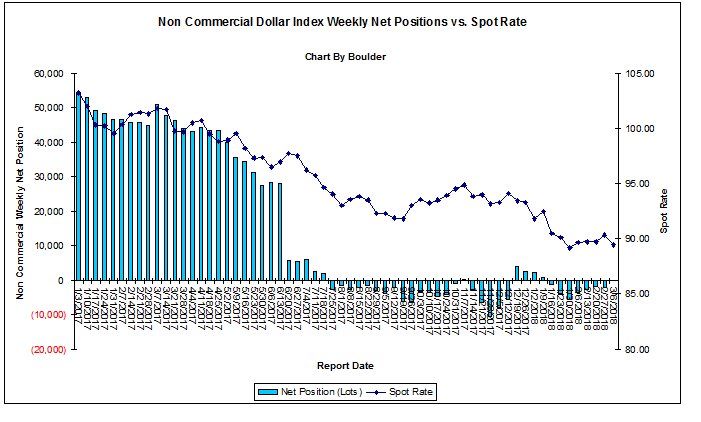

For Dollar, the latest COT as of Tuesday, Mar 6, 2018, institutions decreased bearish bets by 1,967 contracts to net position negative 121

1,610 longs were added and 357 shorts were closed as well, Now Longs total 24,345 contracts vs shorts total 24,466 contracts .

50% long exposure vs 50% short exposure, both even. Longs added 2% and shorts dropped 2% from the previous week

Dollar near term resistance at 90.50-91 and support at 88-89 area. Price has been in this range for last 7 weeks

Dollar is currently above 20 day 89.8. As long as the support holds, price may move higher to challenge the resistance at 90.50-91

Long term Bearish, Short term points to higher

Please note institutions take weeks and months to build a position in the currency market. For dollar, they have been decreasing their net long positions for over a year

Therefore, the bearish sentiment is more for long term outlook, not intended for short term trading.

Nice post. Keep it up. Following

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit