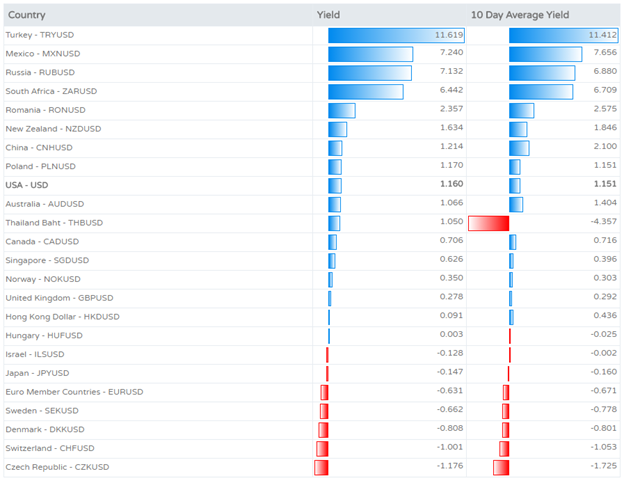

Comment: Market participants are going to want to keep an eye on FX rolls this month, with traditional liquidity needs for year end will start coming into play. Overlay Capital publish daily yields that are derived from these FX swaps. Domestic money markets inside the freely tradable countries have utilized the currency swap market for decades to raise or get rid of balances.

China could take center stage this year with yields inside the country expected to tighten into year end. Below you can see the 10 day average yield is 2.1%, but underlying inflation pressures, profit taking from Chinese investment and a need to maintain a tax on capital outflow, will provide at times surges in the short date interest rates. The impact on the currency could get interesting as reaction in yield may give the CNH a boost, but an already strong currency is expected to find sellers on any rally.

Creating Yield through Currency Swaps - The world of Overnight Money Markets and the Foreign Exchange Markets are closely related. As interest rates rise and fall, a form of arbitrage opportunity presents itself in the Foreign Exchange Market. This form of Carry Trade creates new price discovery mechanism for the Overnight Money Market that eventually brings equilibrium between the overnight interest rates in domestic money markets and those achieved in the OTC FX swap markets.

The OTC FX swap market represents the interest rate differential between two countries. By using the FX swap market prices and the federal reserve effective fed funds rate, we are able to generate daily yields for each country. Combining this with our Adaptive Hedging Methodology creates a unique Adaptive Carry strategy.

Email us for more information about our yield generating Adaptive Carry strategy [email protected]