Daily Analysis Update

Every Trade has difficult days. We are no different at Day Trade Ideas. On difficult days it is important to recognize it as quickly as possible and limit your losses. Staying disciplined and protecting your capital is an important component of being a long term successful trader. With that being said below is our insights as to why yesterday was a difficult day.

A difficult day yesterday with my theory of a dollar turn around put to the test. So here is some explanation of my thinking:

The $ Index is testing longer term Fibonacci resistance at 99420. Obviously if this holds (as I think it will) we are going to turn lower. I thought the negative candle on Friday signalled the turn in overbought conditions but we unexpectedly bounced back yesterday to retest the Fibonacci level.

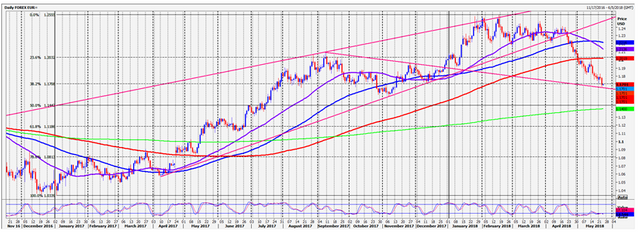

EURUSD longs at important support at 1.1730/00 are being held as we hold above the stop level of 1.1670 in severely oversold conditions. I am still expecting a recovery, targeting 1.1750, 1.1795/99 & perhaps as far as strong resistance at 1.1860/70 for some profit taking before the weekend.

10 Year T Note has seen a very strong bounce to the upper trend line of the channel as you see in the chart below. A good chance we turn lower therefore.

AUDUSD dipped further than expected, breaking 7530 to stop out of longs before a bounce from 7520. I thought we had a bullish head & shoulders reversal (with the neckline drawn in the chart below) but this pattern failed yesterday on the pullback. The pair is building a very slow recovery & I do think this can continue higher but we will need to beat 7565 & then 7580/85. Once we sustain a break above here we target 7600/05 & 7655/60 before strong resistance at 7685/90.

NZDUSD I was completely wrong - we unexpectedly pulled all the way back to 6882, to stop us out of longs. Outlook neutral & I think we will trade sideways.

USDJPY shorts at 110.90/80 worked well but I got out too early at 1st support at 110.40/30. We bottomed here for a few hours then broke to the next target of 109.80/70. The bounce topped exactly at 110.30/40, so it was a good day for trading the levels.

GBPUSD lower as expected to the next targets of 1.3345 & 1.3310/05. We bottomed exactly here.

GBPJPY broke the most important support of the day at 148.90/80 for a sell signal targeting 148.55/50 then only minor support at 148.20/15 but we collapsed a full 300 pips to 145.93.

EURAUD bounced over 100 pips as we held the support as expected. Key to direction is obviously important support at 1.5470/65 in severely oversold conditions. I think it is worth betting on a bounce to 1.5515 & 1.5555. Strong resistance at 1.5615/25 likely to hold a rally at this stage. A sustained break below 1.5440 is a sell signal & could wipe another 200 pips off the pair.

Gold levels are working as we bottomed exactly at 1288/86 as expected but we are only trading sideways as we topped exactly at first resistance at 1293/94.

WTI Crude lower as predicted yesterday & a good day's trading as we bottomed exactly at the best support for the day at 7120/10. A bounce to 7200 offered a further 80 ticks potential profit.

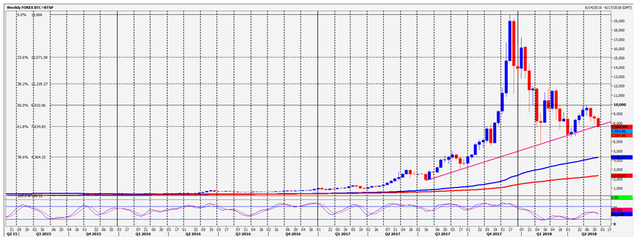

Bitcoin unexpectedly collapsed to important 10 month trend line support at 7700/7650 & over ran as far as 7435. Obviously I tried to pick the low way to early in the low 8000's but this is the best chance bulls have had for a month & we could see a similar recovery to the one in April now.

Either the US dollar reverses lower as I suspect or it breaks higher & proves me wrong. We are at crucial levels so it is a knife edge. Confirmation should come with the weekly close tomorrow.