EUR/NZD Key Points

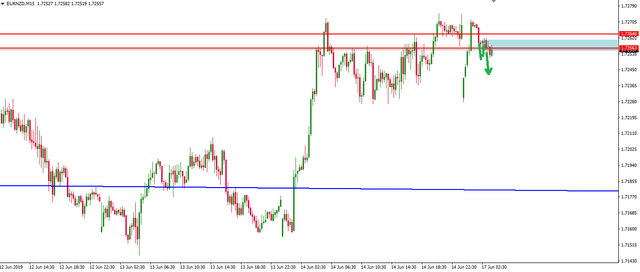

- EUR/NZD capped by hither time frame resistance zone.

- Price action showing weakness on the intraday charts with a double top holding.

- Intrday retest of previous short term support as resistance gives an entry signal.

EUR/NZD Technical Analysis

Morning team.

So after ending last week, speaking about EUR/NZD being capped by horizontal resistance, I wanted to give a quick update.

Just as a refresher, here's the higher time frame, daily chart and the resistance zone that has caught my attention:

We know that higher time frame is king and while price has broken out of that trend line (no matter how you draw it), it is still capped by clear as day horizontal resistance.

I then went on to say this about a potential plan of attack:

While it's below the zone I'd be looking for weak price action on the intraday chart...

So, something like this?

You can see on the live 15 minute chart that price was unable to break throuh that previous swing high resistance level. I've also drawn in the price action path that I'm looking for price to trade in.

With price showing weakess by trading back down, this little rally back into previous short term support as resistance that I've marked with the blue box, could be an opportune point to get short.

Depending on how aggressive you are, you can keep your stop fairly tight and feel safer knowing that you aren't selling the absolute bottom like you are if you're trading a pure breakout lower.

Let's see how this EUR/NZD narrative continues to unfold.

Best of probabilities to you.

Dane.

Upcoming Economic Releases

EUR ECB President Draghi Speaks

EUR German ZEW Economic Sentiment