NZD/JPY Key Points

- Higher time frame, NZD/JPY bearish trend with broken support.

- Price retests higher time frame broken support as resistance and holds.

- Intraday ascending wedge breaks lower and short term support holds as resistance.

NZD/JPY Technical Analysis

Morning team.

I'm back at my desk after the Queen's birthday holiday and keen to share this sweet piece of NZD/JPY technical analysis with you.

It feels like the weeks have all been interupted lately, because quite frankly... they have been.

But this is the beauty of trading forex!

My life, my schedule, my terms.

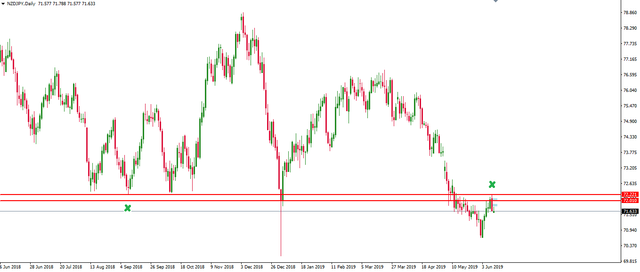

Let's start on the higher time frame and take a look at the NZD/JPY daily chart below:

You can see that price is in a pretty obvious bearish trend on the daily, culminating with the break of horizontal support.

If you go through most of your Yen charts, you'll see that big spike down on them all.

I can't remember what it was off the top of my head, but when price drops like that and immediately retraces, you can pretty safely say the move isn't worth worrying about.

The real level worth worrying about is still the original level just like I've drawn here.

A level which price went through and now we have seen the retest of previous support as resitsance which looks like holding.

So, we're bearish on the higher time frame.

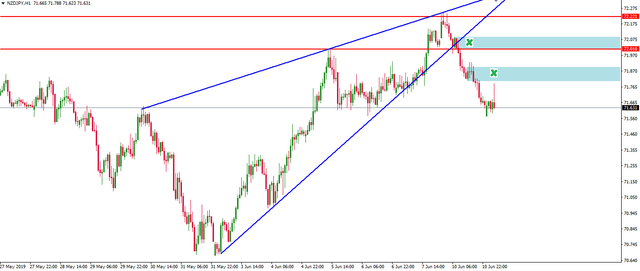

Now zoom into your intraday, NZD/JPY chart and take a look. I've gone the hourly below:

You can see that on the pullback to retest higher time frame broken support as resistance, the top coincided with an intraday wedge breakout.

We've now had a solid day of big bearish momentum and it's time to find some areas to short and manage our risk around.

The obvious areas of short term support that I'd look to be retested as resitance and find an entry around have been highlighted in blue.

But god that momentum is strong...

If you're a conservative trader, then patience. You'll get a low risk chance to short soon enough.

If you're agressive and think this wedge breakout was/is enough already, then smash that shit.

Best of probabilities to you.

Dane.

Upcoming Economic Releases

USD CPI m/m

USD Core CPI m/m