USD/CAD Key Points

- Higher time frame, USD/CAD bearish trend.

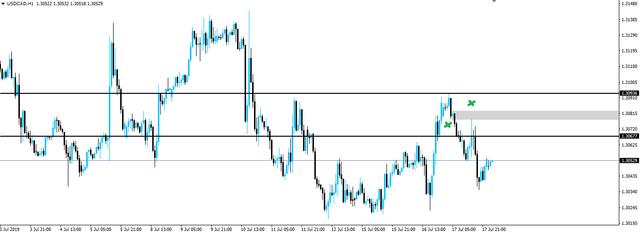

- Price retesting higher time frame support as resistance.

- Resistance zone holding.

USD/CAD Technical Analysis

Morning team,

I have to be careful how I word this one, because I know the conservative traders among you made money on yesterday's USD/CAD short, while the aggressive traders got stopped out.

Here's an extract from the setup, or click the link in the paragraph above to read the full posts with all charts included:

I like the fact that now price has gone below the higher time frame support zone, it hasn't been able to break back above and printed a bit of a double top within the zone. As price rejected out of the zone as resistance, I've marked a retest of previous short term support as resistance and a confrmation for shorts.

Use the higher time frame zone to manage your risk around and the risk:reward should still be there for you, even getting in a little late here.

With these types of setups, there are two ways to trade them. You can attack them aggressively, or you can be more conservative.

If you trade the setup aggressively, then you want the highest risk:reward ratio that you can get, because that means you can trade bigger size and ultimately make more money from a move. To get this, you'd place your stop tightly, probably just above the intraday retest which is in this case, that grey box.

If on the other hand, you trade the setup more conservatively, then you're all about trying to stay in the trade for the maximum time before your analysis is definitely wrong. While you might not get as much out of the trade, you're going to be staying in trades for longer and aim to profit from this fact. To get this, you'd place your stop above the higher time frame zone that held and got you into the trade in the first place. Remember, it's only if this zone breaks, does the trade actually become invalid.

Now let's take a look at the updated USD/CAD hourly chart that includes yesterday's price action:

As you can see, if you were aggressive and placed your stop just above the intraday retest, then you were stopped out. We got in late and the initial move had already been spent. Sometimes we get a second chance to enter here, but this wasn't one of those times.

Price instead ripped through the intraday zone and tested the double top that marks the top of the higher time frame support/resistance zone that got us into the short in the first place. Higher time frame resistance held and then price went boom, straight down to the most recent lows.

I've uncluded an updated USD/CAD daily chart here, just because it looks mighty weak:

Price looks to me like it's hanging on barely by a thread. This one is remaining in play for me.

Best of probabilities to you.

Dane.

Upcoming Economic Releases

CAD Core Retail Sales m/m

CAD Retail Sales m/m

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Join my Inner Circle ⭕️ - www.forexbrokr.com

Congratulations @forexbrokr! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wowsers. That’s quite a bit of support I’ve received.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit