What Is Forex?

When a person is first introduced to Forex trading (or trading of any sort), there are a range of obstacles for them to overcome. The first being all the technical jargon associated with trading.

With confusing terms such as bullish, bearish, leverage, margin, divergence and quantitative easing, to name only a few, a person is left frustrated trying to decode all of this terminology. However, it is important to remember that terminology is all that it is. When starting off in any other field there are usually words that you will need to know the meaning of, so don’t let the technical jargon put you off as everything will be explained in the following paragraphs and reinforced during the entire process during and after the course.

So to begin with let's answer the most important question of what forex actually is. As you may or may not have guessed, forex is an abbreviation for ‘FOReign EXchange’. Foreign exchange is the process of buying and selling a domestic currency for a counter foreign currency.

For example, at an individual level, when you go on holiday and you change your pounds (or your own domestic currency) for your destinations currency you are taking part in a foreign exchange transaction.

Companies also take part daily in the foreign exchange market. For example, a company in the UK may need to import a particular product which cannot be sourced in the UK and only can be purchased in Canada. To import the product the company would need to convert their pounds that they have into Canada’s currency of choice which is the Canadian Dollar, also known as ‘the Loonie’. As they convert the British Pounds into Canadian Dollars they are actively taking part in the foreign exchange markets.

In all these examples, take note that there are always two currencies in question when a currency exchange is made. The domestic currency and the foreign counter currency. This is because you are selling your domestic currency to buy the foreign counter currency. From this it follows that foreign exchange is the simultaneous buying of one currency and selling another.

Super-banks, governments, investment banks, hedge funds, proprietary trading institutions and individual retail speculators also use the forex markets in their daily operations and we will be covering this a little later when we discuss the structure of the forex market and its players.

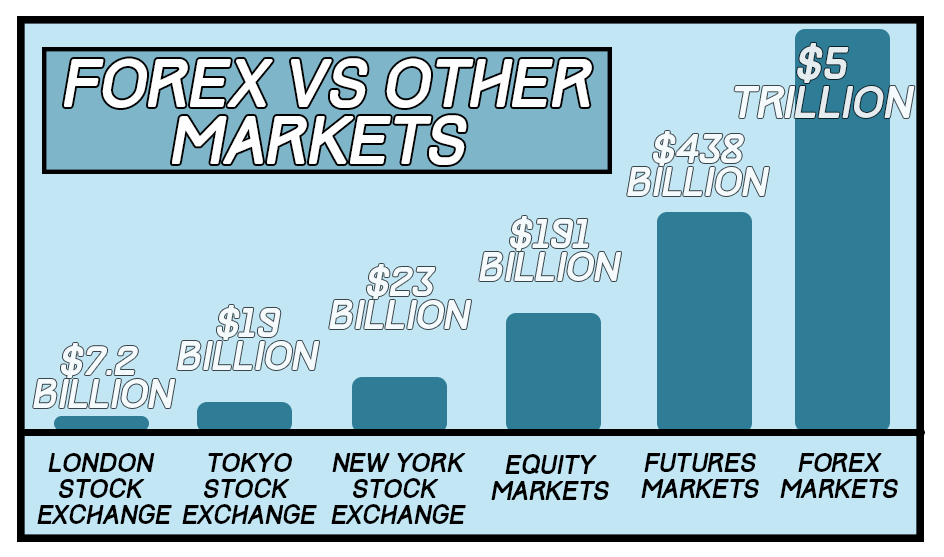

Considering the number of players in the forex market, it makes it the largest financial market in the world with an estimated daily volume of circa $5 trillion dollars. The forex market exceeds volume for the London Stock Exchange with a daily average volume of around $7billion in comparison. In fact, the FX market exceeds the value of all the stock exchanges around the wold combined on a daily basis.

This large amount of volume is a great advantage for trading forex as it makes the forex market a very liquid market; which basically means you can get in and out of a trade quickly because there are so many other traders willing to take up the offer. For some financial instruments in the stock market, the liquidity is so low that you could end up holding onto a stock for a long time, at your own disadvantage, as nobody is willing to buy it off of you or alternatively you would have to sell your stocks at a much lower price than you intend to.

To conclude, Forex is an abbreviation for foreign exchange. It involves the exchange of one currency for another as a transaction for goods or services.

What Exactly Is Traded In The FX Markets?

In the stock market the assets that are traded are stocks. It is the traders job to identify and invest in stocks which have the potential to climb in price and then to sell those stocks when their target price has been reached. In the forex market the asset that is traded, in most simplest definition, is money. Money is traded for money, currency is exchanged for currency. A forex traders job is to identify which currencies may appreciate or depreciate in value against another currency’s value and to buy or sell depending on his/her decision, in order to make profit.

There are a selection of major and minor currencies that a trader can choose to trade against each other. Following is a list of the major forex currencies and their respective symbols and trading nicknames:

Currency |

Symbol |

Alternative Names |

Daily Share(2003) |

| British Pound | GBP | Cable | 11.8% |

| United States Dollar | USD | Buck, Greenback, Benji | 87% |

| Euro | EUR | Fibre | 33.4% |

| Japanese Yen | JPY | Yen | 23% |

| Canadian Dollar | CAD | Loonie | 4.6% |

| Swiss Franc | CHF | Swissy | 5.2% |

| Australian Dollar | AUD | Aussie | 8.6% |

| New Zealand Dollar | NZD | Kiwi | 2% |

Every currency symbol has three letters, the first two letters identify the country of that currency and the last letter identify the the currency name. Note in the Swiss Franc currency the letters CH stand for "Confoederatio Helvetica," which is the latin name of the country.

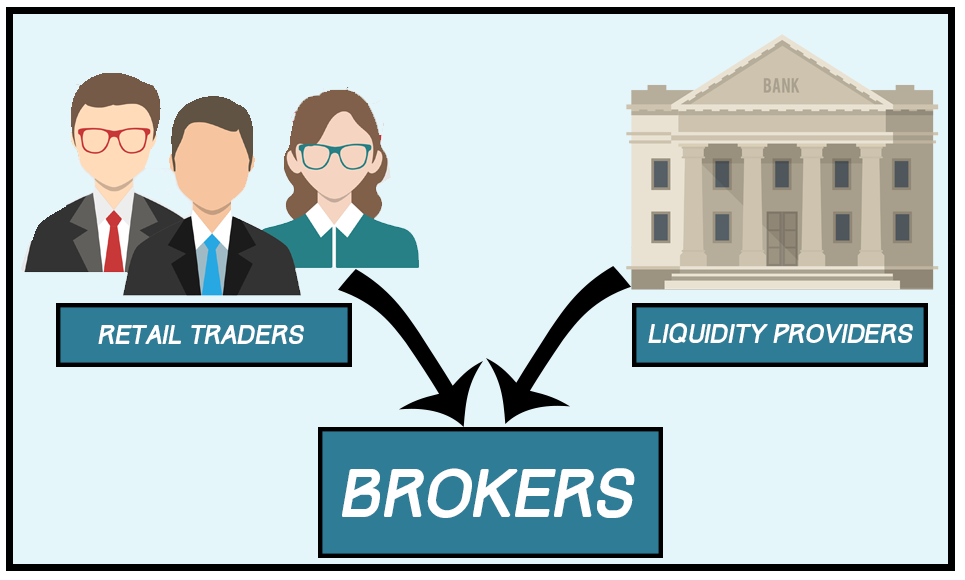

In the forex market trades are made by connecting buyers to sellers. These parties are connected through a forex broker who provides the liquidity to the retail traders to place trades instantly. The brokers provide a currency quote to the retail trader quoting the market price at that moment in time. The quotes are always given in currency pairs.

When a trader is given a forex quote by a broker or an exchange, it is always quoted in pairs. An example of a typical foreign exchange rate of a currency pair quoted by a forex broker is:

GBP/USD = 1.44984

(base/quote) = Exchange Rate

In the example above we can see we are trading the British Pound (GBP) against the United States Dollar (USD). The first currency in the quote is always called the BASE currency. In this example the base currency is the Pound. The base currency is always equal to one. The second currency is the QUOTE currency or also known as the counter currency. In our example the counter currency is the United States Dollar. The final element of the forex quote is the exchange rate or price. You can think of the exchange rate as how many units of the quote currency you would need to buy the base currency. So in our example you would need $1.44984 dollars to buy £1, or alternatively, you would receive $1.44984 dollars if you were to exchange your £1.

Let us present another an example to analyse for further clarification:

USD/CAD = 1.30226

(base/quote) = Exchange Rate

In this particular example, we can see that we are trading the United States Dollar (USD) against the Canadian Dollar (CAD). The first currency in the exchange rate, the base quote, is the United States Dollar. The second currency in the exchange rate, the quote currency, is the Canadian Dollar. The current price for the financial asset is 1.30226, this means that you would need 1.30226 units of CAD to buy 1 unit of USD. Alternatively, if you were to exchange 1 unit of USD, you would receive 1.30226 units of CAD.

It is important to understand why currencies are quoted in pairs by brokers. To illustrate this let us bring our attention back to our holiday example mentioned at the start. When you exchange your British Pounds for Euros when going on holiday to somewhere in Europe you have three elements in the equation. Your British Pounds, the currency converters Euros, and the exchange rate to change these over. There are always these three elements needed for any foreign exchange transaction to happen.

To illustrate this in a market example, if we were to buy the GBP/USD at the quoted price of 1.44984 we would be buying the British Pound and at the same time we would be selling the US Dollar. In this scenario we expect the Pound to raise in value relative to the US Dollar by either the Pound going up (appreciating), the US Dollar going down (depreciating) or both!

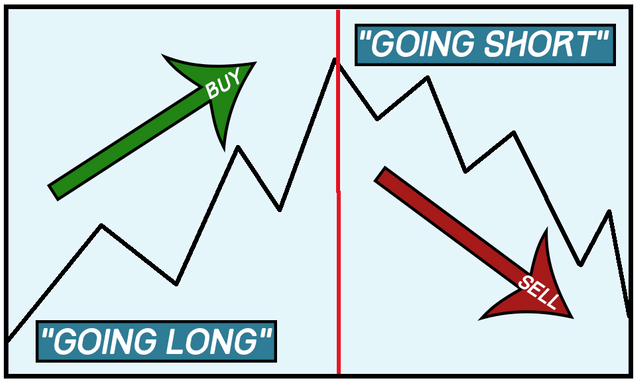

A common term traders use for buying a specific currency pair is “going long”. Going long simply means you are BUYING the BASE currency within the pair. In our example a trader would be buying the British Pound in the anticipation that it will rise in value relative to the United States Dollar. The opposite of going long is “going short”. If a trader was going short on a currency pair it would mean they would be SELLING the BASE currency within that currency pair. In our example, if a trader was to go short on the GBP/USD that would mean that they are selling the British Pound in the anticipation that it will fall in value compared to the Dollar. Another way to look at this is to see it from the Dollar side angle. The trader could think that the Dollar is going to rise in value relative to the Pound. The trader would have to “short” the currency pair in this scenario.

In many cases traders will say, in general conversation, that they have a long or short bias on a particular single currency. It is important to be able to understand how to interpret in which way to place a trade without getting confused and placing the wrong trade by accident. For example, if a trader was to say he is “long on the Dollar”, from this we know that his trading bias is that the Dollar will appreciate in value. For the trader to be able to trade his bias he would be selling the GBP/USD currency pair. In this scenario he would be going short the pound and going long the Dollar which co-insides with his trading bias. In this scenario if the Dollar does rise in price he will be getting more Pounds for each dollar than he was previously.

You can imagine the vast amount of forex pairs you could trade against each other. To make it easier they are categorised into two sections; the Majors and the Minors. Considering that the United States Dollar controls up to 87% of the total daily volume, most people consider it to be the worlds reserve currency. Because of this, all crosses that contain the United States Dollar are in the Majors category, which includes;

Currency Pair |

Average Daily Distribution (2003) |

| GBP/USD | 8.8% |

| EUR/USD | 24.1% |

| USD/JPY | 18.3% |

| USD/CHF | 3.4% |

| AUD/USD | 6.8% |

| USD/CAD | 3.7% |

| NZD/USD | 1.5% |

Any currency pair that does not contain the United States Dollar is considered a ‘minor’ or ‘cross’ currency pair. There are many cross currency pairs a trader can trade from. These crosses are further divided into their subcategories namely; Euro Crosses, Pound Crosses, Yen Crosses, Aussie Crosses and Other Crosses. Below we take a look at some of the most popular pairs from each subcategory.

Euro Crosses |

Pound Crosses |

Yen Crosses |

Aussie Crosses |

| EUR/CHF | GBP/CHF | EUR/JPY | AUD/NZD |

| EUR/GBP | GBP/AUD | GBP/JPY | AUD/CHF |

| EUR/CAD | GBP/CAD | CAD/JPY | AUD/CAD |

| EUR/AUD | GBP/NZD | CHF/JPY | |

| EUR/NZD | AUD/JPY |

Just as a stock (which is considered a financial instrument) is quoted from a stock broker as a three or four letter symbol next to a price, you can think of a forex quote as a financial instrument or a financial market which can be traded.

Thank you for reading this post! This is only part 1 and there are many more to come!

Here at the FX Learning Club, we became tired of all the OVERPRICED forex courses available on the market. So we decided to let our course be completely FREE. Our android app takes you through an in-depth forex course that will take you from beginner level to advanced. We have also developed 19 exercises for you to gain experience with regards to applying the knowledge in the course!

We are on the hunt for our first set of BETA testers to be the first to use the app! Message us NOW and start learning to trade forex TODAY!

www.fxlearningclub.com

Congratulations @fxlearningclub! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Im uber excited to get to more posting :D:D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent article. I look forward to future posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you ! I appreciate the kind comments !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @fxlearningclub! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit