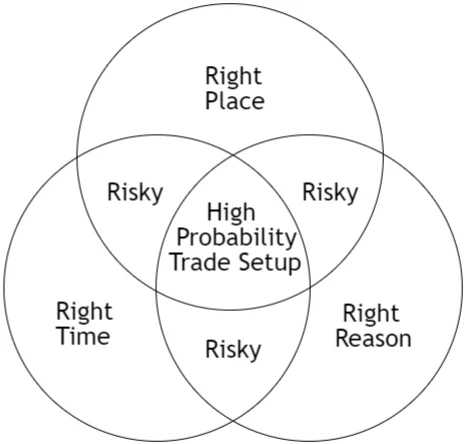

Setups need to be in the Right Place, at the Right Time, and for the Right Reason.

Examples:

Right Place + Right Time

Price is at an unmitigated demand zone (Right Place) at the open of New York session (Right Time), but there is unfulfilled Imbalance and another unmitigated demand zone below. Price now has a reason to violate the current demand zone (Wrong Reason). This makes for a risky trade setup.

Right Place + Right Reason

Price is at an unmitigated demand zone (Right Place) and there are no unmitigated POIs below the zone that price has a reason to go to (Right Reason). But this setup presents itself at the end of New York session and start of the Tokyo session (Wrong Time), which makes it a risky trade.

Right Time + Right Reason

Setup forms at the New York session open (Right Time) and there is an unmitigated demand zone that price should react (Right Reason) to but price has not yet reached the demand zone (Wrong Place). This is high risk to buy because price hasn't reached the Right Place yet.

Right Place + Right Time + Right Reason

Setup forms at an unmitigated demand zone (Right Place) during the London and New York overlap (Right Time) and there are no unmitigated POIs below the demand zone to give price a reason to violate the demand zone (Right Reason). This is a higher probability setup.