The Breaker is basically an institutional break and retest or supply turned demand or demand turned supply.

In most cases the nature (bullish or bearish) of the candle that initiates the creation of supply or demand will match the nature of the trade setup after the supply or demand zone is violated. So if a bearish candle precedes a bullish BOS that creates a demand zone, when the demand zone is violated with Imbalance it should now become a supply zone (bearish breaker). Vice versa for a bullish candle that precedes a bearish BOS where a demand zone forms that ends up being violated and becomes supply (bullish breaker).

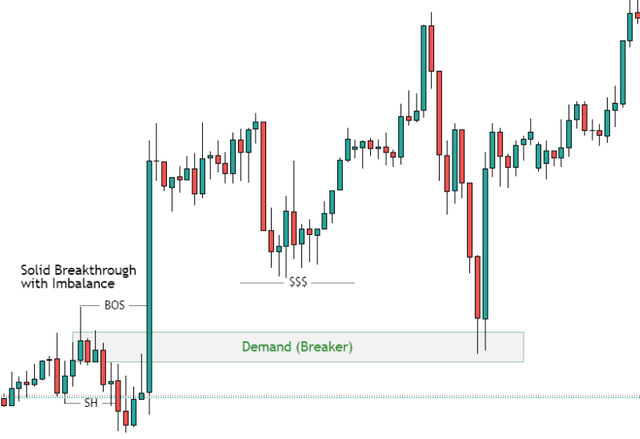

It is important that the supply or demand zone is broken through solid with a strong candle and Imbalance crossing the span of the zone. This validates the breaker and increases its probability. If the zone is broken with small candles, multiple candles, or wicky candles consider it low probability. You want to see a single clean candle with very one sided trading break through the zone.

Breakers that border Imbalance or border/overlap other supply or demand zones of the same bias have a higher probability as well. When there is an unmitigated supply or demand zone beyond the breaker it is best to wait for confirmation before entering in case the breaker becomes liquidity for the unmitigated zone.

The image shows an example of a bullish breaker which formed when a supply zone is violated with Imbalance and becomes demand when price retests from the other side.

I don't chase this pattern but I jump on it when I see a clear setup, but only if the breaker zone is validated by imbalance.