With A-Book (or STP) execution, the broker manages the risk of each individual trade.

But what if one trader opens a long position in GBP/USD and another trader opens a short position in GBP/USD at or at the same time?

Instead of the A-Book broker having to hedge each trade separately with LP, why risk two irrevocable trades?

Well, they can.

Instead of managing the risk for each individual trade, a broker can aggregate trades from clients with the same currency pair.

This process of aggregating transactions is called internalization.

For example, some customers may buy GBP/USD, while others may sell GBP/USD. Different traders have different opinions, so there may be cases where opposing trades can be “matched” or “deleted” together.

When a broker matches one client's trades with another client's, it removes market risk in a similar way to hedging trades with an external liquidity provider (LP).

Since the broker does not send trades to the LP, it saves money by NOT having to deal with the LP and pay the difference of the LP.

A broker can aggregate all long and short positions in GBP/USD and offset them against each other.

This is why forex brokers want a large client base. This allows them to more easily “internalize” the risk. The larger their customer base, the more transactions, which means the more likely the deals can match.

As the cost of dealing with liquidity providers (due to spreads) saves the broker money.

For example, the broker can see from his book that he has a total of 10 million units of GBP/USD long positions and 8 million units of GBP/USD short positions. 10M long 8M short = 2M long net

10M long - 8M short = net 2M long

The difference would leave the broker with a net long position of 2 million GBP/USD.

This “spread” is also known as the “residual” because it is what is left after all transactions are cleared.

What remains exposes the broker to market risk, which is why it is also known as “residual risk”.

The broker must now decide how to manage this residual risk.

He has two choices:

· Take the Risk (“Do Nothing”)

· Risk Transfer (“hedge”)

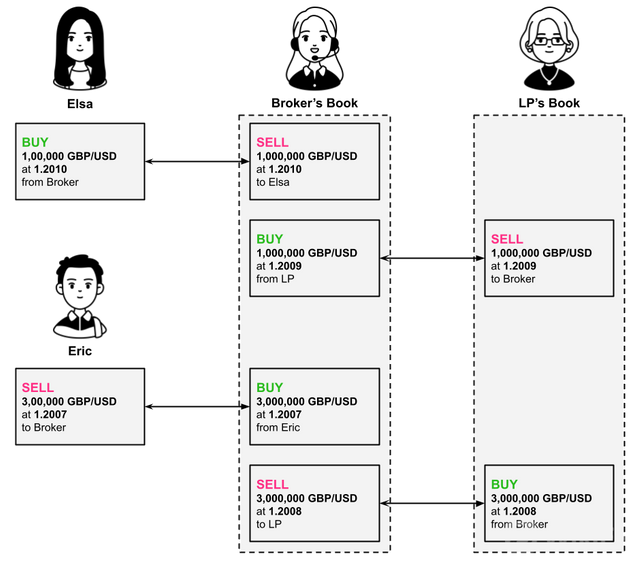

Example: Ledger execution vs internalization (full compensation)

Elsa buys and Ariel sells the same amount of the same currency pair (GBP/USD) at the same time.

In this case, the broker wants to transfer his market risk to his LP. LP price up 0.0011 or 1 pip:

Let's take a look at the difference between running on Books and internalizing.

A-Book

Continue Reading: https://www.wikifx.com/en/learn/202201214164234535.html