I've seen beverage ads. The story is a small basketball player facing his opponent who has twice the size of the body. Long story short, the small basketball player managed to outwit the big players and do the slam dunk. At the end of the ad appears the words "Size does not matter". Size is not important.

Do you agree with the ad?

I do not completely agree.

You see. For a trader or analyst, size is precisely the thing to be paid attention to. The size in question is LOT size. For example, if you only have $ 10,000 in your trading account and you make a transaction often lots, you might get bankrupt soon.

One of the common mistakes that beginner traders do is overtrade, which is a condition in which it does too many transactions. They do not know what the maximum number of transactions they can do based on the strength of their capital, whereas the mistake to calculate the strength of capital will directly affect the equity/capital strength.

Techniques that can provide such information is called position sizing. Beginner traders should not risk more than 1-2% of total funds owned. That is, if a trader has $ 10,000 in his trading account, then he should not lose more than $ 100- $ 200 per transaction.

For example, if the trader is at risk of 1% and he sees no buy signal with a 50 pips stop loss, assuming that 1 pip is equal to $ 10 then he can only make a maximum of 2 (two) lots only. Thus, if the two lot deal is about stop loss, it will only incur a loss of 2 x $ 500 = $ 1000.

If the transaction of two lots is successful in producing a profit of 50 pips as well, then the trader will earn a profit of $ 1000. This is where problems begin.

Most beginner traders think that they will be able to quickly multiply their profits by increasing the number of lots because they are lucky some of the first transactions turn out to be profitable.

This is a HUGE error. The lot number - or called the position size - is like a double-edged sword. A large position size can provide multiple benefits, but it can also cause painful losses. Multiple profits will come if the position is taken in the direction of the market movement, but a heart-piercing loss will also come if it turns out the position taken against the direction of market movement.

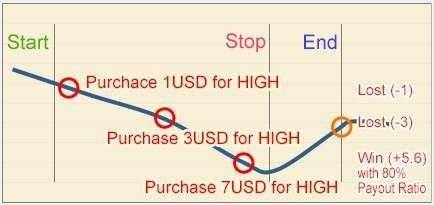

Another amateur step by beginner traders is to double the number of lots when previous transactions suffered losses, in the hope that the correction movement will soon mask their clutter. This technique is known as a martingale.

Illustration of Martingale

"Wait a minute, the martingale is an amateur move? Are not many traders out there; even those who have experienced more than five years; do that? "

Do not be surprised. The length of someone in the trading world does not necessarily make the person professional. This technique is indeed an amateur technique. No single successful professional trader suggests this technique. Call it Alexander Elder, Ed Seykota, Victor Sperandeo, even Warren Buffet though never suggested to do this technique. All the people mentioned agreed that "the trend is your friend", while martingale technique actually makes the trend as an enemy. This is actually a bigger mistake because not only will the trader become more emotional because of the previous loss, but also because this technique will drain the power of capital in a very fast way.

A trader must learn to reduce the number of transactions - instead of adding! - if the market is not in the direction of the trader.

The more money you lose from your trading account, the closer you are to bankruptcy. Especially if you lose the loss by increasing the number of transactions without taking into account the strength of capital.

Instead, the more money you have in your trading account, and the smaller the amount you enter in each transaction, the longer your breath will be in the trading world.

Remember, in trading: size DOES matter!