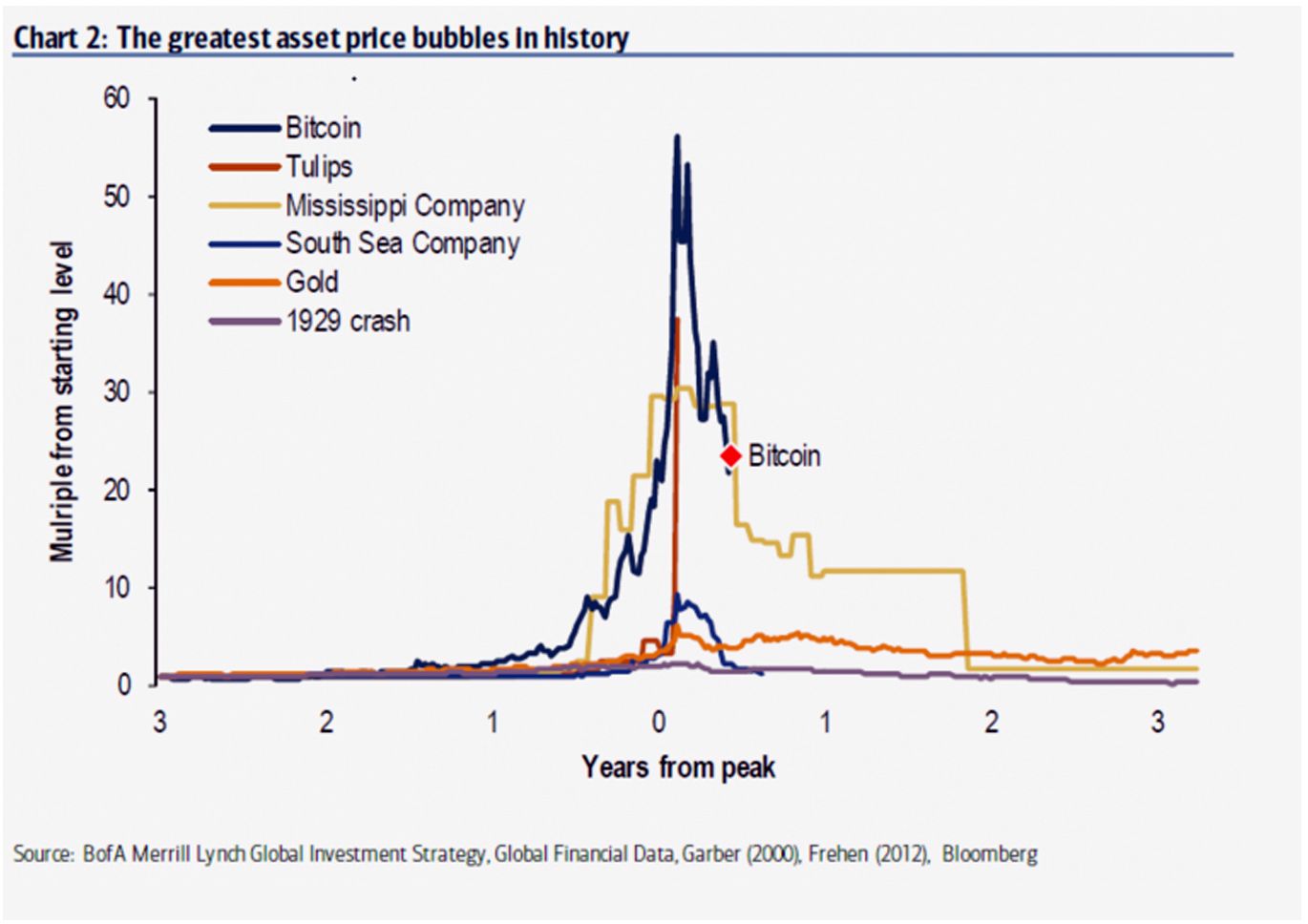

A distributed graph demonstrates that the bitcoin bubble has the best resource value increase by a critical edge. At its pinnacle, bitcoin's cost was almost 60 times what it had been three years previously. Dutch tulip costs just rose by a factor of around 40, the analysts said.

As per CoinDesk's Bitcoin Price Index, bitcoin topped at $19,783 on Dec. 17. At the season of keeping in touch with, it exchanges at $6,835.

BAML's outline demonstrates the result of renowned authentic rises and additionally their run, showing that once costs crash, they stay at their new, bring down levels.

The same has not demonstrated valid for bitcoin up until now, in any case. The current bitcoin bubble isn't history's - or occasion bitcoin's - most noteworthy air pocket. The cost of bitcoin shot up 120-overlay in 2010 and 2011, to around $11, before slamming. Its ascent in 2013 and 2014 was additionally substantially more extreme than the current buyer advertise.

That being stated, correlations between the 2017 air pocket and past ones were uncalled for, the note said. The 2017-2018 air pocket had more capital put resources into the market than either 2010-2011 or 2013-2014.

A similar factor entangles examinations amongst bitcoin and money markets. For instance, in August 1929, the New York Stock Exchange's postings were worth well finished $1 trillion, balanced for swelling. S S

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coindesk.com/bank-of-america-bitcoin-bubble-is-already-popping/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yea dear i can share this for more people

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit