Traders, both newbies, and professionals need to know the best stocks or forex trading strategies. More importantly, they need to know which market works best for them in order to manage risks and maximize their return on investment.

Nowadays, forex and stocks are two of the most profitable markets. But which is the better option? How do you know which market to choose?

Before you start shelling out money, it’s crucial to understand their differences and how you can trade in each market. Find out everything you need in our guide to forex vs stocks below.

Forex vs Stocks: A Brief Introduction

Forex and stocks market are quite popular financial markets.

Statistics show that there are about 10 million FX traders and around 9.6 million stock traders worldwide.

Despite their similarities and undeniable interconnectedness, stocks and forex are very different markets. Each market has something unique to offer. Also, they come with varying pros and cons.

What is Forex?

The foreign exchange market is a highly fluid market where you can trade one currency against another. It’s fluidity and immense growth can be primarily attributed to the high demand for foreign currency exchange all around the globe.

For example, if you go to Japan with a US dollar in your wallet, you need to exchange your currency to buy food and pay for your fare and other expenses. The same is done for companies who do business with those clients from other companies.

Unlike the rest of the financial markets, forex uses a decentralised system.

Instead of going to an exchange market such as the New York Stock Exchange, you can trade OTC via networks of computers. You can trade against folks from all around the globe 24 hours a day, 5 days a week.

You need to trade currencies by pairs. In order to make a profit, you need to observe the market trend. You need to pay attention to key forex signals to help you identify the most opportune moment.

What is the stock market?

The other type of market we will tackle in this guide is the stock market. It’s a type of financial market where investors connect and trade investments such as stocks to buy a share of a company.

Nerdwallet compares the stock market to an auction company where buyers, as well as sellers, can negotiate and make a trade.

Companies list the total number of shares an investor can buy in order to raise money for expansion.

In most cases, investors trade the shares they purchase with other investors to gain profit or to liquidate their available assets.

The price of a company's stocks is primarily affected by the available supply plus the market demand. Traders mostly make use of apps or software provided by their brokers to determine which stocks can provide them with the best outcome.

Main Differences Between Forex and the Stock Market

Now that you have a bit of background about forex vs stock trading, we can start looking at their differences and how you choose the right option for you.

Volume

The most obvious difference between forex and stock market is their volume or size. According to DailyFX, the FX market trades approximately $5 million per day.

Majority of the trades made are between the following pairs:

-GBP/USD

-USD/JPY

-AUD/USD

-EUR/USD

-USD/CAD

-USD/CHF

Because traders can readily buy or sell a currency pair online or through electronic platforms, the market’s volume is expected to grow faster compared to other exchange markets.

On one hand, Visual Capitalist lists 60 major stock exchange markets across the globe.

Here are a few examples of stock exchange markets around the world:

-NYSE

-Nasdaq - US

-TMX Group

-Nasdaq OMX

-London Stock Exchange

-Hongkong Exchanges and Clearing

-Japan Exchange Group

-Shanghai Stock Exchange

-National Stock Exchange of India

In total, these stock exchanges are valued at $69 trillion, with the US stock exchange market accounting for 40.6% of the total revenue.

Last 2017, the stock market the US stock trade market generated more than USD 27.4 trillion worth of domestic stocks.

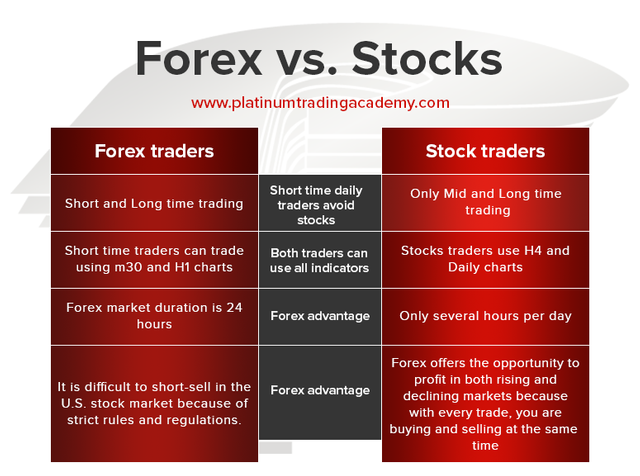

24-hour markets

When it comes to trading accessibility, the forex market also presents a huge advantage to traders. You can trade any time of the day because you can transact online or via the broker's provided platform.

Stock market traders, on the other hand, have more limited options because of the varying timezones across different territories and a long list of other variables.

Liquidity

Another key difference between the forex and stock market is their liquidity. Take note that markets with high trade volumes mostly have higher liquidity compared to others. As a result, these markets offer lower transaction expenses plus tighter spreads.

In the stock market, it can be difficult to trade stocks that have low volumes because these can't be sold or bought quickly and easily. This can possibly result in huge capital loss.

Broker commission

Aside from the trading schedule, market liquidity, and trading volume, it’s also crucial to look at the commission charged by the brokers.

Most of the time, the forex broker doesn't charge commissions. Instead, these brokers take advantage of the spreads. Stocks or equities broker, on one hand, charge traders both the spread and commission.

Market focus

Last on the list of the differences between the forex vs stock market is their market focus.

As a newbie trader, it's important to understand the value of market focus. This will help you formulate your trading strategy and analyze your previous transactions.

If your goal is to narrow down your market focus, it's better to trade in the forex market. As we have discussed earlier, there is only a short list of major currency pairs that you need to monitor.

If you don't mind exploring more options, then you may be a good fit in the stock trading market.

You can choose from an extensive selection of publicly listed company shares. However, you should know which stocks you should invest in to minimize your possible losses.

Choose a Market Based on Your Trading Style

Aside from knowing the difference between stocks and forex, and the different trading strategies it’s equally important to know your trading style so you can choose the right market for you.

Short-term Trader

Short-term traders or scalpers prefer completing their transactions within a few minutes. They mostly focus on small movements in the trade market that can provide them with the highest leverage.

Such type of traders quickly realizes when he/she might profit or lose money. However, this kind type of trader invests large capital in order to maximize their leverage.

Short-term trading is commonly used in the stocks market especially if the trader has a clear grasp of the trends, overall patterns and cycles, and moving averages.

This style is commonly used in forex trading. Short-term FX traders conduct his/her trade within 24 hours. They mostly use the candlestick or bar signals when they make a trade. Also, most of these traders open multiple trading accounts to increase their chances of gaining more profit.

Medium-term trader

Medium-term traders are those who hold their positions for a few days or so to take advantage of technical situations.

They invest a lower capital compared to scalpers and long-term traders because they only make use of their leverage to boost their profits.

Medium-term traders mostly stick to stock trading because they choose to hold their accounts for up to several weeks. However, some medium-term traders also engage in FX trading. These traders focus on holding their accounts up to 72 hours and use various and techniques and signals as their guide.

Long-term trader

Long-term or positional traders only open or close their accounts after a few months or years based on a long list of trading signals and factors.

This type of trading style if you're looking to benefit from long-term profits. However, you need to have a big capital to make up for possible losses due to the volatility of the trade markets.

As discussed above, both long-term and short-term traders need to have a large capital to generate profitable leverage and to cover losses.

Long-term trading is considered as the safest trading method. The risks involved are much lower compared to medium and short-term trading. If done correctly, you can potentially earn larger profits compared to day trade.

Last few bits of advice

Traders from all around the globe have mixed opinions when asked which between the forex and stock market is the best option.

In our guide, we tackled how each market works, their major differences, as well as the three basic trading styles.

Take note of the key information needed, read more resources such as forex blogs and stock trading books, watch stocks or forex trading videos and start searching for potential brokers who can help you set up your account.

Here are some last few bits of expert advice to help you choose between forex trading vs stock market:

-Stick with what works - There’s no right or wrong choice. Everything boils down to how you handle your trade, analyze your loses and profits and plan your strategy.

-Choose based on your goals and trading style - Know which market suits your goals, personality and trading style. This will help you learn the ropes faster.

-Understand the main differences between the two - Review the tips provided above in order to differentiate each option and determine where you should invest your hard-earned cash.

With everything discussed in the forex trading vs stock trading guide above, which among the two markets sound more appealing to you?

Leaning towards trading in the Forex market? Enroll in our Forex Trading course to learn everything you need to know about the largest financial market in the world.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.platinumtradingacademy.com/forex-vs-stocks-trading/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit