Weekly Analysis USD / IDR The following is based on last week's market closing price (February 16, 2018), and is full as a reference for day and long trading.

Fundamental assessment

The rupiah strengthened to show off last week after sharply slumped 2 weeks in a row. The rupiah closed at 13555 per USD compared to 13623 in the previous week, still above the psychological level of 13500. The most recent gain was Thursday 15 February before the Lunar New Year market due to US retail sales in January that minus inflation rose above. Retail sales reflecting consumer spending slumped 0.3% despite monthly inflation rising 0.5%, well above the previous month's 0.1% rise.

The investors' losses to US economic strength and the possibility of rising USD stagflation index sag to the level of 88.25, the lowest in 3 years. However, the possibility of Fed rate hike next month according to CME FedWatch until the end of last week is still above 80%.

Previously the Rupiah continued to weaken to 13655 (strong resistance this week) with positive sentiment towards US Dollar, but the decision of Bank Indonesia to keep interest rate (7 days Reverse Repo Rate) of 4.25% caused the Rupiah to strengthen Indonesia in January back USD 0.68 billion deficit while this will surplus USD 0.19 billion.

Technically the strengthening of the Rupiah last week is a retracement or honesty, and this week is still stable. But if it breaks the 50% level Fibo expansion is likely to rise.

From the US there will be a minutes of FOMC meetings and some temporary FOMC members from within the country have no important data releases. If still active, USD / IDR strong resistance is at the level of 13655 until 13689, and if it strengthens the strong support is at the level of 13520 until 13475.

Fundamental release schedule data:

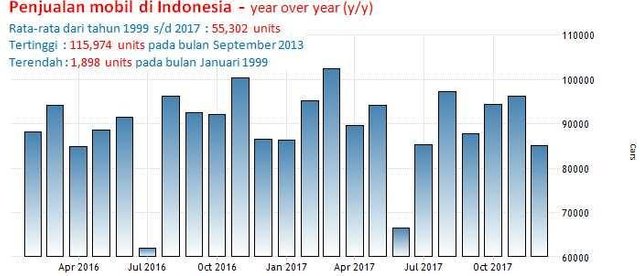

Monday, February 19, 2018: 11:00 WIB: car sales in Indonesia in January 2018 year on year (y / y): previous month: -2.0%.

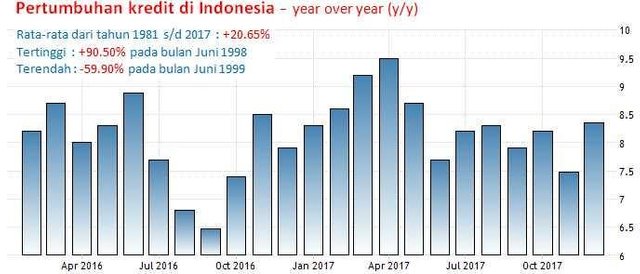

14:00 WIB: credit growth data for January 2018 year over year (y / y): previous month: + 8.35%.

Weekly pivot level: 13584.33

Resistance: 13565.00; 13606.60

(61.8% Fibo expansion); 13655.00; 13689.00

(level 76.4% Fibo expansion); 13723.00; 13819.82 (100% Fibo expansion); 13905.00; 13954.00

(123.6% Fibo expansion); 14012.00; 14063.00; 14133.00; 14337.00; 14493.00; 14784.00.

Support: 13541.45

(50.0% Fibo expansion); 13520.00; 13474.85

(38.2% Fibo expansion); 13453.00; 13393.77

(23.6% Fibo expansion); 13362.00; 13314.00; 13263.00; 13212.64; 13171.00; 13082.00; 13048.00; 12990.00; 12899.00; 12800.00; 12754.00; 12623.00; 12560.00.

Happy trading All

use good of management

look low risk

Great info post !

Got my upvote !

Thank you for sharing !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank @angelinafx dont forget follow and upvote...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

got mine !

:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks sis...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by rizalfa from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit