Why Do You Need Forex Trading System?

Learning how to trade profitably requires you to learn and master a few Forex trading systems. The key to trading is becoming a master of a few trading strategies not the jack of all. Forex trading systems are important as they will provide you with structure, a set of rules, and a plan to follow. This article will discuss some of the different types of Forex trading strategies that are currently in the Forex market and teach you how to identify what makes the best FX trading system

Trading systems that actually work...

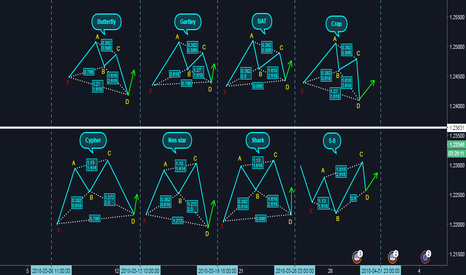

Harmonic trading patterns.

Harmonic trading is the art of recognizing particular price patterns in line with Fibonacci extensions and retracements to calculate turning points in the financial markets. Confused yet? Harmonic trading is complex and requires a lot of time and practice to master, yet it could be one of the best trading systems because it offers high reward vs risk ratios and it is very versatile. It can be traded on any market in any timeframe.

If you are just starting off learning how to trade the market your initial focus should not be on harmonic trading patterns as they will take a lot of time and focus to understand. However, for more experienced traders looking for a new trading system to add under their belt, harmonic trading is worth a look.

Price action trading systems to learn:

- Pin Bar Setup.

The pin bar price action Forex trading strategy is a reversal system. It is designed to trade tops and bottoms of markets and can also be used in trend continuation by buying dips in upward trends and selling peaks in downtrends.

- Inside Bar Setup

Inside bars can be used very effectively when trading Forex. They are primarily used when trading strong trending markets as a trend continuation strategy.

- Engulfing Bar Setup

Engulfing bars are great for trend reversals. They are rare, but a very strong price action reversal signal. Can be used when trading trends, but is typically found at end of trend reversals.

- Fakey Setup

The fake setup is a trend-based trading approach that watches for a false breakout of an inside bar formation. This setup can usually be found at levels of support and resistance, very similar to the pin bar setup. Fakey's are used to buy dips in an upward trend, and sell peaks in downtrends.

Learn How To Be A Successful Trader: tinyurl DOT com/2cx3f9vr ( Copy And Paste This In A New Tab And Remove DOT and Replace With actual dot (.) )

Secrets Of Successful Trader: tinyurl DOT com/bde58av6 ( Copy And Paste This In A New Tab And Remove DOT and Replace With actual dot (.) )