If you truly want to OWN YOURSELF…you have no choice but to work FOR YOURSELF.

This doesn’t mean you cannot be an employee but it does mean you need a side hustle to eventually free yourself from the rat race.

It is very important to understand the rules you live under. If you don’t understand them…you won’t know how to break them. You won’t understand they were designed to be broken

for certain individuals.

There is TWO tax systems in the United States.

One to make you rich..and one to make you poor.

The rich wrote the rules so you should resolve to play be their game.

The SELF employed AKA owners are taxed on their LAST dollar.

The employe AKA servant class is taxed on the first dollar.

What does this mean and why does it matter?

It means when you get your paycheck, your taxes are taken and based upon the idea that 100% of that money is taxable.

When you write the checks it works the opposite way. Only the dollars you choose to subject to taxation are taxed.

The IRS and government survive by taxing the worker. So they NEED workers. It just so happens that 70% of job creation comes from the small business sector.

So they assist you.

If you need extra money and you go get a second job…you raise your tax bracket…you increase your costs and none of them are deductible.

So the solution is…

The home based business instead of a second job.

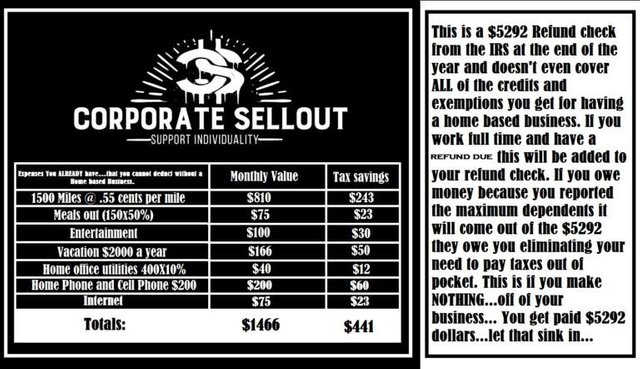

A home based business allows you to “write off” just about everything you require to run your business. From your spouse, your house, utilities, your vehicles, gas, mileage, cost of goods, websites, your office space. ALL of it!

Of course there are actual perks like time freedom, no commute, unlimited income. The IRS even has laws such as the section 179. This allows you to buy a 25,000 dollar vehicle on December 31st…and write off the entire amount. Even if you only put $500 dollars down. The vehicle cost $25,000 dollars…you need it for business…and you got a 25,000 dollar credit for it! That’s a big refund check at tax time. If you are used to regular employment it may seem odd that you could get MORE money back at tax time than you paid originally…but this is how the game works for people who OWN THEMSELVES. This is why the owner has the nice cars. They don’t pay the same price you do.

So if you are working a full time job and they are taking thousands out…you can get it all back and then some by making ONE single change to your life.

Turn your taxes paid into a 100% refund check. You can get more than 100% back!

It is important to note…this is THE LAW. You are following THE LAW. This isn’t a trick or a scam. This is what the IRS wants you to do…in hopes you will be successful. The reality is 80% of businesses fail. They can’t afford that…so they reward you for trying. Tax evasion is a crime. Tax avoidance is your right and your duty.

Other benefits include filing a “Schedule C” and hiring your kids. If they are 7-17 years old they are not subject to payroll tax. You will have to file a w-9 and 1099 form to show what you paid them…but this reduces YOUR tax obligation and can create wealth for your kids tax free. You can even gift tax free money.

The greatest expense you will ever incur is taxes. more than your house, or your cars. When you realize every human activity is taxed…you should do everything in your power to keep your money. 30% saved is 30% of your life you don’t have to work assuming you can live off of your income.

You can give gifts THROUGH your company instead of your personal bank account. This is perfectly legal.

Double deductions on mortgage interest and taxes.

Slap an ad on your car, log your miles, depreciate your assets. Meals entertainment. Everything you do is potentially deductible if it is documented.

Are you afraid you will be audited? There’s nothing to fear! You have a 1% chance of being audited in your lifetime. It’s also not as scary as they want you to think. If you can show the expense and explain it as a part of your business…you’ve earned the deduction. The worst thing that can happen is they disagree.

Your W2 expenses cannot exceed taxable income. Yet 90% of us spend every penny we earn and have credit cards to show…we spend even more than we earn. Well there is no such thing as a “personal loss” for employees. The IRS doesn’t care how you spent your money. They only care how self owners are making out. So if you spend more than you made…you get that money back for trying so hard.

So these are the benefits if you’ve FAILED at generating ANY money!

The real magic is when you realize…you were under valued, and under paid your whole life. Who is going to pay you what you are worth other than you?

Intend to make a profit!

Employee are taxed 5 times before paid! Just resolve to put an end to that by making ONE change in your life.

Leave no money on the table! It’s yours and any tax professional will validate this information.

Build that business on the side until you don’t need the job.

The key is starting a business that doesn’t cost a ton to start. I own a business that I paid 60,000 in equipment to start… and a marketing company that cost me 100 bucks to start. Either businesses gives me equal access to all the deductions.

If you are interested in starting a home business I can help you. I’ve got a business that pays up to 240 per sale..and the buyer only has to pay 40 dollars for you to get that commission check. It’s not too good to be true and I can explain it all to you. It’s an A+ business with the BBB and has been in business since the 70s. So not only do you start off with creating the ability to get all your taxes paid back, you also get a highly profitable side gig.